Gold's luster is continuing to attract rising domestic demand and China will continue to "outperform" other countries in private consumption of the precious metal, with sales growth remaining above 20 percent over the next two years, an industry expert said.

The amount individual buyers purchase as an investment is expected to surge two-fold annually, Zhang Bingnan, secretary-general of the China Gold Association, said.

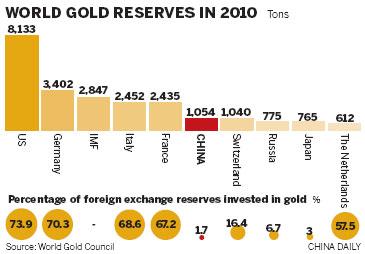

And the government's gold reserves are "far from enough", and should be increased to fend off global financial risks, he said.

According to the China Gold Association, domestic gold sales grew 21.26 percent to 571.51 tons last year from 2009.

Since the international financial crisis China has led growth in gold sales worldwide.

This is set to continue in the coming years as the "average holding of gold by individuals is still too small and the nation's rapid economic growth will further stimulate consumption and investment", Zhang said.

"Demand for gold, mostly driven by investment, will grow at least 20 percent this year," he said.

Sales can be divided into three categories: ornaments, such as necklaces, investment in gold coins and bars and industrial demand.

Since China deregulated its gold market in 2008 gold sales as a means of investment have surged, with an annual growth of 100 percent from 2007 to 2010, compared with 30 percent for the global investment market during that period.

"Enthusiasm for gold as an investment will get stronger, and domestic sales in this category will keep doubling in the next two years," Zhang said.

Zhong Wei, director of the Financial Research Center of Beijing Normal University, agreed.

"Inflation and the weakening purchasing power of the yuan have driven up private demand for gold and this will continue," he said.

1 2

Source:China Daily

Weekly review