After a sales boom in 2010, auto market growth has begun to slow in the first quarter of this year, with passenger vehicle sales increasing only 10 percent from a year ago. Zhang Chi / for China Daily

March is an important month for cars sales in China. It normally accounts for the highest monthly sales in the first quarter of the year and it is the month that indicates the full year's sales potential.

But it is different this year.

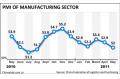

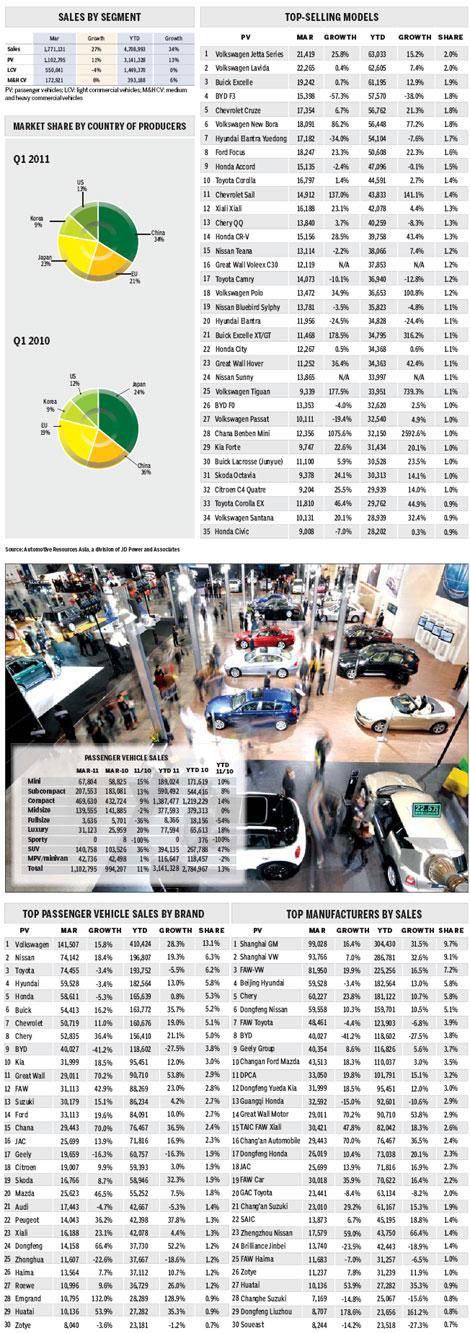

Many of the numbers are what we've come to expect in China - demand for light vehicles in March totaled 1.7 million units, up 5 percent from a year ago, as passenger vehicle sales rose 10 percent over March last year to 1.2 million units. Total first quarter growth came in at 14 percent.

Yet the light commercial vehicle segment reported negative growth for the first time in over past two years. Their sales decreased 4 percent to 550,000 units in March, offsetting growth in the previous two months and leading to a flat first-quarter performance.

On a seasonally adjusted annualized rate, March figures indicate full-year sales of 17.1 million units, which is lower than expected.

To be specific, the figures mean 2011 of passenger vehicle sales should hit 12.3 million units, 5.8 percent higher than the rate indicated in the previous month, but 7 percent lower than the five-month average. Light commercial vehicle sales would be 4.8 million units, 10.6 percent lower than the rate indicated in February, the lowest since last June.

Yet we still think the market drivers remain positive.

The near-term economic outlook remains strong, with GDP growth projected to reach 9.8 percent this year.

Consumer spending remains robust. While deposit rates have been on the rise, real deposit rates remain negative due to high inflation. This is encouraging consumers to invest in properties and buy consumer goods rather than turn to saving.

However, rising fuel prices and recent output cut caused by the Japanese earthquake increases the uncertainty and the downward risk of the market.

The Chinese government has raised the fuel price twice this year. The price for 93 octane gasoline is now 7.85 yuan a liter, up 17 percent compared to last June. It is possible that the price could be raised again this year, pushing it above 8 yuan.

Fees and more fees

In conjunction with the rising parking fees, registration fees and vehicle and vessel taxes, the cost of using a vehicle is set to increase considerably, so short-term demand could be affected.

In the long-term, if the fuel price continues rising at the same rate, the boundary line of 10 yuan a liter could be easily reached in early 2013, which will have considerable impact on car demand.

The impact of Japanese earthquake on the Chinese auto market started to show a month after the disaster struck. Japanese automakers in China have now felt the impact and we expect non-Japanese manufacturers to be also affected, although to a lesser extent.

Due to the supply shortage of some components, some Japanese joint venture plants have rescheduled their production in April and May. About a third of the output could be cut and fewer shifts are needed.

Some automakers without Japanese backing are also feeling the impact, though indirectly, as some of their suppliers are victims of the disaster.

If output in Japan recovers in May, almost all the volume lost is expected to be recovered in 2011. But if it doesn't recover by June, we think the full-year output will decline. As a result, there will be a supply shortage that will in turn reduce sales.

Taking these factors into account, we think the downside risk has increased, but the full impact from the Japan earthquake has not been fully felt. It will have more impact on the quarterly output and less on full-year production.

So we are keeping our forecast unchanged right now. Demand for passenger vehicles is projected to be 13.3 million units, up by 12 percent from a year ago, and light commercial vehicle sales will be 5.7 million units, up 7.7 percent.

The author is an analyst with JD Power and Associates.

(China Daily 04/19/2011)