BEIJING - China Investment Corp (CIC) and Temasek Holdings Pte are among key investors who plan to buy a combined $415 million of shares in Huaneng Renewables Corp's initial public offering, according to two people with knowledge of the matter.

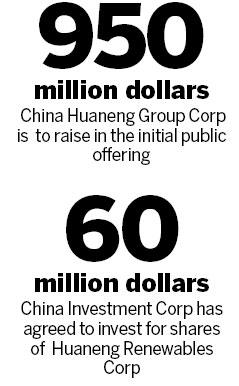

CIC, the Chinese sovereign wealth fund, has agreed to subscribe for $60 million of shares, while Temasek, Singapore's state investment company, plans to invest $50 million, said the people, who declined to be identified as the process is private. The funds are among 13 so-called "cornerstone" investors that include General Electric Co, the people said.

The wind-power unit of China Huaneng Group Corp, China's biggest electricity producer, is seeking to raise as much as HK$7.4 billion ($950 million), offering about 2.5 billion shares at between HK$2.28 and HK$2.98 each, the people said. They added that the company aims to start trading on June 10.

Cornerstone investors, who get guaranteed access to IPOs in return for agreeing to hold the shares for typically six months, account for at least 44 percent of Huaneng Renewables' sale, as the Beijing-based company tries to garner support for its second attempt at listing in Hong Kong since December.

Hu Xiaoyu, a director at China Huaneng Group's news office in Beijing, declined to comment, as did Temasek spokesman Jeffrey Fang. Phone calls to CIC's public relations office in Beijing went unanswered.

Huaneng Renewables said on Dec 13 that market volatility had forced it to scrap a planned IPO. Its rival, China Datang Corp Renewable Power Co, the wind unit of the nation's second-largest power producer, began trading in December after raising HK$5 billion.

General Electric plans to buy $15 million of shares, while China State Grid Corp has agreed to invest $50 million in the IPO, the people said. A unit of Standard Chartered PLC and CSR Corp, China's largest listed trainmaker, plan to invest $50 million each in the offering, they said.

Bank of China Group Investment Ltd, China Huadian Corp and Anshan Iron & Steel Group each plan to buy $30 million of stock, the people said. Morgan Stanley, China International Capital Corp and Macquarie Group Ltd are managing the IPO, according to the people.

Bloomberg News