Brief Analysis on Price Index 20110523

A. the analysis on the main price indices of textile products:

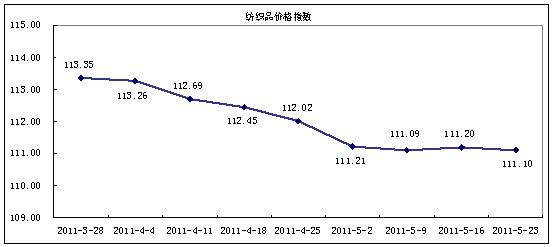

The price index of issue 20110523 of China Keqiao Textile Index closed at 111.10 points, 0.09% lower than that of the previous issue. The price index rose by 6.14% compared with that at the beginning of this year and up by 15.86% year on year. In this issue, the indices on the first classifications indicated: the price index on raw materials, home textile and fashion accessories dropped in different degrees, driving the general price index to decline slightly; but the price index on grey cloths and apparel fabrics rose, relatively restraining the falling rate of the general price index.

B. the analysis on the operation of price index

1. As the oil price fluctuated, the prices of polyester chips declined. The cotton price continued to decline. On May 13, New York Mercantile Exchange light crude oil June futures price closed at US $ 99.65/gallon, and closed at US $ 99.49/gallon on May 20; On May 13, London Brent crude oil June futures price closed at US $ 113.83/gallon, and the July futures price closed at US $ 112.39/gallon on May 20. As the international crude oil priced fluctuated, the prices of polyester materials went up and down in an uptrend. For instance, the spot price of PTA in east China was 9500 yuan/ton on May 13 at the lowest, and rose to 9620 yuan/ton on May 20; the spot price of MEG was 8520 yuan/ton on May 13, and went to 8750 yuan/ton on May 20. In Jiangsu and Zhejiang, the spot price of semi-dull chips was 12025 yuan/ton on May 13, and 11800 yuan/ton on May 20. The domestic cotton price continued to go down. For instance, the quotation of the domestic 328 cotton closed at 24895 yuan/ton on May 13, and 24552 yuan/ton on May 20, which dropped 343 yuan/ton; the quotation of 229 cotton closed at 26901 yuan/ton on May 13, and 26588 yuan/ton on May 20, which dropped 313 yuan/ton.

2. The demand in the downstream is still insufficient, the limit in electricity continues to affect the output. 1) The "cumulative" effect on the business of textile enterprises will be more severe. Recently, the prices of cotton, yarns and other textile raw materials are decreasing dramatically, but the situation in textile production is not greatly improved. The cumulative effect brought by labor costs rise, monetary tightening, RMB appreciation and other unfavorable factors result in the worse situation that enterprises have to face. Due to lack of foreign demand, textile raw materials inventory is still sufficient, the downstream demand is still decreasing. For these reasons, downstream textile companies have large inventory for the decreasing orders. This year, since the central bank raised the deposit reserve ratio for five times, along with the increase of the interest on loans, textile and garment export companies have light capital chain. Affected by the declining cotton price, tightening credit loan policies the hike of labor costs and other factors, some textile enterprises currently have sluggish sales, and the downstream purchasers still keep wait-and-see attitude. 2) The electricity shortage continues to affect the textile industry in Zhejiang. Since May, textile enterprises in Jiangsu and Zhejiang come to the peak of limiting electricity. On May 17, the grade of Zhejiang province for consuming electricity orderly is adjusted from Grade D 2.4 million kilowatts to Grade C 3 million kilowatts. The electricity limit policy of working for five days and stopping for two days and working for four days and stopping for three days in Changxing and other cities of Zhejiang province are implemented. This will greatly affect the business in downstream companies.

3. The sales in grey cloths continued to increase. Recently, in the grey cloths market of China textile city, the sales in chemical fiber grey cloths and blended fiber grey cloths tend to climb up. The demand for summer thin grey cloths rise, and the advantage in marketing is highlighted.

4. The price index on apparel fabrics rose slightly but the summer clothes fabrics sole actively. Recently, the sales of China textile city markets still remain active. The price index on apparel fabrics rose slightly, the sales tend to fluctuate in an uptrend compared with that in the previous period, and the sales in creative fabrics are still active. In apparel fabrics, the turnover in T/C fabrics, polyester/wool fabrics, T/R fabrics, polyester/spandex fabrics, viscose fabrics, viscose/wool fabrics and fashion fabrics climb up in different degrees. The sales volume of summer clothes fabrics continue to go actively, the sales in creative fabrics continue to increase. However, the sales in FDY jet-weaving printed chiffon and 118DFDY knitted printed 2-way stretch T-shirt fabrics shrinks partially. Some small and medium-sized business operators have a decline in spot transaction of staple products, but some cloths companies with a shop in front and a factory behind and large business salesrooms still have an increase in creative-pattern summer clothes polyester fabrics. Printed rayon fabrics in creative patterns continue to sell well, the daily transaction keeps increasing, and the turnover still ranks ahead among the major fabrics.

C. the outlook of next week s price index

It is expected that the sales in the traditional trade area and corporatisation trade area will keep rising, and the sales in summer clothes fabrics will continue to climb. In apparel fabrics, the sales in polyester fabrics, T/C fabrics, viscose fabrics, polyester/nylon fabrics, nylon fabrics and fashion fabrics will rise in different degrees. The sales in FDY jet-weaving printed chiffon, 118DFDY knitted printed 2-way stretch T-shirt fabrics, 118DFDY knitted printed 4-way stretch T-shirt fabrics and printed rayon fabrics in creative designs will continue to increase largely. All these drive the price index on apparel fabrics to go up slightly

Top 10 Categories in Rising

Top 10 Categories in Falling

1 Fashion Fabrics

2.24%

1 Lining Materials

-1.94%

2 Viscose/Wool Fabrics

1.13%

2 Laces

-1.93%

3 T/C Fabrics

0.99%

3 Other Chemical Fiber

-1.44%

4 Thread & Rope

0.97%

4 Cotton Fabrics

-1.15%

5 Bedding Sets

0.61%

5 Belts

-1.09%

6 Polyester/Wool Fabrics

0.53%

6 Daily-use Home Textile

-0.85%

7 Chemical Fiber Grey Cloths

0.44%

7 Polyester

-0.59%

8 Blended Fiber Grey Cloths

0.26%

8 Polyester/Nylon Fabrics

-0.48%

9 Viscose Fabrics

0.18%

9 Cotton/Ramie

-0.33%

10 Polyester/Spandex Fabrics

0.16%

10 Blended

-0.29%

In this issue, the price indices on fashion fabrics, viscose/wool fabrics, T/C fabrics, thread & rope, bedding sets ranked the first five categories in rising. The sales volume increased in different degrees compared with last issue. The slight increase of unit price of partial representative products was the main factor.

In this issue, the price indices on lining materials, laces, other chemical fiber, cotton fabrics and belts ranked the first five categories in falling. The sales volumes declined in different degrees compared with last issue. The slight decrease of unit price of partial representative products was the main factor.