--Strives to develop a complete value chain to enhance strategic positioning Steps up branding and development of China s retail market

Hong Kong, 30 March, 2010 -- China Agri-Industries Holdings Limited and its subsidiaries ( China Agri or the Company ; Stock code: 606.HK), a leading producer and supplier of processed agricultural products in China, today announced its annual results for the year ended 31 December 2009.

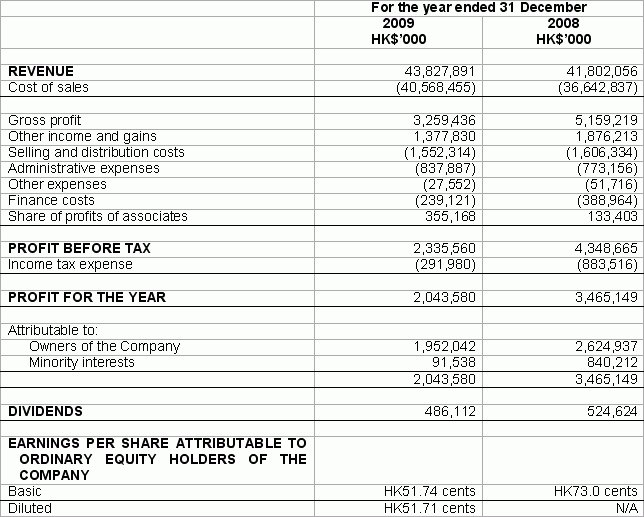

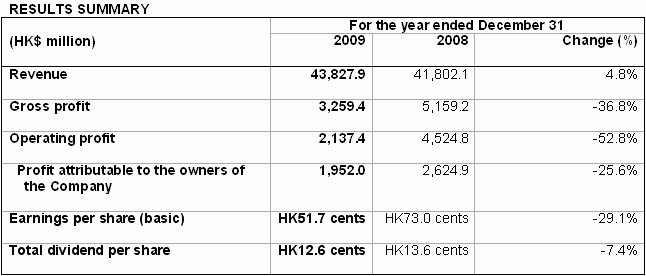

The Company recorded total revenue of HK$43,827.9 million for the year 2009, an increase of 4.8% from HK$41,802.1 million in 2008. Profit attributable to the owners of the Company was HK$1,952.0 million, a decrease of HK$672.9 million from HK$2,624.9 million for 2008. Basic earnings per share were HK51.7 cents (2008: HK73.0 cents). The decline in profit was primarily attributed to declines in the prices of raw materials and that of the relevant finished products, and thus gross profit margins of oilseeds processing and brewing materials business units returned to normal levels from exceptionally high levels in 2008, which is in line with management s expectations.

The Board has recommended a final dividend of HK5.9 cents per share. Together with the interim dividend of HK$6.7 cents, the total dividend payment for the year 2009 was HK12.6 cents per share (2008: HK13.6 cents per share).

BUSINESS REVIEW

(1) Oilseeds processing business

The oilseeds processing unit remained the largest revenue and segment results contributor for the Company. Revenue for the year 2009 amounted to HK$26,811.8 million (2008: HK$27,539.5 million), accounting for 61.2% of the Company s total revenue and 48.7% of segment results. As a result of the global economic downturn, the prices of raw materials have trended lower, which in turn has exerted price pressure on oilseeds products.

In particular, the price decrease in finished products was greater than that of raw materials. Nonetheless, higher relevant sales volume was recorded for the year compared with 2008. Through the Company s effective hedging policy, the risk of price fluctuations for raw materials and related products was reduced.

As a result of falling product prices, gross margin returned to 4.3% from an exceptionally high level of 11.5% in 2008. The Company intends to increase its oilseed processing capacity from the current 5.58 million metric tons to 8.28 million metric tons by 2011. Considering the improving economic environment, and as new investment projects continue to power full steam ahead, sales of the Company s oilseeds products are expected to grow further in both volume and revenue.

(2) Biofuel and biochemical business

Turning to biofuel and biochemical business, revenue for the year increased by 33.1% to HK$7,750.6 million mainly attributable to the Company s effective cost control measures, and stronger sales volume as a result of higher production capacity driven by new plant projects. In addition, the business was also benefited from grants from the Chinese government for ethanol and corn products. Gross margin was up slightly from 10.4% in 2008 to 11.6%.

(3) Rice trading and processing business

The Company s revenue from rice trading and processing business rose from HK$3,383.0 million in 2008 to HK$4,106.8 million, mainly driven by surging domestic sales and the Company s effective pricing strategies. During the year, domestic sales increased to 343,300 metric tons, up 176.6% compared with 2008. Building on its effective sales strategies, extensive sales channels, product mix and brand positioning, the Company has laid a solid foundation for the continued growth of the segment. Gross margin continued to stay at a relatively high level of 18.0% (2008: 22.8%) during the year.

(4) Wheat processing business

Benefitting from scale and effective sales strategies, the Company s wheat processing revenue rose by 12.7% to HK$3,661.0 million for the year. Gross margin remained stable at 9.3% (2008: 9.6%). The Company aims to increase its market share by expanding flour production and optimizing product mix.

(5) Brewing materials business

The brewing materials market remained weak throughout 2009. The industry struggled due to sharply lower material prices and product prices. And as the decline in product prices were steeper than that of raw material costs, the Company s brewing materials business recorded a 17.1% decrease year on year to HK$1,497.8 million and posted a loss of HK$7.7 million. Going forward, the Company will step up its efforts in developing the export and domestic markets for brewing materials to deliver stronger sales and profit.

OUTLOOK

Building on the food safety policy of its parent company COCFO Corporation ( COFCO ), the Company has laid down its own strategic goals to develop a complete value chain based on the core values of safety, assurance, health in conjunction with other COFCO companies. Guided by this strategy, as well as market trends and customer needs, the Company will develop its own brand and strive to expand its sales business in the domestic retail market so as to enlarge its share of the market and enhance its competitive strengths, which in turn will enable it to fulfill its social responsibility commitments and deliver shareholder returns.

About China Agri-Industries Holdings Limited

China Agri-Industries Holdings Limited is a member of the COFCO Group and enjoys industry-leading position in each of its subsidiary business segments in China, namely oilseed processing, biofuel and biochemicals, brewing material, rice trading and processing, as well as wheat processing. China Agri has been listed on the Main Board of the Hong Kong Stock Exchange since 21 March 2007.

Website: www.chinaagri.com

For further information, please contact:

China Agri-Industries Holdings Limited

Charlotte Cheung

Tel: (852) 2833 0314

Email: charlottecheung@cofco.com

Hill and Knowlton Asia Ltd.

Benny Liu

Tel: (852) 2894 6251 / (852) 9387 6545

Email: benny.liu@hillandknowlton.com.hk

Christy Lee

Tel: (852) 2894 6254 / (852) 6181 8496

Email: christy.lee@hillandknowlton.com.hk

Condensed Consolidated Income Statement

Year ended 31 December, 2009