SHANGHAI: Copper regained some of its lost ground in Shanghai Tuesday, following a rebound in China's stock market, but prices are likely to enter a period of consolidation as the market waits for seasonal demand to return.

The benchmark Shanghai Composite index ended down 0.7 percent, recovering from a 2 percent fall earlier in the day as concern eased over interest rate hikes.

"The upward trend in metals is intact, but is facing headwind. Prices are likely to move in a wide range in the next few months," said Fang Junfeng, an analyst at Shanghai CIFCO Futures.

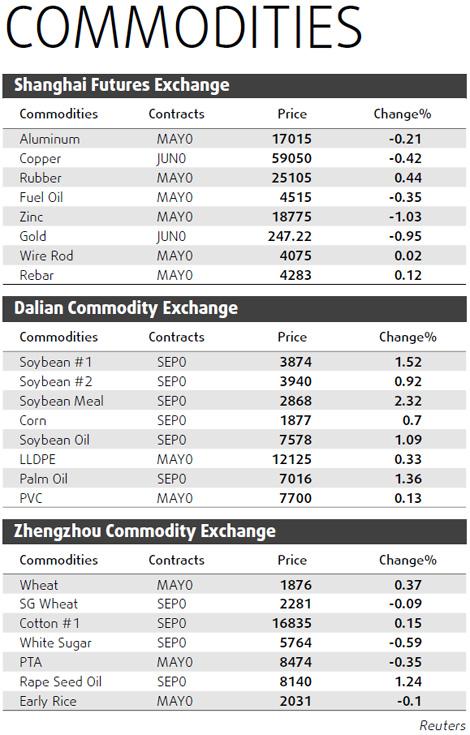

Shanghai's benchmark third-month copper futures contract edged down 0.2 percent to end at 58,890 yuan ($8,623) a ton, rebounding from an intra-day low of 58,260 yuan a ton. Three-month copper on the London Metal Exchange pared losses from earlier in the day to $7,320 a ton by 7:01 am in London.

"We are seeing some technical correction in copper prices," said Zhu Yanzhong, an analyst at Jinrui Futures. "But the bright outlook for the second quarter will give strong support to copper prices, despite the tightening signals."

Market needs to adjust to the 9 percent gain in copper prices on the London Metal Exchange last week, analysts said.

Support for Shanghai copper will be around 57,000 yuan to 58,000 yuan a ton, and for LME copper, $7,000, Zhu added.

The much-expected post-holiday buying from China has yet to emerge, as many factories have not returned to production, analysts and traders said.

"Traditionally seasonal demand should be strong from March to May, as copper tube production steps up to meet demand from air-conditioner producers. But so far we haven't seen much of that," a Shanghai-based trader said.

Buying was scarce after Shanghai copper opened up about 6 percent on Monday, leading to sharp falls in the open interest in copper contracts.

Open interest in Shanghai's copper contracts fell 19,730 lots from the previous session to 142,436 lots on Monday, according to exchange data.

Aluminum was the only metal in the positive territory, with Shanghai aluminum edging up 0.2 percent to 17,015 yuan a ton and LME aluminum up $9 to $2,159.

Although LME's aluminum stocks were still near record highs, cancelled warrants - materials tagged for delivery - rose to 302,025 tons as reported on Monday, compared with 243,175 tons on Jan 19.

"Demand from downstream users is improving," said Liang Lijuan, an analyst at COFCO Futures. "Aluminum prices are supported around the 16,000-yuan level by higher production costs."

The production cost of aluminum in China has risen to at least 15,000 yuan a ton, from 13,000 yuan at the end of 2008, due to higher power tariffs and raw material costs, she added.

Reuters