A traffic warden directs traffic in front a branch of Agricultural Bank of China in Shenyang, Liaoning province June 23, 2010. [Agencies]

HONG KONG - Agricultural Bank of China plans to raise up to $11.4 billion in the Hong Kong leg of its dual-exchange IPO, sources close to the deal said, but its total offering, including a Shanghai listing, may fall short of the record set by Industrial and Commercial Bank of China.

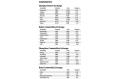

AgBank, which is kicking off a formal marketing roadshow, set a proposed price range of HK$2.88-HK$3.48 a share for the Hong Kong offering, said the sources who are directly involved with the deal but cannot be named as the information is not yet public. AgBank could not be reached for comment.

Local media, citing an unnamed person involved in the deal, have said AgBank is likely to price the Shanghai part of its dual listing at 2.60-2.70 yuan ($0.38-$0.40) a share.

At the high end of those ranges, the total initial public offering would raise up to $21.3 billion, just missing the record $21.9 billion raised by bigger rival ICBC in 2006.

Depending on demand, though, AgBank's underwriters could exercise the overallotment, or greenshoe, option and issue up to an extra 15 percent of the shares, raising as much as $24.5 billion, according to a term sheet obtained by Reuters.

The Hong Kong range gives China's third-largest bank with assets of $1.4 trillion a price-to-book value of 1.55 to 1.79 times, before any overallotment.

That puts the Beijing-based bank founded in the 1950s on par with fourth-ranked Bank of China and below the more than 2 times book that China's top banks trade at.

Valuation will be critical to setting the final IPO price.

James Liu, analyst at Sinopac Securities, said that with ICBC trading at above 2 times book, the expected AgBank valuation looked reasonable, noting that AgBank has a much bigger non-performing loan book than ICBC.

"The current range of pricing is relatively lower, and therefore, quite attractive," Liu said.

Special Coverage:Focus on ABC's IPO PlanNews at the weekend that China is relaxing control of the yuan has boosted China's stock market, helping sentiment for the mega-IPO.

The term sheet confirms an earlier Reuters report that part of the IPO will be syndicated in Japan -- in an offering set at 3-5 percent of the Hong Kong tranche, pre-overallotment, meaning it could raise up to $570 million.

AgBank plans to debut its shares in Shanghai on July 15 and in Hong Kong a day later.

The bank, headed by 53-year-old Xiang Junbo, and its underwriters are marketing the offer to institutional investors, having sold $5.45 billion of the Hong Kong deal to corporations and sovereign wealth funds.

AgBank is offering 25.4 billion shares in Hong Kong and 22.2 billion in Shanghai.

The bank, which has more than 350 million customers, more than the population of the United States, started premarketing the IPO to potential Chinese investors last week. It is scheduled to begin taking subscriptions on July 1.

It should set the IPO price on July 7.