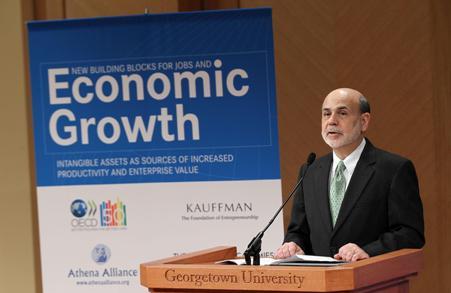

US Federal Reserve Chairman Ben Bernanke speaking recently at Georgetown University in Washington. Bernanke sent out a strong signal on Tuesday that the Fed is not planning to change its monetary policy despite weaker economic data. [Photo: Agencies]

A survey by the Federal Reserve on Wednesday showed the economy slowed in several U.S. regions for the first time this year, echoing Fed chairman Ben Bernanke's gloomy assessment of the recovery.

As the Fed's second round of quantitative easing, dubbed QE2, is due to expire at the end of the month, the central bank once again took the spotlight.

Economists said that with U.S. economic growth still slow and fragile, the Fed will be very patient before it begins to tighten the monetary policy.

RECOVERY SLOWER THAN EXPECTED

More and more evidences showed the recovery in the world's number one economy was running out of steam recently.

Not only have home prices fallen back to the lowest level since recession, manufacture sector, once leading the economy on the path of recovery, also notably weakened.

Even more bothering, the non-farm sector added merely 54,000 new jobs in May, far short of the 200,000 monthly level which economists believe is robust enough to slash the unemployment rate over the long run, according to the latest government jobs report.

As a result, the unemployment rate rose to 9.1 percent in May from the 9 percent in the previous month, reversing a four-month decline of the widely scrutinized figure.

When addressing a banking conference in Atlanta on Tuesday, Bernanke admitted that the U.S. economic growth was "somewhat slower than expected", citing supply chain disruptions associated with the earthquake and tsunami in Japan are hampering economic activity this quarter. However, he said the economic growth " seems likely to pick up somewhat in the second half of the year."

"It's probably going to take a bit of time before we over time figure out where the cost exceeds the benefits and we make the appropriate adjustments," Bernanke said.

Also on Tuesday, president Obama told a press conference that he is not concern about a double-dip recession, saying he is not so sure at this stage whether the disappointing jobs data report in May is a "one month episode" or "a long time trend."

QE3 UNLIKELY TO LAUNCH

Some economists believed that the Fed was very unlikely to launch another round of asset purchases unless the recovery suffers further major setback. On the other hand, QE2 seemed have done little to boost the economy.

"QE2 adds liquidity to the system, makes it easier for banks to lend, has given that message that the Fed wants to present that it is willing to do anything and everything to get the financial system moving again. But the key there is that the Fed is willing to do everything to make it possible for the banks to be more aggressive in lending but the banks are still holding back. The economy is not expanding rapidly, the banks are very hesitant and as a consequence QE2 has had at best a modest impact on the economy." Paul Wachtel, Professor of Economics NYU Stern School of Business, told Xinhua.

Alan Valdes, a veteran trader in the New York Stock Exchange, said to Xinhua: "QE2 really kept the stock market going, but it helped nothing in the economy. It didn't create jobs and it didn' t help the housing market."

"If one didn't work, if two didn't work, three is not gonna work. It only put off the disaster for a couple more months. That' s all it can do," Valdes said.

Wachtel also said QE3 is not the cure for the economy and he expected the Fed to keep its benchmark interest rate at historic low for a longer period of time.

"The Fed is unlikely to reintroduce quantitative easing, but I think they will sit with extremely low interest rate targets hovering just above zero well into 2012. I don't see any increase in the target for the Fed's fund rate for the course of this year, " Wachtel said.

"Remember the Fed was reluctant to do QE2. By the time they did the quantitative easing program, they already had five months of weak job numbers and so far we only have one month of weak numbers," said Ethan Harris, head of North American Economics at Bank of America Merrill Lynch in an interview with Xinhua. "To get them to do a QE3, we have to see an equally bad period ahead, a lot more weakness in the second half of the year. I think they don't want to do a QE3 and I certainly hope they don't. Because when you see QE3, we are in a very bad world."

LONG WAY TO EXIT

However, according to economists, given the weak economic recovery, the Fed will not exit from the easing monetary policy either.

Harris said the U.S. economy was still "in rehab," which means the Fed will be very patient when talking about an exit.

In fact, the period of easing will not end with the expiration of QE2. For the Fed, it will only be "ended" when it seeks to reduce its balance sheet and unwinds its purchases.

"The quantitative easing program number 2 involves 600 billion dollars in purchases by the Fed. That accompanied with all the purchases that were made earlier and the enormous expansion of the Fed balance sheet going back from 2008 on, does leave the Fed with this enormous balance sheet compared to four years ago," Wachtel said.

Wachtel said it's difficult for the Fed to maintain such a large balance sheet while it's not going to reduce it soon because the Fed feared that selling off assets might lead to interest rate increases and depressing various financial markets.

"There are some risks of the Fed sitting on that very large balance sheet but, I think, given the weakness of the economy at the present time, that's exactly what they are going to do for the time being."

"Fed wants a real healing process, which means a long drop of unemployment rate. If the unemployment rate doesn't drop, you don' t heal the housing market, you don't heal the household balance sheet. We need a falling unemployment rate to heal the underlying wounds of the economy," Harris said.

"We don't see the Fed hiking interest rate until the unemployment rate drops to 8 percent and still falling."

According to Harris, the Fed is expected to drop its wording of "extended period" in the second quarter of 2012, followed with its first rate hike in the third quarter. Then the central bank is going to begin asset sales in 2013.