SINGAPORE: Gold will climb to $1,500 an ounce and silver will top $25 this year as the dollar loses its haven status, according to Jeffrey Nichols, managing director of American Precious Metals Advisors.

"Fear of sovereign debt defaults by one or another European country could benefit the dollar and temporarily hurt gold," New York-based Nichols said. "But gold is the ultimate safe haven and the dollar, without the support of sound monetary and fiscal policies, is a depreciating asset."

Gold surged to a record $1,226.56 an ounce on Dec 3 and has slipped 9.5 percent since then as the Dollar Index, a six-currency gauge of the greenback's strength, rallied amid concern that sovereign debt problems in the 16-nation eurozone would spread.

The cost of insuring against losses on Portuguese government debt surged to a record on Wednesday and central bank Governor Vitor Constancio said cutting the budget deficit would require "difficult" measures.

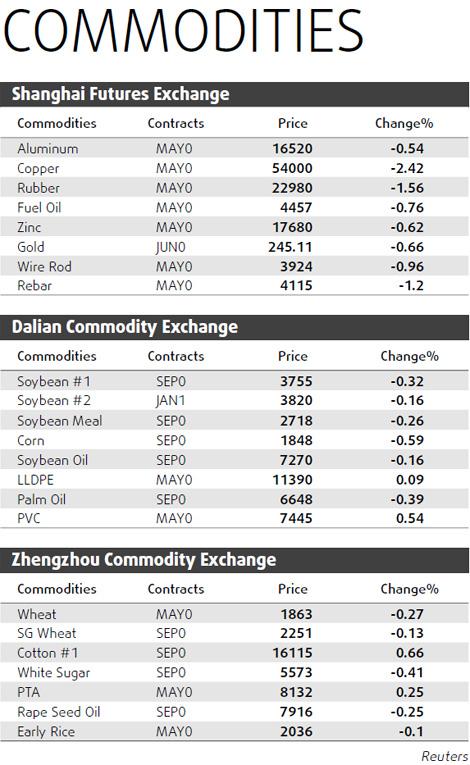

Gold for immediate delivery was little changed at $1,110.10 an ounce at 10:43 am in Singapore. Spot silver was little changed at $16.3875 an ounce.

"As in the past year, these occasional reversals will lead some to believe the party is over for precious metals," said Nichols, a precious metals analyst for more than 25 years. "But I believe periods of weakness will be opportunities for those underweighted in gold and silver to augment their holdings of physical metal."

Gold advanced 24 percent last year as the Federal Reserve held interest rates near zero to spur growth, pushing the Dollar Index 4.2 percent lower. The US government has boosted spending to combat the global recession, pushing the nation's marketable debt to an unprecedented $7.27 trillion.

"It is only a matter of time before the dollar's safe-haven appeal diminishes and gold regains its status as the ultimate safe haven," Nichols said.

Growing Chinese interest in gold, increased central bank bullion purchases and a worsening outlook for production should all boost the metal, he added.

Nichols estimated China's private-sector investment gold purchases totaled as much as 100 tons, or 3.2 million ounces, last year and said it could rise by more than 50 percent in 2010 as growing incomes and inflationary expectations give "more people both the means and the motivation to invest in the metal".

Jewelry sales in China, which is bought both for adornment and as a store of wealth, totaled 350 tons last year and could increase by 100 tons or more this year, he said.

Bloomberg News