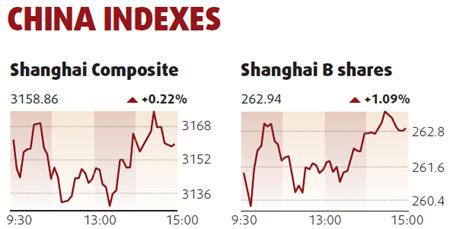

Mainland stocks rose, led by banks and insurers, after the nation's growth rate accelerated to the quickest pace since 2007 in the fourth quarter.

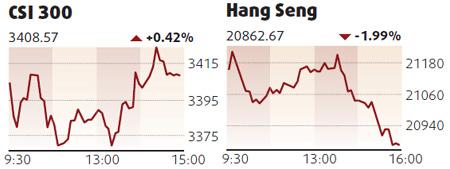

The Shanghai Composite Index rose 7.01, or 0.2 percent, to 3,158.86 at the close, erasing a 0.8 percent loss. The CSI 300 Index gained 0.4 percent to 3,408.57.

"China's economy has recovered strongly, particularly in the second half," Thomas Deng, head of China strategy at Goldman Sachs Group Inc, said. "We're still positive on the market."

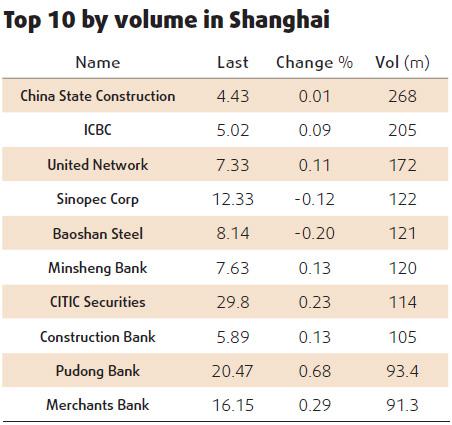

Industrial & Commercial Bank of China, the nation's biggest listed lender, added 1.8 percent to 5.02 yuan. Construction Bank, the second largest, rose 2.3 percent to 5.89 yuan. Shanghai Pudong Development Bank Co, the Chinese partner of Citigroup Inc, advanced 3.4 percent to 20.47 yuan.

China Asset Management Co, the nation's biggest mutual fund company, bought Chinese banks and transport companies and sold mining stocks in its flagship fund in the fourth quarter, according to the company's website.

Jiangxi Copper Co paced declines by commodities producers on concern the government will rein in credit growth to avert asset bubbles.

The company lost 1.5 percent to 37.33 yuan. Aluminum Corp of China Ltd slid 1.4 percent to 13.72 yuan. PetroChina Co dropped 1.2 percent to 13.51 yuan.

Hang Seng falls

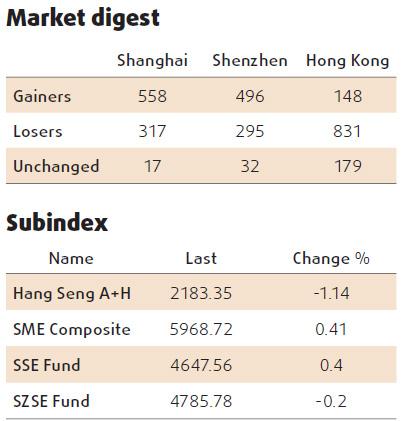

Hong Kong stocks fell 1.99 percent to their lowest level in more than three months yesterday, as investors exited banks and property stocks after the mainland's strong economic data reignited fears of further tightening measures.

The benchmark Hang Seng Index fell sharply in afternoon trade, ending down 423.50 points at 20,862.67, its lowest close since Oct 6. The China Enterprises Index of top locally listed mainland stocks was down 2.64 percent at 11,957.83.

Market turnover rose to HK$83.13 billion from Wednesday's HK$74.62 billion.