A man at the entrance of a recent real estate fair in Beijing. The China Se Shang Property Index tracking 33 companies declined 2.4 percent in the past three months. [China Daily]

China's property stocks, the worst performers this quarter, will rebound because policy changes are "factored into" shares and the government needs the industry to bolster consumer spending, CLSA Asia-Pacific Markets said.

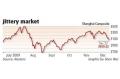

The China Se Shang Property Index of real estate shares fell the most in two weeks on Tuesday, led by the largest developers China Vanke Co and Poly Real Estate Group Co, after the government said it will target "excessive" growth in property prices in some cities. That follows the cabinet's statement last week that it will re-impose a sales tax on homes sold within five years, after cutting the period to two years in January.

"The market has more or less factored in policy risk" as property shares have lagged behind the benchmark index in the past three months, said Manop Sangiambut, Shanghai-based head of China A-share research at CLSA, which was voted best in overall research in Asia excluding Australia and Japan by Asiamoney magazine. "The overall property market remains quite healthy."

Sangiambut, who has an "overweight" recommendation on mainland-traded property stocks, didn't disclose his recommendations. He predicts the CSI 300 Index, which measures exchanges in Shanghai and Shenzhen, will rise to 4400 next year, a 23 percent gain from Tuesday's close of 3583.34.

Valuations

"China's stocks represent value at current levels," he said. The property index tracking 33 companies has declined 2.4 percent in the past three months, compared with the 7.9 percent advance in the Shanghai Composite. The real estate gauge trades at 32 times profit, below the Shanghai index's 34.7 times and this year's high of 43 in July, according to weekly data compiled by Bloomberg.

Analysts say that the recent property measures are attempts by the government to clamp down on real estate speculation while sustaining a recovery in the world's third-largest economy.

China isn't likely to adopt "heavy-handed policy measures" next year as "any sharp correction in the property market may hamper overall economic growth", Fitch Ratings wrote in a report.

Gross domestic product will expand 9.3 percent next year, according to a Bloomberg News survey of economists, after growth accelerated to 8.9 percent in the past quarter on record lending, a 4 trillion yuan ($586 billion) stimulus package and subsidies for consumer purchases.

Pricey realty

Andrew Mattock, who manages the $342 million Henderson Horizon China Fund, said this week he would stay "fairly aggressive" on property stocks because tightening risks are priced in. Dreyfus Greater China Fund manager Hugh Simon said on Dec 11 that he would not add to his real estate holdings after the Shanghai property index jumped 121 percent this year.

"Developers are doing well this year in terms of earnings but that will change because of the government crackdown," said Zhang Ling, who helps oversee about $7.21 billion at ICBC Credit Suisse Asset Management Co in Beijing.

RBC Capital Markets said on Dec 11 that a recovery in exports and a pick-up in inflation would force the Chinese central bank to increase interest rates in the first quarter of 2010.

Home prices climbed last month at the fastest pace since July 2008, adding to concern that record lending may fuel unsustainable asset-price increases. In Shanghai, the average home price rose to a record 22,270 yuan per sq m last week, the Shanghai Daily reported, citing Shanghai Uwin Real Estate Information Services Co.

China may impose property taxes on large and luxury homes, and curb purchases of real estate by foreigners, the Oriental Morning Post newspaper reported, citing a researcher at E-house China R&D Institute. The China Securities Regulatory Commission has asked eight property developers, including Shenzhen-based Vanke, to provide information on their capital flows, according to a separate report in the newspaper.

The government is unlikely to scrap preferential lending rates for buyers of second homes, introduced in December 2008, as China "still needs a strong property market to boost consumption", said CLSA's Sangiambut.