SHANGHAI: China's benchmark stock index fell as developers dropped on concern tighter lending standards will curb demand for property, countering gains by consumer-related companies ahead of the weeklong Lunar New Year holiday.

Poly Real Estate Group Co, the nation's second-largest developer by market value, dropped 2.3 percent and Gemdale Corp lost 1.6 percent after the Financial News said Industrial & Commercial Bank of China Ltd will limit the amount of new loans this year. Suning Appliance Co, China's biggest home appliance retailer by market value, added 2.9 percent and Panda Fireworks Group Co jumped 6.6 percent.

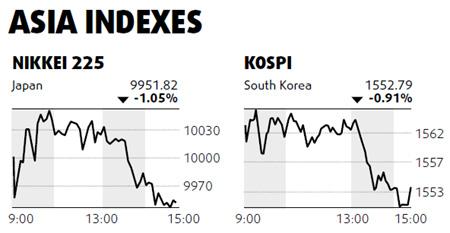

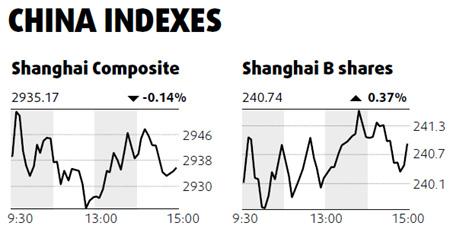

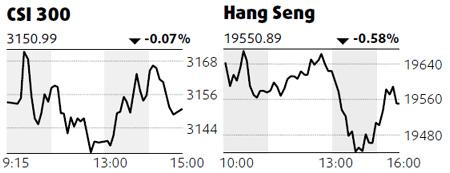

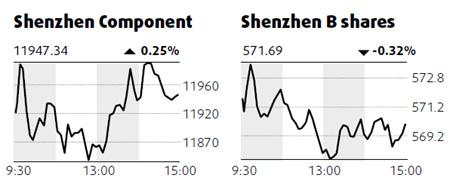

The Shanghai Composite Index fell 4.23, or 0.1 percent, to 2,935.17 at the close after swinging between gains and losses more than 10 times. The gauge has slumped 10 percent in 2010 on concern the government will raise interest rates and curb lending to cool the economy and avert asset bubbles. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, slipped 0.1 percent to 3,150.99.

"Policy risk is still the biggest concern to the market and we might see some action such as reserve ratio or interest rate increases after the holiday," said Yan Ji, who helps oversee about $1.2 billion at HSBC Jintrust Fund Management Co in Shanghai. "Trading will be light this week as investors aren't in the mood for trading before the Lunar New Year."

China's Lunar New Year holiday begins on Feb 13 and lasts until Feb 21.

Poly Real Estate fell 2.3 percent to 18.64 yuan, dragging it to a 17 percent loss this year. Gemdale, the country's fourth largest developer by market value, dropped 1.6 percent to 11.66 yuan. China Vanke Co, the biggest, lost 0.9 percent to 9.12 yuan.

Hang Seng falls

Hong Kong's benchmark stock index fell to a five-month low on continued concern the mainland will act to rein in economic growth and commodity producers dropped along with metal prices.

The Hang Seng Index fell 0.6 percent to 19,550.89, its lowest close since Sept 2.

The Hang Seng China Enterprises Index, which tracks the so-called H shares of Hong Kong-listed mainland companies, lost 1.3 percent to 10,989.19, closing at its lowest level since July 16.