BEIJING - The banking regulator will soon come out with rules governing the payment system for commercial lenders and may join the global efforts to curb excessive risk-taking by clamping down on bank bonuses, people with knowledge of the matter told China Daily on Tuesday.

Under the guidelines, the base pay of a bank employee should not exceed 35 percent of the total remuneration, while bonus payments for senior management should not be more than three times the base salary, the source, who declined to be named, said.

The remuneration system of Chinese lenders consists of base pay, bonus payments and allowances for specific needs, the source said.

Lenders in Western nations have been facing flak after the financial crisis as their payment system encouraged excessive or improper risk taking. That in turn, often endangered the safety of individual institutions and in some cases the entire financial system.

The new rules, slated to come into effect this month, are the second in the Asian region covering banks' remuneration policy and structure. The Hong Kong Monetary Authority made the first move in this regard late last year.

The regulations stipulate that at least 40 percent of the bonus payments for senior management needs to be retained by the lender for future risk contingencies and should be paid out after a lockup period of at least three years.

The amount of bonus that needs to be deferred will be hiked to 50 percent for top decision-makers and those whose activities could have a material impact on the risk exposure, the source said.

If there are significant losses, banks will also have the power to take back the bonuses already paid and stop further payments.

Jiang Dingzhi, vice-chairman of China Banking Regulatory Commission, the nation's top banking watchdog, first mooted the bank remuneration system overhaul at a financial forum late last year and wanted lenders to link the remuneration policy with future risk.

"Most of the time, the risk is not visible in the near term. Therefore, it is necessary to defer part of the bonus to offset any possible risk," Jiang told a financial forum late last year.

Commercial lenders should also set up a remuneration management team in the board and at least one third of the members should be financial professionals, the source said.

They are not allowed to increase bonus payments if they are unable to meet certain regulatory criteria for the previous year like profits, risk management and social responsibility, the source said.

The regulator has stipulated a capital adequacy ratio of over 11.5 percent for big lenders this year and more than 10 percent for small- and medium-sized banks, people familiar with the matter said last week.

Banks have also been asked to shore up capital after a record lending surge last year.

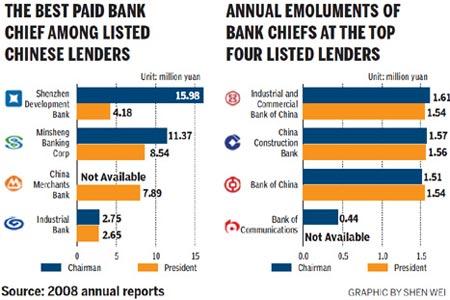

Frank Newman, chairman of Shenzhen Development Bank, was ranked as the highest paid senior executive of a Chinese company in 2008.

Executives at the medium-sized joint stock Chinese lenders were better paid than their counterparts in large State-run banks. Dong Wenbiao, chairman of private lender Minsheng Banking Corp was the best-paid Chinese banking executive in 2008, with annual emoluments of 11.37 million yuan.