SHANGHAI: Mainland stocks dropped on the first trading day after a weeklong break as financial companies fell after the central bank ordered lenders to set aside larger reserves, countering gains by Fujian-based companies.

China CITIC Bank Corp, the banking unit of the nation's largest investment company, slid 1.7 percent. Poly Real Estate Group Co and Gemdale Corp retreated at least 1.5 percent as Goldman Sachs Group Inc reduced share-price estimates for property companies.

Fujian Cement Inc led gains among stocks based in the southeastern province as President Hu Jintao called for the faster development of a Fujian economic zone.

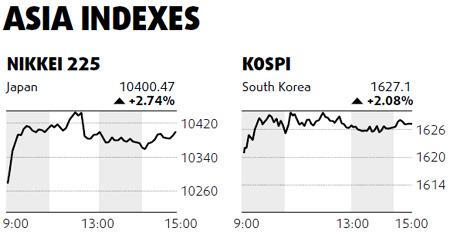

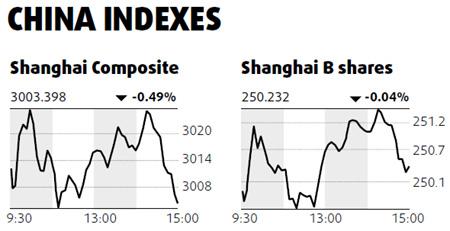

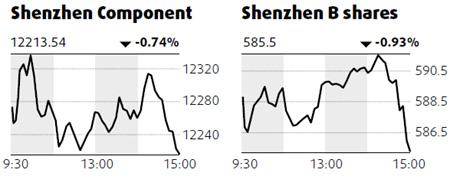

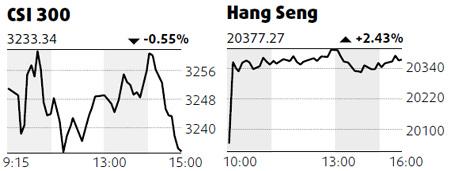

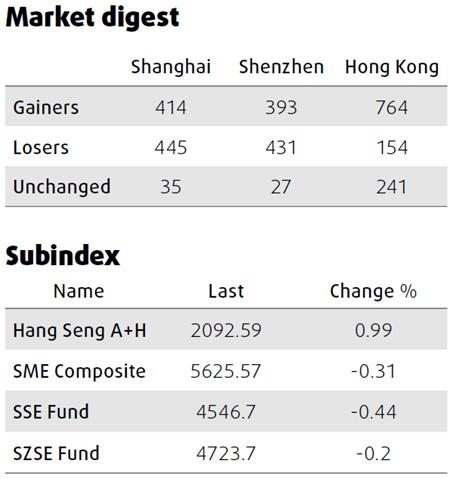

The Shanghai Composite Index fell 14.74, or 0.49 percent, to close at 3003.40 after changing direction about six times. China's markets were closed last week for the Lunar New Year holiday, when the MSCI World Index added 2.5 percent. The CSI 300 Index dropped 0.55 percent to 3233.34.

"It's clear that tighter monetary policies will be in place for a while and that continues to pressure stocks that are sensitive to credit," said Zhang Ling, who helps oversee about $7.21 billion at ICBC Credit Suisse Asset Management Co. "With the market fluctuating, thematic investments are probably the best plays now for quick money."

Hang Seng rises

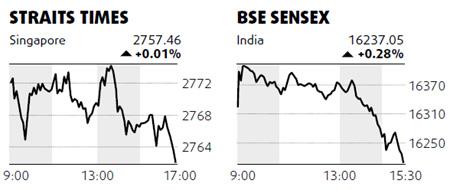

Hong Kong stocks rose as the city's first land auction of the year beat most estimates and after a smaller-than-estimated increase in US consumer prices eased concern the Federal Reserve will increase interest rates.

"Interest rates in Hong Kong are so low and the economy is doing quite well, so that is fueling the property boom," said Khiem Do, Hong Kong-based head of multi-asset strategy at Baring Asset Management (Asia) Ltd.

The Hang Seng Index climbed 2.43 percent to close at 20377.27, snapping a two-day, 3.1 percent drop. The Hang Seng China Enterprises Index added 2.3 percent to 11519.56.