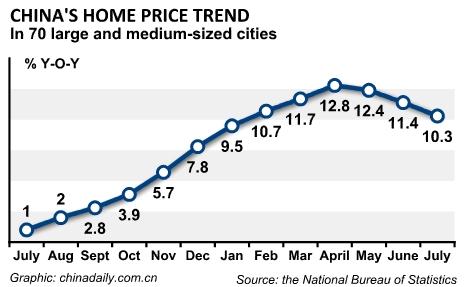

BEIJING - Housing prices in major Chinese cities rose 10.3 percent year on year in July, down from the 11.4 percent growth in June, the National Bureau of Statistics (NBS) said Tuesday.

It was the third consecutive month that China's property prices rose at a slower pace and the lowest growth rate in six months.

Property prices in the 70 large and medium-sized cities grew 12.4 percent in May and 12.8 percent in April, the highest since July 2005 when the government started to issue the data.

The slowdown follows a series of government measures to curb speculation in the property market and rein in excessive price rises.

On a monthly basis, July property prices in the cities were unchanged compared to a month earlier, the NBS said in a statement on its website.

New home prices rose 12.9 percent year on year in July, down 1.2 percentage points from June. Prices of second-hand homes gained 6.7 percent last month, compared with an increase of 7.7 percent in June.

The value of property sales in July fell 19.3 percent from a year earlier to 306.6 billion yuan ($45.3 billion). Property sales by floor space declined 15.4 percent year on year to 64.66 million square meters.

Investment in property development rose 37.2 percent to 2.39 trillion yuan in the first seven months of this year. In July, investment climbed 33 percent to 411.8 billion yuan.

The government started a campaign in April to rein in soaring prices, including tighter scrutiny of developers' financing, limited loans for third-home purchases, and higher downpayment requirements for second-home purchases.

"It's good growth in housing prices is slowing, but I think the growth rate is still more than what the government desires," said Zhuang Jian, a senior economist with the Asian Development Bank in Beijing.

The government should stick to their tightening policies already in place as there is still room for a correction in prices, he said, adding that there is no need for a further tightening.

He expects housing prices to continue to see slower growth rates over the rest of the year.

The China Banking Regulatory Commission said earlier this month the government will maintain policies to cool the property market. It also ordered banks in regions with soaring property prices to suspend making loans for third home purchases, according to credit risk assessments.It also told lenders to estimate for a worst-case scenario of a 50 percent to 60 percent property price drop in cities where housing prices have risen excessively, Bloomberg reported Aug 5.

The banking regulator said the stress tests did not reflect its outlook on the nation's property market.

China Vanke, the country's largest property developer by market value, said Monday its first-half net profit rose 11.4 percent from a year ago to 2.81 billion yuan.

Poly Real Estate Group, the country's second largest property developer, said its net profit in the first half rose 16.56 percent year on year to 1.627 billion yuan.