Editor's Note:

The Chinese horn, or vuvuzela, buzzed throughout the World Cup, which ended a week ago, bringing resounding success to Chinese manufacturers and showing the overwhelming 'Made in China' power to the world.For the past decade and more, China has been the manufacturing workshop of the world. But rising labor costs may cast a shadow on the future of the 'Made in China' strategy.

'Made in China' faces vague future

Foreign investors considering relocating production

Strikes at Honda have also aroused concerns among foreign investors about labor unrest in China.

Two large US companies, Ann Taylor Stores, the women's clothing retailer, and Coach, the luxury handbag maker, are poised to relocate production to countries, where labor rates are cheaper.

Mike Devine, chief financial officer of New York-headquartered Coach, which makes luxury hand bags, said at a conference recently a move was in the pipeline.

"We are looking to move production into lower-cost geographies, most notably Vietnam and India," he said.

Michael Nicholson, chief financial officer of Anne Taylor Stores, also told the Wall Street Journal recently the company was assessing the quality of production sites in other countries.

A recent survey by EEF, Britain's leading manufacturing association, said one in seven of its members were looking at shifting production back to the UK, fed up with problems in countries such as China.

"Getting goods of the right quality, issues such as time to market and rising fuel costs have been driving this trend," said Lee Hopley, EEF's chief economist. [Full Story]

Employees at Hon Hai's Foxconn plant peer out from the back of a company sign in Shenzhen. Foxconn, which makes iPhones and iPads for Apple at its factory in the southern Chinese city, increased labor rates by 70 percent recently after a spate of suicides among workers.[China Foto Press]

Employees at Hon Hai's Foxconn plant peer out from the back of a company sign in Shenzhen. Foxconn, which makes iPhones and iPads for Apple at its factory in the southern Chinese city, increased labor rates by 70 percent recently after a spate of suicides among workers.[China Foto Press]Rising labor costs trigger industrial relocation

China has seen more and more manufacturing companies moving their plants to or setting new plants in the country's interior from coastal provinces as factory owners try to cut costs. Higher labor and realty prices made China's traditional manufacturing bases, like the mainland's top exporting province of Guangdong, less advantaged than before. However, inland provinces and cities that offered improved transportation capacities and preferential policies shine as new investment destinations.

As this changes, a new chapter is being written in the inspiring story of economic development in Asia. Starting with Japan, country after country grew rich by following the same playbook: step on to the lowest and most labor-intensive rung of industrialization and gradually move up the value chain as you build up skills and capital, letting poorer countries take on the tasks you shed.

This is how the "Asian tigers" copied Japan, and how successive generations including China itself followed. The current relocations are no less momentous for happening within a single country. [Full Story]

A man sews a down jacket at a factory in Pinghu, Zhejiang province. [QILAI SHEN / BLOOMBERG NEWS]

A man sews a down jacket at a factory in Pinghu, Zhejiang province. [QILAI SHEN / BLOOMBERG NEWS]Counting the cost of rising wages in Chinese industry

Labor cost rises as economy develops

No one can deny that increasing wage rates in China is not a significant issue. The average annual manufacturing wage in Guangdong, China's industrial heartland, increased by 144.2 percent from 1998 to 2008, according to EIU figures.

The rises were even greater in the bordering autonomous region of Guangxi Zhuang, and Hunan and Guizhou provinces, all within the Pearl River Delta basin.

Manufacturing wages in Hunan increased by 263.2 percent, while the rises in Guizhou at 258.8 percent and Guangxi at 244.2 percent were not far behind.

The picture in the rest of the country is very little different. Wage rates have soared in the Yangtze River Delta too.

The annual manufacturing wage in Shanghai in 2008 was the highest in the country at 42,311 yuan, increasing by 226.8 percent over the 10-year period.

There was a similar story in the neighboring Yangtze provinces of Zhejiang and Jiangsu, where wages rates rose by 186.2 percent and 247.2 percent, respectively.

Those companies hoping to get a cheaper deal on labor costs in the more western provinces such as Sichuan would also find it difficult.

The average annual manufacturing labor rate there of 22,046 yuan is only slightly lower than in Guangdong itself.[Full Story]

Suicides and strikes force pay hikes

Foxconn, which makes iPhones and iPads for Apple at its factory in Shenzhen, increased labor rates by 70 percent recently after a spate of suicides among workers.

Strikes at Honda have also aroused concerns among foreign investors about labor unrest in China.

Manufacturing wages across China have increased by 14 per cent over the past year (see inside cover story), making the prospect of producing goods in nearby Southeast Asian countries such as Vietnam or in Bangladesh, Sri Lanka and even Africa seem a viable alternative. [Full Story]

Workers rest during a strike at a Atsumitec Co plant in Foshan, southern China's Guangdong province July 16, 2010. A strike has broken out on Monday in the city of Foshan at Atsumitec Co, which supplies parts for Japan's Honda Motor, the latest in a string of stoppages by Chinese workers demanding a bigger piece of the country's economic wealth.

Workers rest during a strike at a Atsumitec Co plant in Foshan, southern China's Guangdong province July 16, 2010. A strike has broken out on Monday in the city of Foshan at Atsumitec Co, which supplies parts for Japan's Honda Motor, the latest in a string of stoppages by Chinese workers demanding a bigger piece of the country's economic wealth.New generation of workers has higher aspirations

"Strikes happen all the time. The current generation of workers have higher aspirations than perhaps their parents had," he said.

Thun also believes current labor cost pressures could be a catalyst for change in China.

"One of the problems that China historically has faced is that it has never been pushed into innovation-based activities because of this excess supply of labor," he said.

"Pushing manufacturing into high value-added activity is very much what the government wants. This kind of cost pressure stimulates upgrading." [Full Story]

China reaches so-called "Lewis Turning Point"

China had reached the so-called "Lewis Turning Point" (named after the British economist Arthur Lewis) at which an economy reaches a point in its development when it exhausts its supply of rural migrant workers, thus putting pressure on wages.

"Another explanation is that we are seeing the effects of the stimulus package which has created jobs in infrastructure development in western and central China, reducing the pool of labor for manufacturing. It is not likely to be one or the other but a combination of both," he said. [Full Story]

Analysts: Manufacturing in China 'has a future'

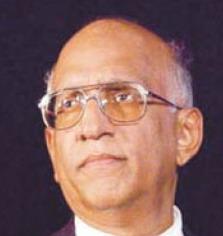

Alexander van Kemenade, an analyst with the China Regional Forecasting Service for the Economist Intelligence Unit.

Alexander van Kemenade, an analyst with the China Regional Forecasting Service for the Economist Intelligence Unit. No dramatic mass exodus of production to cheaper countries predicted

Manufacturing will remain a major part of the Chinese economy for at least the next 100 years despite strikes and increased labor costs, according to a leading economics research body.

Manufacturing currently makes up around 47 percent of China's gross domestic product (GDP), compared with 23 percent in the United States.

Alexander van Kemenade, an analyst with the China Regional Forecasting Service for the Economist Intelligence Unit (EIU), said speculation of a mass exodus of manufacturers to cheaper locations such as Vietnam and Bangladesh was alarmist.

"I would say it was very overblown. I would give it 100 years maybe before China has the same level of manufacturing as the United States," he said.

Van Kemenade said China still had a lot of strengths as a manufacturing heartland and any move away to other countries in Southeast Asia would happen only gradually. [Full Story]

Jim Pinto, an expert in automation based in San Diego, California.

Jim Pinto, an expert in automation based in San Diego, California.China's manufacturing sector more resilient

Jim Pinto, an expert in automation based in San Diego, California, who predicts future trends in manufacturing, said China's manufacturing sector was likely to prove more resilient than many realize.

"Labor is not the big element to manufacturing costs many people think. A lot of manufacturing is relatively automated. What distinguishes China is the low margins its companies can survive on," he said.

"China can make an iPhone for $200 and sell it to Apple for $220, whereas a European maker, for example, would sell it for $360. The availability of cheap loans and tax holidays means it can survive on these lower margins."

Pinto, the manufacturing futurologist, said China was not about to lose its crown as the world's workshop overnight.

"China has really learnt how to ramp up manufacturing. It can provide quantity and quality at speed and this gives it real advantages over many other countries. It is not going to lose that any time soon," he said.[Full Story]

Stefan Halper, a senior research fellow at Magdalene College, Cambridge.

Stefan Halper, a senior research fellow at Magdalene College, Cambridge. China's manufacturers at crossroads

Dr Stefan Halper, a senior research fellow at Magdalene College, Cambridge, and author of the recent book 'Beijing Consensus' about China's future economic outlook, said recent events put China's manufacturers at some form of crossroads.

"China is desperately trying to hang on to its export market. It really doesn't want to give up its advantages which it has carved out of granite," he said.

He said attempts to cling on to its manufacturing prowess by making some of its goods offshore in Southeast Asia and then re-exporting them from China carried risks.

"They are going to find themselves in the same situation as American manufacturers, which will add a new interesting dimension to the globalization process. They will not win friends in the countries they site their new factories if they also export the worst conditions of China factories," he added. [Full Story]

Companies: China remains favorite manufacturing destination

Big wheels get ready for the fast lane despite labor bumps

China will retain its competitive edge and remain a favorite manufacturing destination for global automakers, but the recent labor unrests may increase costs for companies, industry sources and analysts said on Tuesday.

Kevin Wale, president and chief executive of General Motors China told China Daily that the recent labor disputes will not impact the company's investment appetite in China.

"It's common. Labor issues occur everywhere, but China's huge market potential is more important," said Wale.

Foreign carmakers' success in China have been the vital cogs for their strong global performance, and hence no company can avoid its presence here, said Xu Changming, research director of the China State Information Center. [Full Story]

Workers at a Honda production line in Guangzhou. China's automobile sales are expected to maintain year-on-year growth of 20 percent in the next five years. [China Daily]

Workers at a Honda production line in Guangzhou. China's automobile sales are expected to maintain year-on-year growth of 20 percent in the next five years. [China Daily]Scandal-hit Foxconn sets sights inland

Inland cities are in fierce competition to be part of Foxconn Technology Group's huge repositioning plans, which were announced shortly after a series of suicides at the company's South China plants.

Zhengzhou in Henan province, Wuhan in Hubei, Chengdu in Sichuan and Langfang in Hebei are all listed as possible locations by the world's largest contract electronics maker, whose operations are currently centered in Shenzhen, an industrial hub in Guangdong province.

Although a final agreement is yet to be reached between the Zhengzhou government and Foxconn, recruitment has already started in this populous province in Central China.

A company document acquired by China Daily shows that the Taiwan-headquartered firm, whose clients include Apple and Sony, will hire 100,000 workers from 18 cities by Sept 20. As of June, about 38,000 people had already joined.

Cheap labor and large-scale production orders are key to ensuring huge revenue for factories, meaning that any change in wage levels, no matter how slight, will have a major impact on Foxconn's balance sheets. [Full Story]

Chen Gang, who works for Foxconn's Communication and Network Solution Business Group, is reluctant to leave Shenzhen and says he will weigh his options if his division is relocated. [Zou Zhongpin / China Daily]

Chen Gang, who works for Foxconn's Communication and Network Solution Business Group, is reluctant to leave Shenzhen and says he will weigh his options if his division is relocated. [Zou Zhongpin / China Daily]Government: Pushing manufacturing into high value-added activity

Innovation-based activity wanted

Dr Eric Thun, lecturer in Chinese Business Studies at the University of Oxford China Center, believes current labor cost pressures could be a catalyst for change in China.

"One of the problems that China historically has faced is that it has never been pushed into innovation-based activities because of this excess supply of labor," he said.

"Pushing manufacturing into high value-added activity is very much what the government wants. This kind of cost pressure stimulates upgrading." [Full Story]

Coastal regions manufacture excellence, low-tech manufacturing moves inland

What the Chinese government would like to happen over the medium term would be for the coastal regions to become centers of manufacturing excellence while low-tech manufacturing moves inland.

If some Chinese or foreign companies decide to switch manufacturing to Southeast Asian countries, the economic damage need not be that great.

During this process, however, China still needs to retain a sizeable labor-intensive manufacturing sector because its unusually large population is always hungry for jobs.

Thun added China could not get into a game of chasing ever lower labor costs because this would be ultimately self-defeating.

"The only way labor costs are going to be kept low is if development doesn't succeed. Development inevitably is going to raise your costs," said Alistair Thornton, an analyst with IHS Global Insight.

"It is nonetheless a dilemma for the government. From an employment perspective they still need low-end manufacturing but, on the other hand, the fact that labor costs are rising is to some extent a sign of success." [Full Story]