A boy walks past a billboard that shows the Central Business District in Beijing. China's economic growth slowed in the second quarter to 10.3 percent from a year earlier, a touch weaker than expected, in response to the fading of government fiscal and monetary stimulus. [Grace Liang / Reuters]

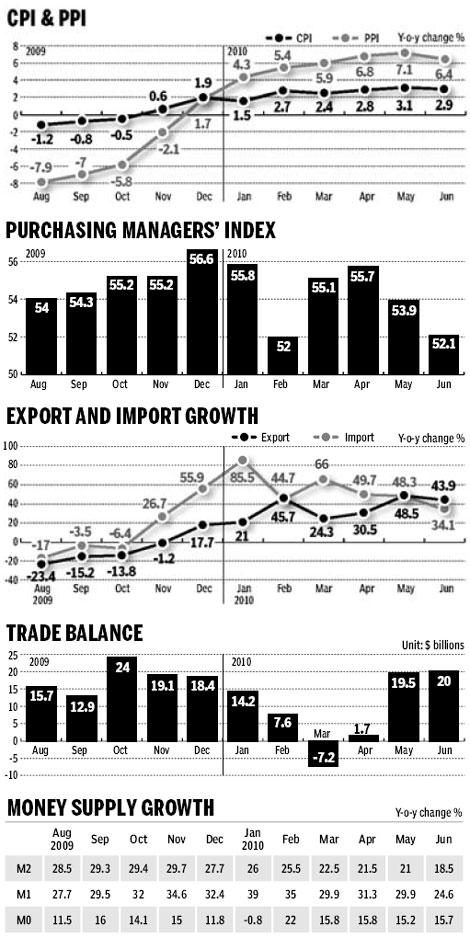

BEIJING - China's consumer inflation will continue to weaken in the second half of this year after easing in June, economists said.The Consumer Price Index (CPI), the major gauge of inflation, grew 2.6 percent in the first half of 2010 over a year ago, the National Bureau of Statistics said on Thursday.

Worries over inflation increased as prices of properties and food soared in the beginning of the year, however, the worst-case scenario has been avoided and inflationary pressures are likely to ease in the second half of the year, economists said.

Consumer prices in China's urban areas increased 2.5 percent and in rural regions by 2.8 percent in the first half, year on year.

The consumer price index rose 2.9 percent year on year in June, 0.2 percentage points lower from 3.1 percent in May.

That figure is lower than the market forecast of over 3 percent.

"It provides an advantageous base for reaching the full year target and the inflationary pressure will be alleviated according to the status quo," said Zhuang Jian, a senior economist with the Asian Development Bank. China has set a 3 percent target for the entire year.

Wang Xiaolu, deputy director of the National Economic Research Institute, said the index will remain at 3 percent for the whole year as the economy is going to be slightly cooler for the rest of the year.

The drop in growth of the money supply and outstanding loans provide an advantage for inflationary control, economists said.

China's growth of M2, the broadest measure of money supply that includes all deposits and cash, declined to 18.5 percent in June, compared with 29.7 percent over the same period of last year.

The amount of outstanding loans of all financial institutions was 44.6 trillion yuan in the first half, down 2.7 trillion yuan compared with that at the end of June last year.

Inflationary pressure for food, which accounts for about a third of the weighting in calculating the index and is regarded as a major target for inflationary control this year, appeared to follow a declining trend.

Prices of vegetables and other food items have fallen due to warmer weather and the government's crackdown on speculation on some agricultural products such as mung beans and garlic.

Prices for grain continue to grow as China's summer grain suffered its first time reduction of yield in the past seven years. This year's summer grain yields were 123.10 million tons, down 0.3 percent year on year.

However, "increase of grain prices would be periodical as China has abundant reserves for grain and won't affect the index much," Zhuang said.

In the second half, the possible overcapacity problems in these industries as a result of falling demand may pull down the Producer Price Index (PPI), a major measure of inflation at the wholesale level.

The PPI grew 6.0 percent in the first half. It rose 7.1 percent in May and 6.8 percent in April, according to the NBS.