Fred Hu, a partner with Goldman Sachs, is stepping down from his post after working with the Wall Street bank for several years. [China Daily]

Dealmaker has vast experience of working closely with Chinese banks

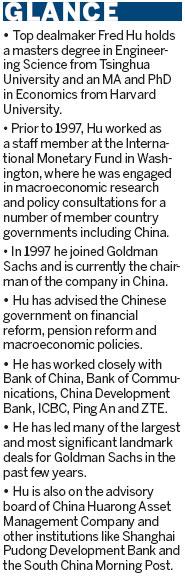

BEIJING - High-profile dealmaker and Goldman Sachs top Asian executive Fred (Zuliu) Hu is likely to take up a senior post at China's central bank after formally stepping down from the Wall Street bank in April, people familiar with the matter said.

The appointment is still under final review by top policymakers, and a formal decision will be made in the next few months, the sources said.

Hu is seen as the right candidate for appointment as the vice-governor of the People's Bank of China (PBOC). His appointment is also part of the government's efforts to bring back the top 1,000 professionals working for Western firms to China to take up senior positions at State-owned enterprises and government departments, the sources said.

Besides the PBOC job, policymakers are also evaluating Hu as a candidate for a crucial position at one of the country's State-run lenders.

Though Hu was not immediately available for comments, the 47-year-old investment banker has been in the limelight in the past few weeks after Goldman Sachs said he was stepping down as partner.

Given his rich financial expertise and international exposure, there were reports that Hu would establish his own private equity firm or join his alma mater Tsinghua University as a professor.

Sources said Hu was still in talks with top government officials on his appointment. If it happens, Hu will be the first high-profile executive from a Western firm taking up a senior position with the government.

During his 13 years in Goldman, Hu spearheaded the multi-billion dollar public offerings of several Chinese lenders. In 2006, he made a $3.78 billion investment for Goldman in the Industrial and Commercial Bank of China (ICBC), now the world's largest lender by market value.

In 2004, Hu helped Bank of Communications, China's No 5 bank by assets, to sell a 20 percent stake to Europe's No 1 bank HSBC Holdings Plc.

Analysts said the move indicates a groundbreaking reform in the nation's selection of senior government officials. It also signals a departure from the tradition that Chinese officials should climb the management ladder gradually.

"Sending a paratrooper to a crucial post at a government financial department is indeed rare. It also indicates the government's determination to achieve breakthroughs in selecting officials and also promote the openness of the financial sector," said He Jun, a senior analyst at Anbound Consultancy.

"Hu's credibility and past career achievements make him an eligible candidate, considering the country's need to attract more professionals to shore up its financial talent base," he said.

The global financial crisis has also created several opportunities for China to woo back its overseas financial talent, as the economy has been on a robust growth track, while Western economies are floundering.

Apart from Hu, there are several other influential Chinese bankers working in Western financial institutions who may join the country's financial entities. Lee Zhang, head of Deutsche Bank AG's global banking for Asia-Pacific outside Japan, is also in discussions with government officials on joining ICBC as vice-president.