China's e-commerce trade revenue is set to hit 1 trillion yuan in the first quarter of 2010, iResearch Consulting Group said in its report Thursday.

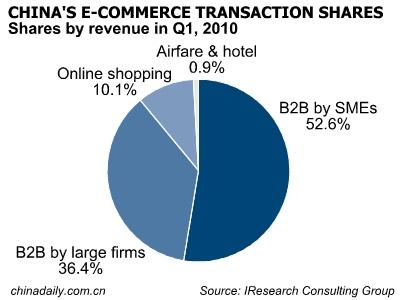

Business-to-business, or "B2B" trade took in a revenue of 903.6 billion yuan, 89 percent of the total. B2B trade by small and medium enterprises took in 534 billion yuan in revenue, accounting for 52.6 percent of the total, and large enterprises of B2B made 369.6 billion yuan revenue, 36.4 percent of the total.

"In e-commerce, security counts. A few overseas buyers cheated. They stole others' credit cards, or used invalid card numbers," Ou Peiwen, a seller on DHgate.com, told chinadaily.com.cn. Ou Peiwen has been involved in e-commerce since 2007, selling consumer electronic goods on an internet trading platform.

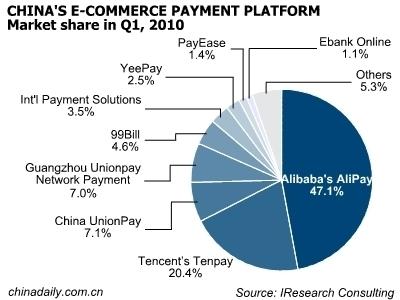

The report said that 47.1 percent of the total payment is through Alibaba's AliPay, 20.4 percent through Tencent's Tenpay, 7.1 percent through China UnionPay's online payment, and 7 percent through online payment services by Guangzhou Unionpay Network Payment Co Ltd, a subsidiary of China UnionPay.

Many e-commerce payment platforms install security control add-ons in user's computers for security reasons, but the payment website redirects to commercial banks' internet banking sites after users log in. Hence traders' security largely relies on the banks.

"Of all the cases of internet fraud, 90 percent is by Trojan horses and phishing websites," said Cao Junbo, chief analyst at IResearch Consulting Group. "Trojan horses are very common and are liable for most of cases."

Banks offer varied security checks on internet banking, such as USB keys, certificating files saved on one's computer, real-time codes sent to registered cell phones, and passwords compiled by two groups of printed numbers on a card.