BEIJING - Chinese commercial banks' capital weighted adequacy ratio (CAR) had risen to 11.6 percent at the end of the third quarter, up 0.5 percentage points quarter-on-quarter, the China Banking Regulatory Commission (CBRC) said Friday.

The figure was 0.3 percentage points higher than at the beginning of the year, the CBRC said in a statement on its website.

The weighted core capital adequacy ratio of Chinese banks was 9.5 percent at the end of September, up 0.5 percentage points quarter-on-quarter and 0.4 percentage points from the beginning of the year.

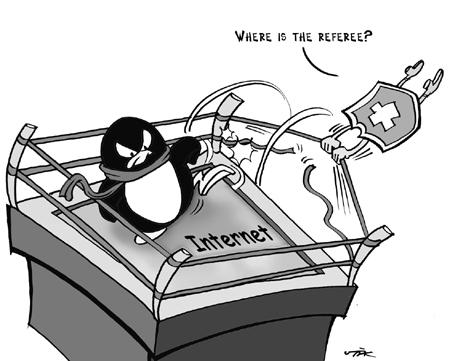

Netizens give QQ thumbs down

Netizens give QQ thumbs downChina Construction Bank, China's second largest lender by assets, said Tuesday it will raise 61.62 billion yuan ($9.21 billion ) in a dual rights issue in Shanghai and Hong Kong to improve its capital base.

Bank of China (BOC), China's fourth-largest lender by assets, said last Friday it will raise up to 60 billion yuan ($8.97 billion) in a dual rights issue in Shanghai and Hong Kong to boost its capital base.

Industrial and Commercial Bank of China, the country's largest bank, also plans a rights issue for the near future.