China's government may be given credit for keeping the auto industry on track to grow, particularly when times are tough, but its policies are not expected to be the main market driver in 2011.

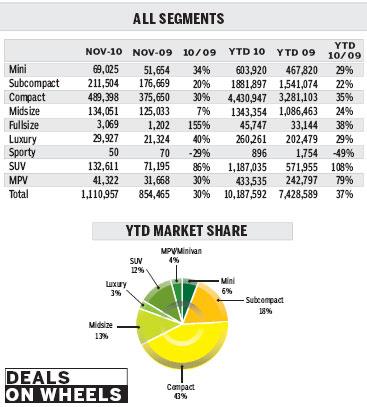

It came as no surprise that the auto market in China recorded yet another sales increase in November. A total of 1.6 million cars and light commercial vehicles were sold, a 28 percent increase over last November and 10 percent higher than the previous month.

Sales of passenger vehicles climbed 31 percent year-on-year to 1.2 million units, while light commercial vehicles rose 21 percent to 468,000 units, pushing the seasonally adjusted annual rate in November to a record high of 19.9 million units.

The growth in annual sales surpassing 30 percent stands in stark contrast to the market decline in 2008 in the wake of global financial crisis. In the fourth quarter of that year, demand for light vehicles in China shrank by 4 percent year-on-year for the first time since 2006.

As the recession began to hit the auto industry, the government intervened.

Stimulus measures

In the first quarter of 2009, the authorities introduced policies to stimulate demand in the auto sector and nine other industries.

They aimed at 10 percent annual growth in 2009 with stimulus measures that included a 50 percent sales tax reduction on vehicles with engines 1.6 liters or smaller and subsidies for buyers in rural areas, which proved to be highly effective.

Small-displacement vehicles were the first to regain growth, followed by the other segments as consumer confidence grew and savers started to spend. Notably, light vehicle sales rose 48 percent in 2009, exceeding expectations.

Fast forward to early 2010. The global recovery remained uncertain, and so was the Chinese economy.

There were concerns that the government might abruptly cancel the stimulus policies, causing a sales decline. Fortunately, the authorities kept the purchase subsidy for rural areas and scrap vehicles, which offset a 2.5 percent increase in sales tax.

But in early 2010, benefits from the stimulus began to dwindle. Monthly sales of passenger vehicles declined for five months in a row from March to July.

As concerns grew, the government brought out a support plan for fuel-efficient vehicles in mid-June and again extended purchase subsidies for rural buyers and replacement of scrapped vehicles until the year's end.

The government has so far recognized 272 variants as fuel-efficient.

Some manufacturers used the 3,000 yuan subsidy as part of their sales promotion and it was indeed helpful.

Since September, monthly passenger vehicle sales have exceeded 1 million units. As it was in 2009, demand grew for both fuel-efficient vehicles and gas-guzzlers such as SUVs and luxury cars as some dealers added incentives to the subsidies.

'May take a hit'

Looking forward, it is likely that tax incentives and subsidies for rural areas will eventually come to an end while the subsidy for fuel-efficient vehicles will most likely remain.

Yet sales of vehicles with engine sizes of 3 liters and above may take a hit as vehicle and expected shipping taxes will treble duties on them.

The policy focus next year will certainly be on new energy vehicles. Although the subsidy for such vehicles is substantial this year, it may not be as effective as other policies in boosting sales.

Sales of passenger vehicles are expected to rise 11 percent to 13 million units but demand for commercial vehicles, especially minibuses, might be affected later in the year once the subsidy for rural areas expires. We expect commercial vehicle sales to edge up 7 percent to 5.7 million units.

We believe there will be a negative impact on sales in the short term, probably in the first quarter of 2011. Although we don't expect demand contraction, we do see growth slowing.