The property market impacts all of us in so many ways. The rise and fall of house prices affects every individual s lifestyle, every family s fortune. In recent years property development has steadily increased its share of GDP in large cities and is now a major driver of China s economic development and therefore of particular concern to government and academics alike.

Data Sources

It is with this in mind that we undertake our annual review of the market and analyze its statistics and trends. In recent years such analysis has been the subject of much debate: some rational, some emotional, some optimistic, some pessimistic. At SOHO we believe it is crucial that such analysis is balanced, and informed by an understanding of the inherent qualities of this market. Property is, by definition, highly locale-specific. Buildings vary from place to place, and even within a given area, individual buildings are not fungible. There can be significant price differentiation even within a single building: among apartments on different floors, or those that face in different directions, or between fully fitted-out apartments versus those not yet complete. If we undertake highly aggregated macro statistical analysis, we run the risk of missing the particular subtle, but crucial, characteristics of the particular property assets, and the results can be misleading.

We rely for source data on three authoritative government databases:

The Beijing Municipal Construction Committee three years ago created a system to record all sales and purchase of properties in Beijing. The government required that all commercialized property transactions in Beijing be registered online (www.bjfdc.gov.cn) before the contract can be validated. This database contained 148,000 transactions for 2007 and it is a definitive data-set, it is not distorted by statistical generalization nor does it contain sample errors.

From August 31, 2004 ( 831 ), China implemented the policy that all land grant transaction must be listed publicly. Every public land sale in Beijing since 831 is listed online (www.bjtd.com), showing the purchase price, as well as the site area and gross floor area (GFA), of each transaction.

In 2007, the Beijing Municipal Construction Committee compiled data to track secondary housing transactions. The secondary market is an integral and important part of the overall property market industry and yet, before now, had lacked reliable data.

Using the above three sources of data, we conducted our analysis of the Beijing property market and its macro evolution in the past few years. As we begin 2008, we present this analysis for public discussion.

Multivariate Market Analysis

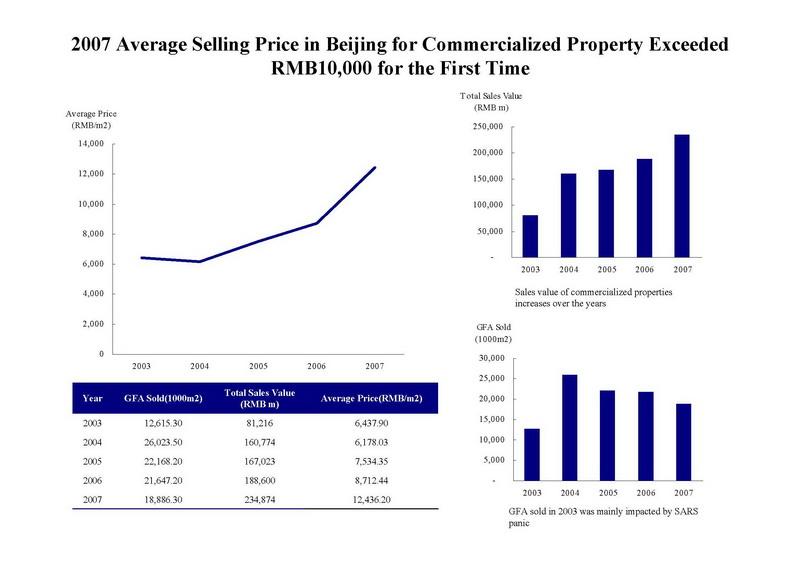

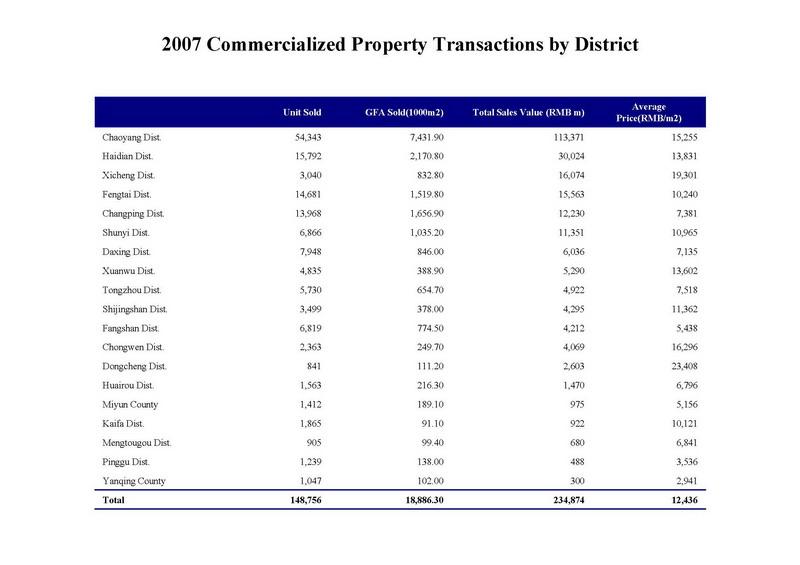

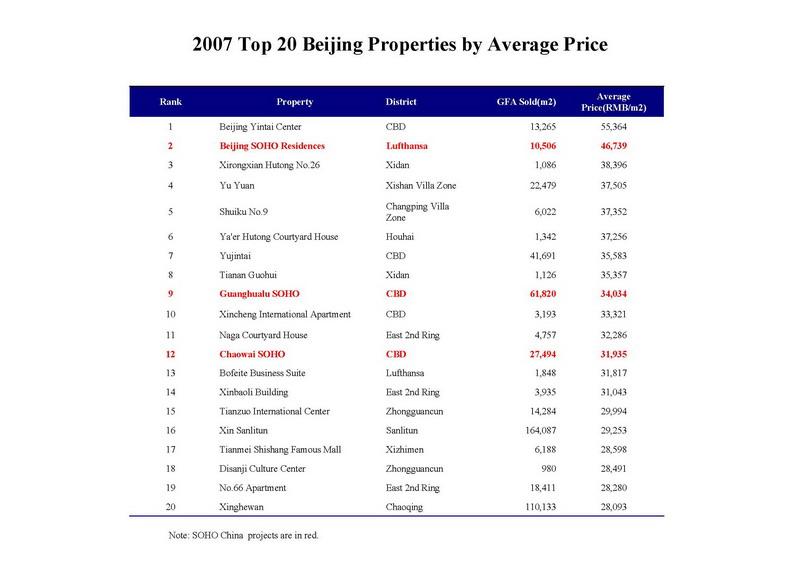

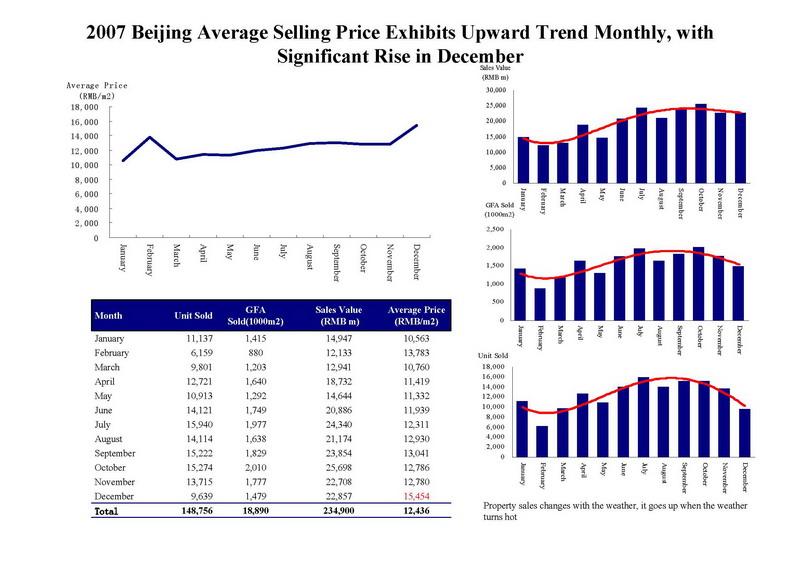

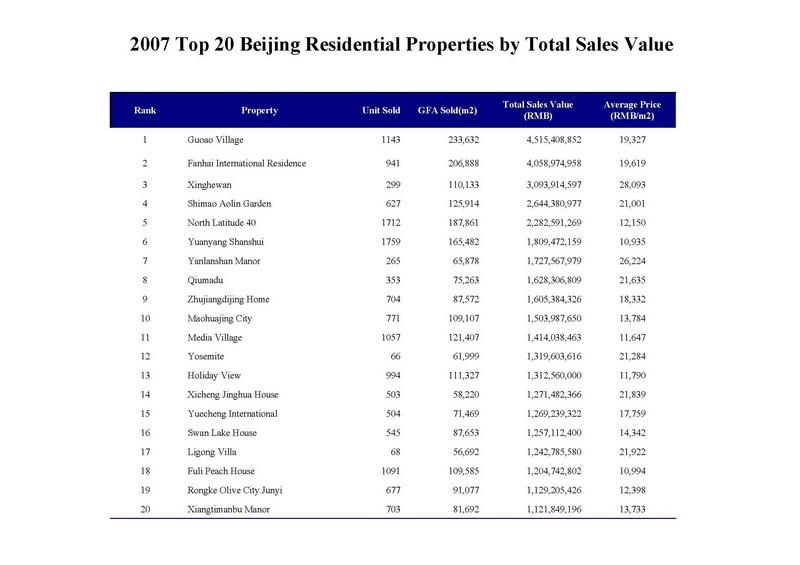

In 2007, total value of Beijing primary property transactions was RMB 234.9 billion, an increase of 24% from 2006. Total GFA sold amounted to 18.89 million square meters, a decrease of 12% from 2006.Over the years, there has been much debate about the relevance of the average selling price or ASP . Most would agree that ASP is, at best, a crude indicator of the state of the property market, as transactions in prime locations such as Wangfujin and CBD are combined with transactions in suburbs such as Pinggu, Huairou and Mentougou to arrive at a single figure. And yet this is hardly an apples to apples comparison. As Beijing ASP does not adequately reflect the direction of the market, we have used multivariate analysis by which we hold other variables constant, and separately analyze the impact of particular individual factors.

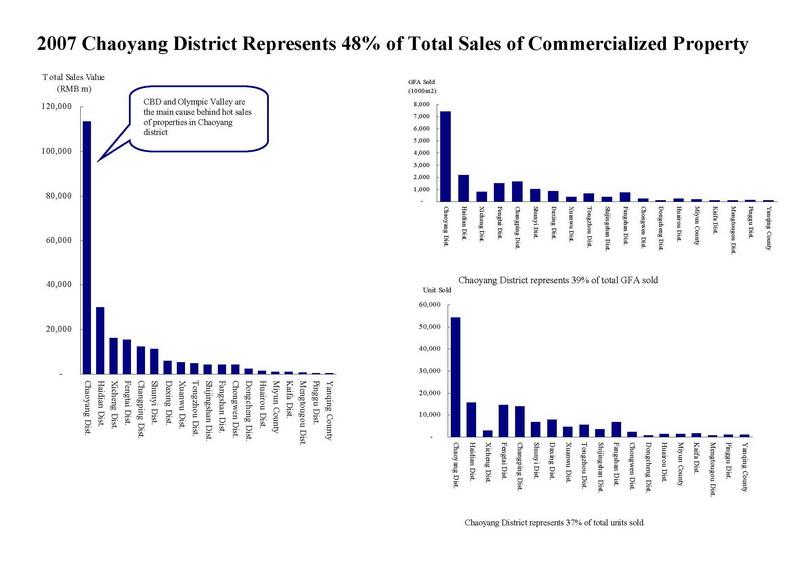

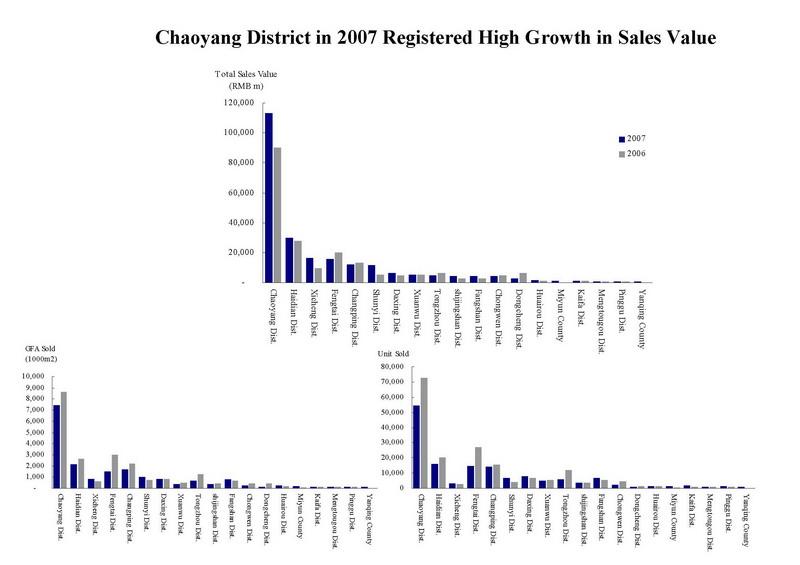

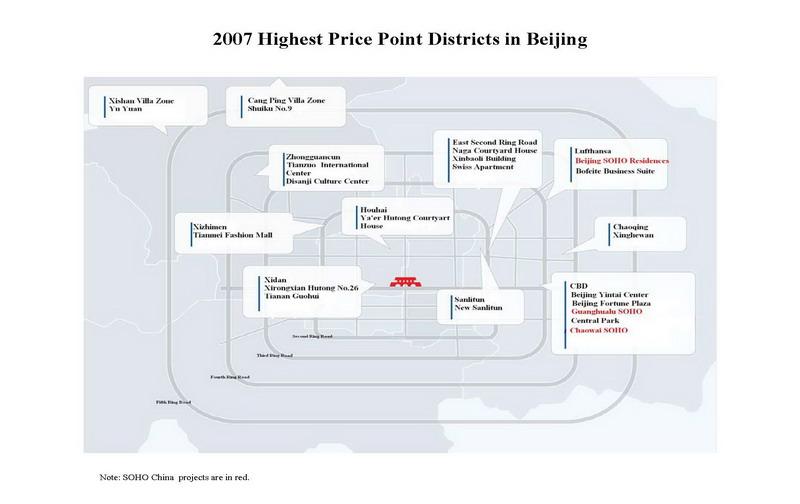

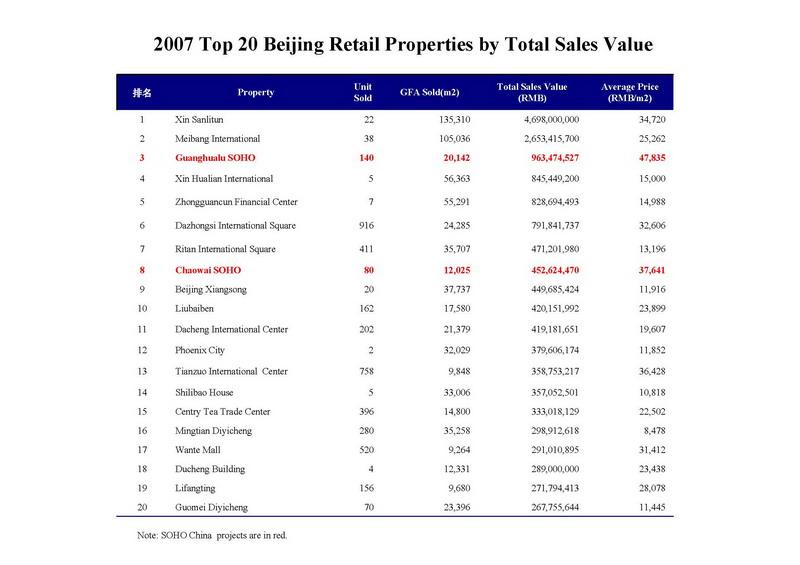

District analysis. Chaoyang district, in 2007, represents 39% of the total GFA sold and 48% of the total sales value in Beijing. If we analyze the districts individually, several high price point districts can be identified which are: CBD, East 2nd Ring Road surrounding, Yansha, Sanlitun, Zhongguancun, and Xidan.

Recurring Seasonality. When we analyze the sales results on a monthly basis, we find a high correlation between certain seasonal externalities. For example, sales are affected in vacation times, and more dramatically, by the time of year: during winter months, there are less transactions.

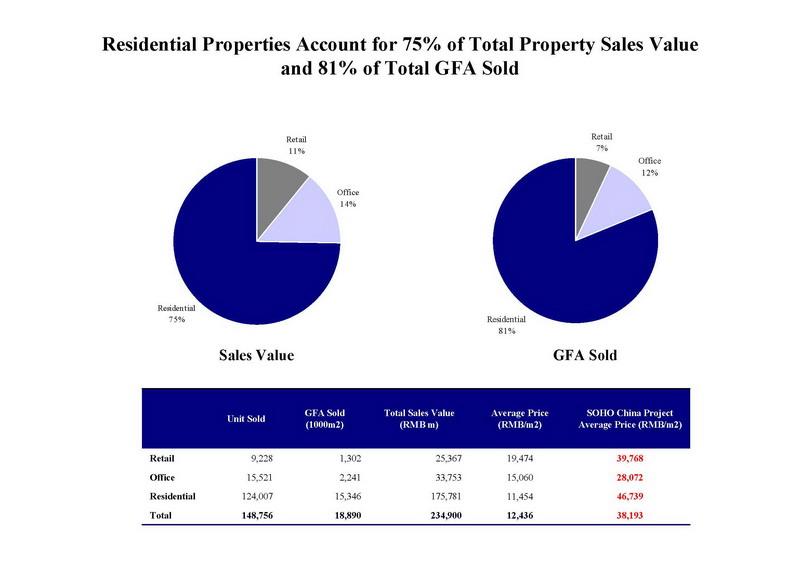

Property Type. In 2007, over 80% of the total GFA sold in Beijing was residential. Office properties accounted for 12% of total GFA sold and retail properties for only 7%. Residential properties represented close to 75% of the total sales value.

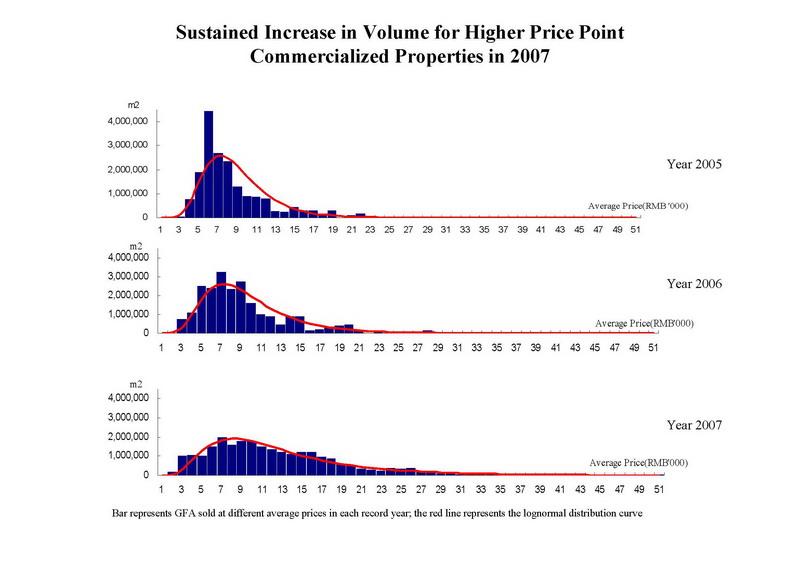

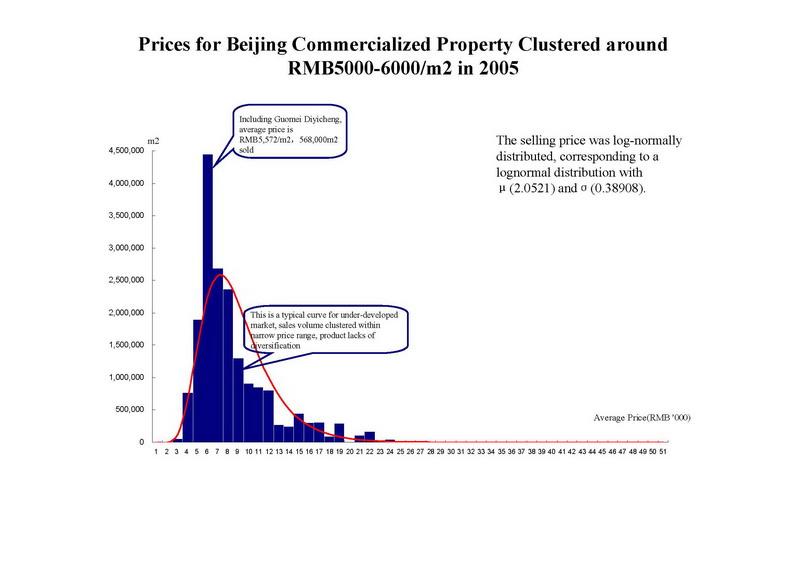

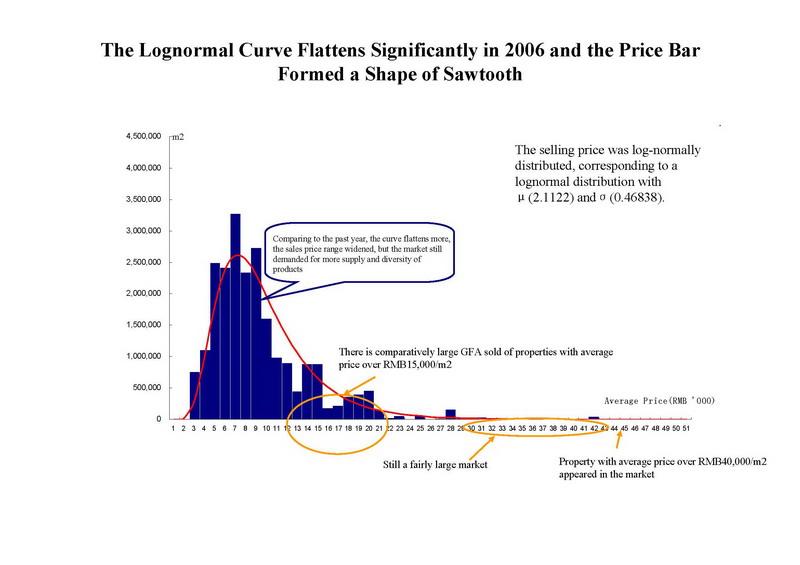

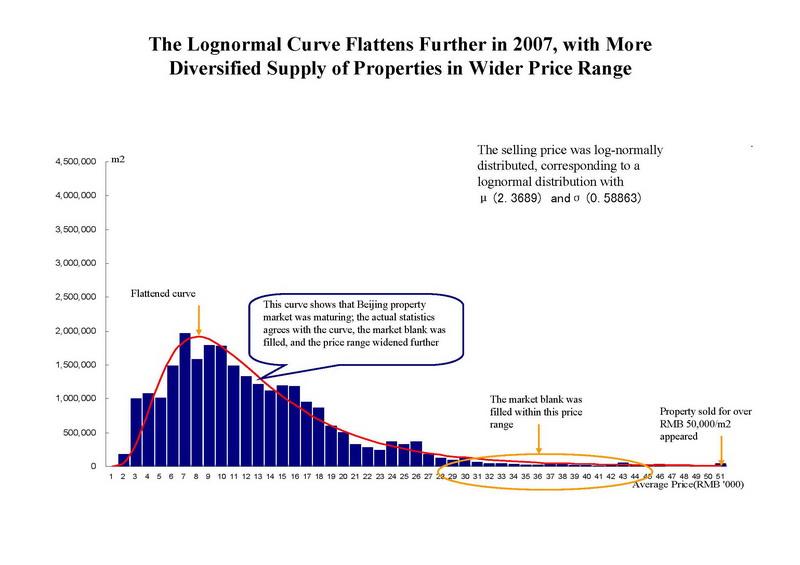

Transaction ASP and GFA distribution. By analyzing different selling prices and their corresponding sales GFA, we found a sustained increase in the volume of higher priced units being sold. This information is of particular concern to existing and aspiring homeowners. It appears that homeowners can match their own target price homes in different price points. In 2007, Beijing commercialized property sales had a ASP range from RMB 2,280 / to RMB 55,364 / . The analysis of data from 2005 2007 shows that there has been a clear trend towards increasing volumes at higher price points per square meter.

Other Factors

We have examined three other factors for their potential impact on the development of the property market: secondary transactions, the supply of land, and movements in the equity markets.

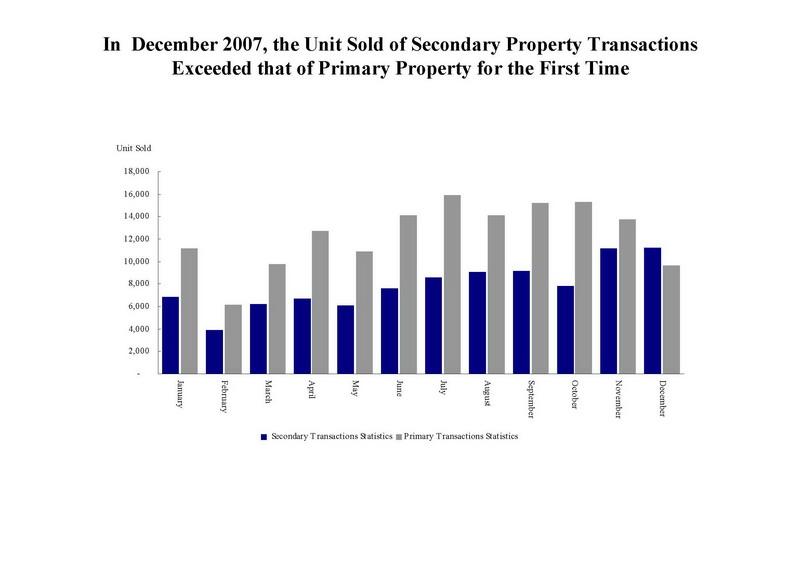

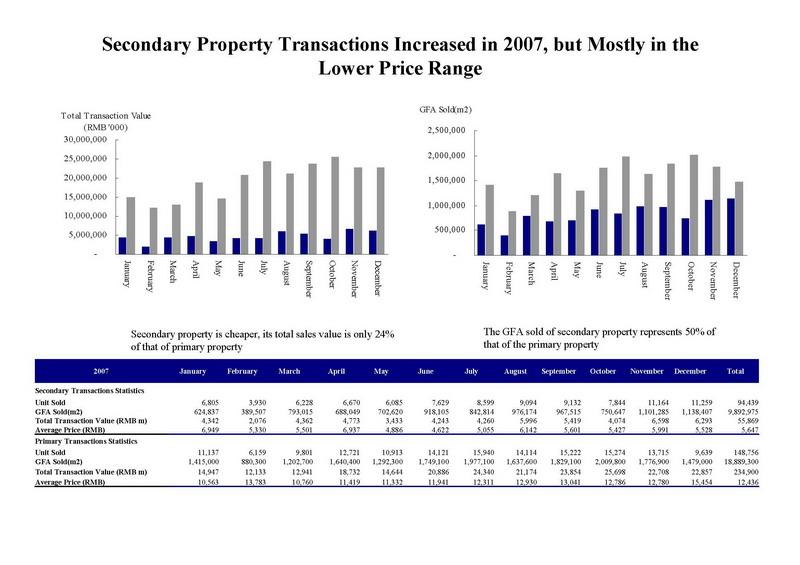

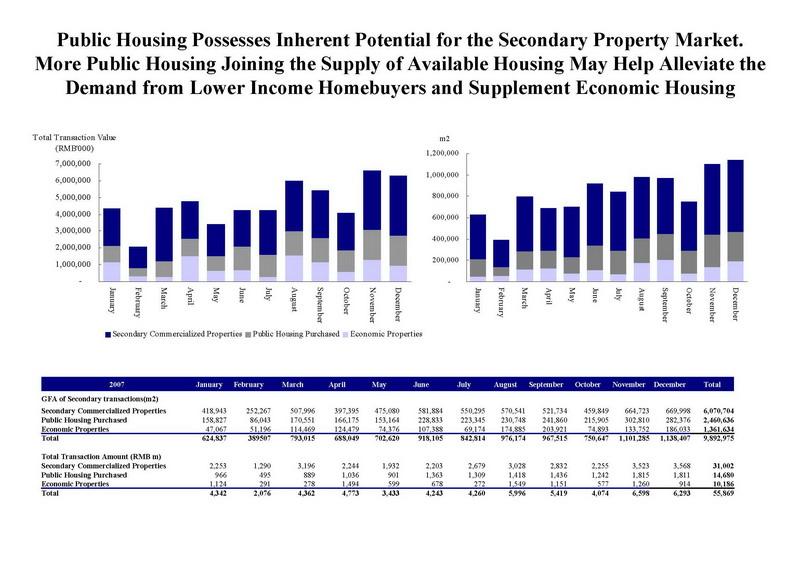

The stimulation of the secondary transaction market is crucial to the future stability of the overall property market. Secondary transactions are an integral part of the property market. In 2007, there were 94,000 units sold in secondary transactions, representing total value of RMB55.9 billion and GFA of 9.89 million . The data indicates that in 2007 secondary sales have increased steadily relative to primary transactions, and in December 2007 actually exceeded the number of units sold by developers. Over 50% of these secondary sales are of commercialized properties while the remaining units are from public housing and economic housing. If the government creates a more favorable environment for secondary transactions, especially within the public housing segment, the overall property market in Beijing should benefit from this increased supply.

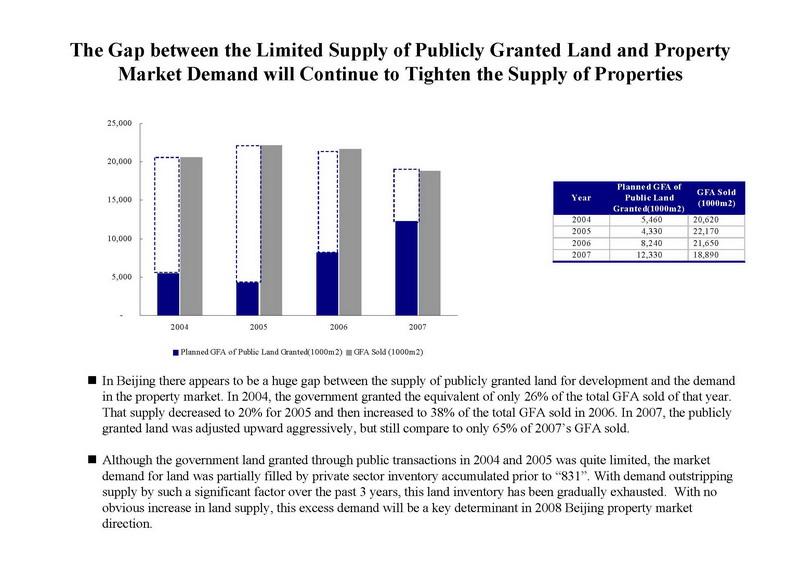

Publicly granted land in Beijing for development did not match the demand from the property market. In Beijing there appears to be a huge gap between the supply of publicly granted land for development and the demand in the property market. In 2004, the government granted the equivalent of only 26% of the total GFA sold of that year. That supply decreased to 20% for 2005 and then increased to 38% of the total GFA sold in 2006. In 2007, the publicly granted land was adjusted upward aggressively, but still compare to only 65% of 2007 s GFA sold.

Although the government land granted through public transactions in 2004 and 2005 was quite limited, the market demand for land was partially filled by private sector inventory accumulated prior to 831 . With demand outstripping supply by such a significant factor over the past 3 years, this land inventory has been gradually exhausted. With no obvious increase in land supply, this excess demand will be a key determinant in 2008 Beijing property market direction.

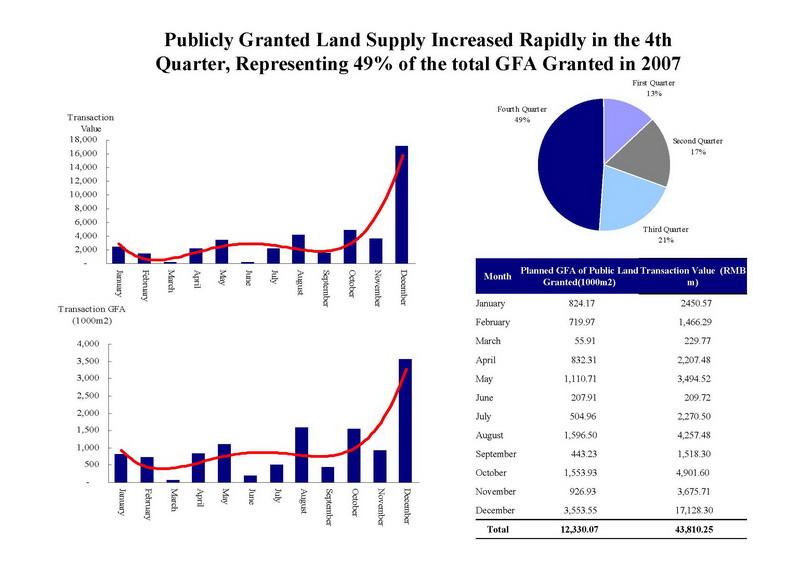

Public land supply increased rapidly in December of 2007. In the 4th quarter of 2007, public grant land transactions substantially increased, with 29% of total 2007 public land transactions concluded in December alone.

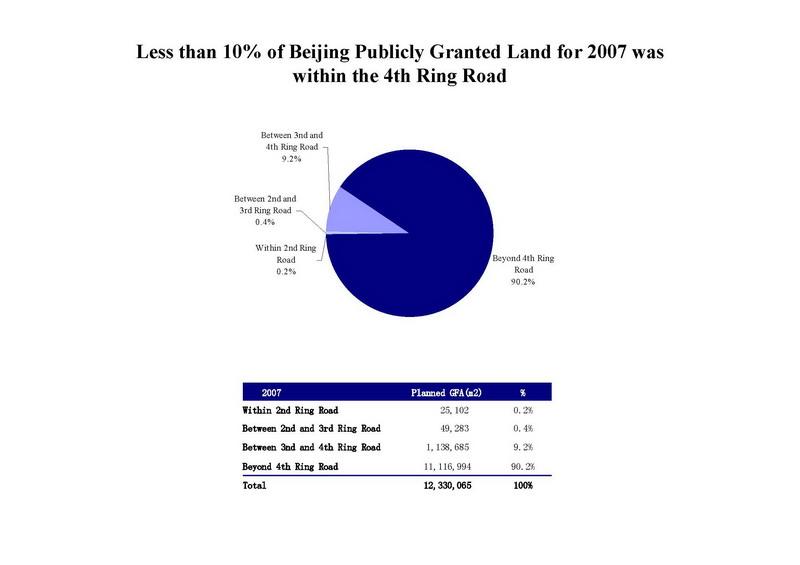

In the past 4 years, the publicly granted land for Beijing was mostly outside of city center. For 2007, the amount of public land granted within the 4th Ring Road amount to less than 10% of the total.

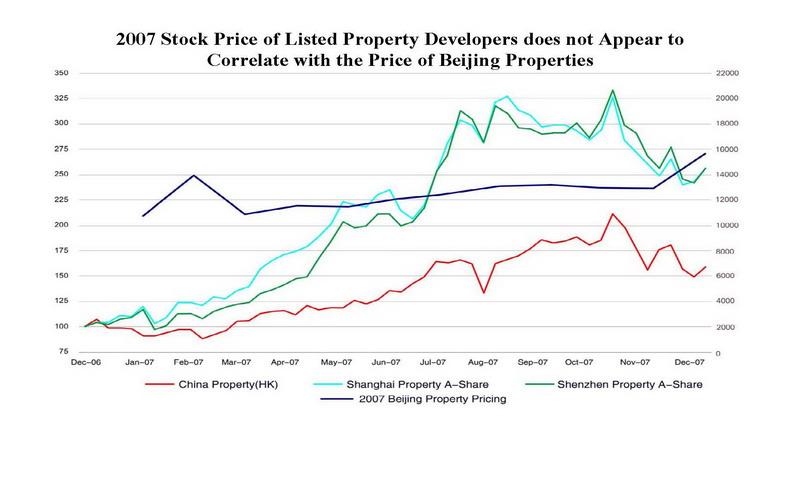

Property market and equity market does not appear to move in tandem. After analyzing 3 years of data, the performance of the stock prices for publicly traded Chinese property developers is not obviously linked to the overall sales of the Beijing property market. The stock price appears to reflect more the prevailing sentiment regarding regulatory environment. As such, we did not provide detail analysis on the relationship between the stock market and property market.

Clearly rental yield achieved on investment properties is an important factor driving investment in real estate. However, there is limited market data on this sector and we have therefore not been able to pursue this analysis.

We wish to thank the Beijing Municipal Construction Committee and Beijing Municipal Construction Committee Research Center for providing the valuable data and insightful discussions.

And also we wish to thank our SOHO colleagues, Xu Yang, Sharon Tong, Amy Chen, Zhao Wei, Gao Chongzhi, Zhou Xujia, Sheng Xunlei. Due to their diligence, we compiled this report for your perusal.

Any questions regard this report, please contact 010 5878 8101, or info@sohochina.com

SOHO China Ltd s website is www.sohochina.com

<

<

Related News

- SOHO China - SOHO China delivers strong full-year results with 477% increase in net profit

- SOHO China - Sanlitun SOHO

- SOHO China - SOHO China acquires large-scale commercial development project inside Beijing s 2nd Ring Road;RMB 5.5 billion acquisition to be renamed Chaoyangmen SOHO

- SOHO China - SOHO China records RMB4.35 billion in sales for Sanlitun SOHO in first week of pre-sales

Photos

More>>trade

- The Establishment of Beijing Aerospace Golden Shield Technology Company

- Aisino Corporation Contributes to China Earthquake Relief Work

- Car storm soars, three-compartment arrives

- Continuous innovation leads to great achievements, new leap through independent

- Glorious release of 1,500,000th Xiali at 1:11 p.m.

market

- China-Russia Car Fleet Initiates Long March from Bird s Nest as China Independen

- TFC Blow Clarion to March Latin America 2500 Units Weizhi and Xiali Exported to

- The second lot shipment have arrived Mexico successfully

- TFC Vehicles Attended the Car Exhibition in Moscow

- WEIZHI (09 type) Launched Into Market

finance

- Laying a Foundation Ceremony of Tianjin FAW HUALI New Plant

- WEIZHI Won Golden Award on 18th National Invention Exhibition

- TJFAW Xiali N5 and Vizi V1 Launch into Eighth Tianjin International Auto Trade

- TJ FAW Xiali N5 Launch into Market

- Stress Test project of CMS, won Shenzhen Financial Innovation Award