Eco-friendly, sustainable and ethical are words that have become part of the permanent lexicon of manufacturers and retailers in recent years.

From the smallest 500-square-foot shop to the mass chain with 1,000-plus stores, companies are looking for ways to lower their carbon footprints, conserve energy, identify ethical sourcing partners and educate consumers about the benefits of saving the planet, and consumers themselves are becoming more interested in the topic as well. According to a survey by WSL Strategic Retail, 55 percent of consumers buy organic products, up from 49 percent a year ago.

Many companies are making investments that will lead to cost-saving efficiencies. A healthy regard for the environment has become part of many firms' identities, from Patagonia to Wal-Mart. For others, such as the Gap, eco-sensitive products and ethical sourcing is part of the culture, something that employees have come to expect and consumers increasingly demand.

Sylvie Benard, director of environment at Louis Vuitton Moet Hennessy, says the idea of environmental initiatives being more expensive than traditional methods is not necessarily true, adding that maintaining environmental efforts in the downturn makes economic sense. "The message that the environment costs a lot has passed," she says. "It has really evolved."

Benard notes that LVMH will maintain its investments this year in everything from boutiques that consume less energy to carbon audits to water measurement. These investments will ultimately lead to cost-savings for the group.

To companies wondering whether they can maintain their commitment to the environment in the midst of an economic crisis, she says: "We must not stop everything because the financial situation isn't as good as we would hope. These are resources that will one day disappear. They are irreplaceable. No matter what the financial situation or the social situation, we have to continue to tackle that."

A stricter regulatory landscape, such as Europe's Registration, Evaluation, Authorization and Restriction of Chemicals, which came into force last year, is prompting some companies to jump on the green bandwagon. Businesses must respond to new obligations, economic crisis or not. Some government policies see green as the route to recovery. The French Ministry of Ecology is working on developing a label for eco-friendly products by 2011 and possibly lowering the value added tax on products deemed eco-friendly.

H&M plans to increase its organic cotton products stable by 50 percent this year, given consumers' desire to buy sustainable products, says Harsha Vardhan, H&M's global environment coordinator.

"Given that most factories have stopped expanding in the current climate, the credit crunch is actually the best time for factories to embark on cleaner production programs," she says. "The price gap between organic and ordinary cotton has narrowed sharply from a previous 100 percent to 20 to 30 percent due to higher production volume and the growing number of suppliers, making this a much more affordable alternative."

From her small store on First Avenue in downtown Manhattan, Lisa Linhardt sells her environmentally sensitive jewelry: engagement rings with ethical diamonds mined in Canada, rings and necklaces made from wood scraps donated by a furniture company and jewelry made from organic South American tagua seeds.

"Customers are reacting positively to it and they are willing to pay more for it," Linhardt says. "In order to be green, you have to have an environmental conscience and a social conscience."

Loomstate for Target, casual men's and women's apparel made from certified organic cotton, debut at the retailer on April 19. "We continue to do ongoing research about what our guests want and it's obvious to us that more guests are craving eco-friendly products," says a Target spokeswoman. "In general, that's been a trend. There really isn't a department in the store that hasn't been impacted by eco-friendly."

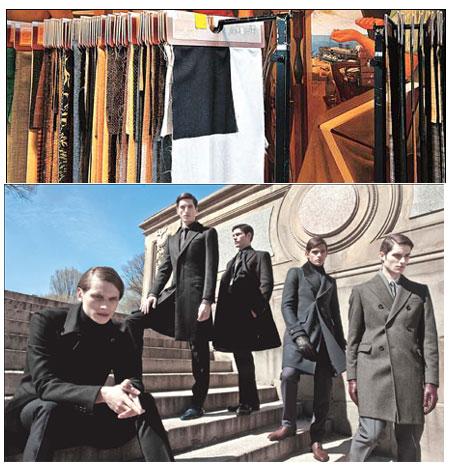

One of the strongest emerging trends in Europe is a move away from throwaway fashion toward more lasting apparel. French consumers are fed up with clothes that don't last. "We are starting to see more people complaining that clothing isn't good quality and falls apart too quickly," says Nathalie Ruelle, professor and sustainable fashion consultant at the Institue Francais de la Mode, referring to an IFM study last October.

"This falls into the slow fashion trend - products that are fashionable but have a longer life span," she says.

"Somewhere along the way, we forgot about making things to last," says David Hieatt, founder of the Welsh sustainable brand Howies. "We convinced ourselves that being different, being new, being quirkier was the thing. Quality was put at the back of the queue."

The company is trying to change course. Hand-me-downs, Howies' latest collection, has prices as high as 400 pounds, or $593, for a classic outdoor tweed-lined jacket, but comes with a 10-year guarantee.

For LVMH's Benard, a product's longevity is a top priority. In fact, LVMH is developing a product life cycle analysis tool that will be used by product design groups across the company's fashion houses. "The goal is that designers take environmental considerations into account at the design stage," she says, "and eventually we won't need the environmental team any more."