China's pace of industrialization has gone faster than Japan's and Chinese products are moving up the value chain, Ernest & Young's Global Chairman and CEO James Turley said in an interview via e-mail with Xinhua.

"When I was a boy in the United States, 'Made in Japan' meant inexpensive, low-value-added manufactured goods. But by the time my son was born, 'Made in Japan' meant some of the very best, most high-tech manufactured goods in the world. That happened in a generation. China's pace of industrialization, and of moving up the value chain, has gone even faster than Japan's," he said.

"Made in China" Goes Further

The head of E&Y, one of the biggest four auditors, said "Made in China" still takes time to rise from low end to high end in the global value chain, but there are Chinese companies today that can compete with anyone on manufacturing skill and there are more and more of them each year.

China's GDP has surpassed Japan as the second biggest economy in the world, and "Made in China" is already all around the world, but the low value-added products, the lack of world-class brands and technology are still a problem for the country. [China 'overtakes Japan in economic prowess']

Meanwhile, Chinese enterprises' exports and investment abroad have encountered trade barriers and protectionism in recent years.

Despite Geely Auto's successful acquisition of Volvo, there were a number of failed overseas takeovers by Chinese energy resources giants and Huawei, Chinese leading telecom equipments provider, in the United States.

The Chinese government had previously advertised overseas "Made in China, Made with the World" to share its ideology of win-win game with other countries.

Turley said the way that China and other developing and emerging markets are producing their own world-class companies is one of the great stories of the past decade, and they will have more and more in the coming years.

"Geely, for example, was the winner of our China 'Entrepreneur Of The Year' competition in 2009 and is a great example of a company that is going places."

"Politics may sometimes be a factor in cross-border acquisitions, no matter what border is being crossed or who's crossing it. As Chinese firms buy more companies overseas, I'm sure they will become more experienced in addressing that factor. But I don't think it has become a 'major risk',"said Turley.

E&Y has been operating in China's Hong Kong for nearly 40 years, and established its first office in Chinese mainland 30 years ago. It has currently over 9,000 staff members in China. To expand its business in China, it just inaugurated a new office in China's tallest building -- Shanghai World Financial Center this month.

World Economy Slowdown, Business Risks

Commenting on the situation of the world economy, the professional of E&Y said a recovery is on the way, but that recovery is happening at very different speeds.

"I agree with those people who have described it as a 'LUV' recovery -- it's L-shaped for Western Europe, it's U-shaped for North America, and it's V-shaped for China and other developing and emerging markets," Turley said.

"But there are still risks that recovery could go into reverse in places. Even though that's a 'macro' risk, companies can still try to mitigate it by ensuring strong risk management, flexible cash management and sustaining cost-cutting measures. Especially if the credit markets tighten up again," he added.

In the second quarter of 2010, substantial changes surged in the world economy. Recently various macroeconomic indicators have shown signs of slower resurrection both in the developed and the emerging economies.

E&Y thinks in this changing macro environment, the other important risk for enterprises to focus on is about corporate governance.

"Every company needs to challenge its system of corporate governance to make sure it's truly up to the job. That means it contains the right checks and balances, puts focus onto the most important risks that company faces, and creates a culture that encourages people to raise their hands, ask questions and challenge the status quo," said Turley.

The auditor's chief mentioned one more risk for some companies, "the risk of being too cautious or conservative in business strategy at a time when recovery is upon us."

Regulation, Responsibility And Green Premium

The international regulatory environment change was listed as the No 1 challenge in E&Y's latest Report of The Top 10 Risks for business. Does it mean that the companies will cost more to comply with the current global regulatory trends?

Turley said he agrees that good regulation is a very important aspect of financial markets and other areas of business, and that good regulation can mitigate system risks.

"Identifying regulation as a challenge for business globally is not to say that the respondents to the survey think regulation is a problem. What they're saying is that business everywhere will need to focus more attention on the changing regulatory environment post-crisis, and that it is vital that regulation be coordinated across geographies to ensure a lack of redundancy and a lack of gaps," Turley said.

Turley also said, in his personal view, being a responsible corporation means what you do every day is to make a "positive difference." He is convinced that enterprises "will do well by doing good."

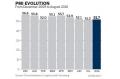

In terms of a green premium, high price/earnings (PE) ratio that eco-friendly public companies enjoy in capital markets, he said a lot of research has shown that consumers are willing to pay for products that are more environmentally friendly.

Besides, companies everywhere are increasingly using their environmental credentials as a source of competitive advantage.

"As both regulation and public scrutiny increases, it's only logical that capital markets will look at organizations' environmental impacts and reward those that work to mitigate them, " said Turley.