Raw material prices jump

An unrelenting rise in the cost of raw materials is cutting textile corporate profits, in some cases, pushing up consumer prices. One glaring example is the sky-rocketing cost of cotton.

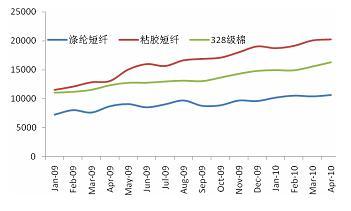

On Jun. 2, China Cotton Index for 328-grade cotton reached CNY 17,591 a ton, adding 37.1% over the average index for 2009. Prices of polyester staple fiber and rayon staple fiber in Apr. were CNY10,593 and CNY20,233.5 per ton, up 21.31 and 31.54 points from last year.

Chart 1. Raw materials prices in 2009

----polyester staple fiber ---- rayon staple fiber ---328-grade cotton

The PMI for May stood at 53.9, 1.8 points down from 55.7 in April, but still higher than the economic expansion boundary of 50 for 15 consecutive months, the National Bureau of Statistics and the Federation of Logistics and Purchasing said. Some analysts said the PMI was probably declining from April due to policy tightening, but the magnitude of the fall was overstated due to seasonal distortion.

Mainland salary increases started this year when Guangdong, Shandong and Jilin cities raised pay by an average of 17 percent because of a labor shortage. Foxconn workers in China will get another pay raise in coming months, on top of an increase that just took effect in response to recent worker suicides, the company said Sunday.

Salaries of Foxconn would be raised in October to 2,000 yuan (US$293) for workers at its plant in the southern Chinese city of Shenzhen. Workers elsewhere in China will get raises in July adjusted for local conditions. Analysts said the moves could trigger a new wave of salary hikes in the "factory of the world" and raise production costs.

Those sectors that are labor-intensive will be hit most as their previous pay levels were actually low.

Uncertain Markets

Besides, the performance of domestic and export markets for Chinese textile products is complicated. The recovery of external demand is fragile and domestic sales growth has experienced a fall, which forced the enterprises to adjust the production pace.

European debt crisis and the consequent sovereign credit risk of developed economies and a new round of global financial market turmoil have limited direct impact on China, but indirect effects can not be ignored. Affected by the debt crisis. The unemployment rate across the 16 countries that share the euro hit a record 10.

1 per cent in April, with almost 16 million people out of work. The unemployment rate for the common currency area, up from March, is now running at the highest since the euro came into being in 1999 -- with almost 1.3 million more people out of work than 12 months earlier, according to Eurostat figures.

'All countries saw a deterioration in growth of output and new orders,' the researchers said, with the rate of contraction in output in recession-hit Greece 'accelerating to its fastest since April last year and to a pace similar to that seen at the height of the global financial crisis.'

On domestic markets, in the first four months of this year, the total retail sales of consumer goods were 4,788.4 billion yuan, a year-on-year growth of 18.1 percent, or up by 3.1 percentage points over that in the same period of last year. It was 0.2 percentage point higher over that in the first quarter of this year. According to the data of 1000 monitoring business surveyed by the Ministry of Commerce, apparel retail sales in April was up 14.6%, but the growth rate was down 0.8 percentage from the previous month.

Production growth weak

In the first four months of 2010, the total industrial production value of statistics-worthy Chinese textile enterprises grew 26.69 percent year-on-year to CNY1296.542 billion, 22.43 percentage points higher than the same period last year, but 0.36% and 0.29% lower than the period of Jan.-Feb. and Jan.-Mar respectively, according to the National Statistics Bureau.

Looking further, from Jan. to Apr., cotton textile production value of statistics-worthy enterprises was CNY352.133, up 27.35%, 0.53 percentage points lower than the period of Jan.-Mar.; chemical fibre CNY143.566, up 41.47%, 3.47 percentage points lower than the period of Jan.-Mar.; and garment CNY 350.413 billion, up 22.41%, 0.27 percentage points lower than the period of Jan.-Mar.

Table 1. Contribution to the change in the growth of total production value by sector

|

Contribution rate to the growth of production value, Jan.-Apr. |

Contribution rate to the growth of production value, Jan.-Feb. |

Change, % |

|

|

Total |

100% |

100% |

---- |

|

Cotton textile |

27.69% |

29.46% |

-1.77% |

|

Dyeing & printing |

5.28% |

5.69% |

-0.41% |

|

Wool textile |

2.84% |

3.25% |

-0.41% |

|

Linen textile |

0.79% |

0.74% |

0.05% |

|

Silk |

3.42% |

3.31% |

0.11% |

|

Manufactured products |

9.97% |

9.17% |

0.80% |

|

Knitting |

7.82% |

6.81% |

1.01% |

|

Garment |

23.49% |

20.03% |

3.46% |

|

Chemical fibre |

15.41% |

17.65% |

-2.24% |

|

Textile machinery |

3.29% |

3.89% |

-0.60% |

Source: CNTAC Statistics Center

Both the growth of production value of sub-sectors and the contribution to the change in the growth of total production value of sub-sectors show that, the contribution of the downstream continued to improve while the contribution of the upstream slowed down. An unrelenting rise in the cost of raw materials is cutting textile corporate profits.

In this regard, we propose that the relevant state departments to strengthen the macro-control for cotton and other raw materials markets, such as expanding cotton imports, timely selling the state reserved cotton so as to stabilize the market price of raw materials and ease the pressure on manufactures.

Related News

Photos

More>>trade

- Showcase of latest fibre & yarn collections at Yarn Expo

- Viscose and Terylene Market Witnesses Positive Activity

- Analysis of economic performance of China's cotton spinning industry in Q1-Q3

- Intertextile - successful event; launch of new show next year

- Dow Corning to exhibit textile innovations at Intertextile