Viscose and Terylene Market Witnesses Positive Activity

Viscose and terylene staple fiber market is very hot as prices rise this year. The main reason for the positive market activity is that cotton prices have increased rapidly. But, there is a worry that the appreciation of the yuan, together with the rate hike will squeeze profit margins of the industry.

Cotton prices hitting a record high, pushing up viscose and terylene price

On Oct. 18 2010, China Cotton Index for 328-grade cotton reached at 24,256 yuan/ton, adding 33.06% over Aug. 2 2010. Same happened to the international cotton prices. The Cotlook A index on Oct. 15 reached to 128.60 cents per pound. The both of them hit a record high. China's cotton futures keep setting new records amid concerns about a shortage. According to the data, China will produce 550,000 metric tons less cotton than previously forecast in the year ending. Output will fall to 6.4 million tons from 6.95 million tons a year earlier. World production will be 96,000 tons less than previously expected at 25.06 million tons, Cotlook said. On Oct 15, futures in New York reached $1.198, the highest level since the fiber starting trading 140 years ago. Chinese output this year might be lower than the market s previous expectation because of the recent low temperatures in main producing areas in the northern China.

Cotton prices hit a record high and price gap narrowed

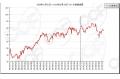

In a good selling situation, viscose and terylene staple fiber prices still keep rising along with cotton prices. During Jan.-May 2010, the average price for viscose staple fibre in China was CNY 3000/ton higher than 328-grade cotton. In Sep. 2010, the average price for viscose staple fibre in China was CNY 400/ton lower than 328-grade cotton. For terylene staple fiber, during Jan.-May 2010, the average price for terylene staple fiber in China was CNY 5000/ton lower than 328-grade cotton. After June, the average price for terylene staple fiber in China was CNY 8000/ton lower than 328-grade cotton.

Chart 1. Price gap between viscose, terylene staple fiber and 328-grade cotton

Prices of chemical fibre head higher

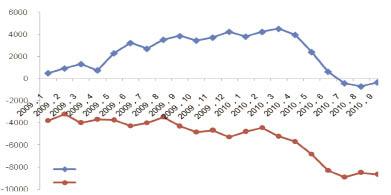

Prices of new cotton linter hiked affected by surging cotton rates as well as bullish expectation for new season. On Oct. 18, the quotation in China even surpassed 9700yuan/mt. Cotton linter pulp plants became reluctant sellers at 13500yuan/mt on rising cotton linter rates, so they raised offers. Some plants quoted up to 16000yuan/mt on Oct. 8, but VSF plants held a wait-and-see stance temporarily. Dissolving pulp supply was rather tight in spot market and few imported goods were available lately.

VSF price jumped for several times on hiking cotton rates and bullish sentiment of suppliers. The prevailing price of VSF 1.5D had risen to 21000yuan/mt and downstream plants kept chasing up. Rayon yarn price also kept uptrend. VFY price saw big increase as well and the higher offer for first-grade VFY 120D reached 40000yuan/mt after long holiday. Traders were reluctant to sell goods at low price now.

Chart 2. Daily price trend of cotton linter, cotton pulp and VSF

Prices of terylene staple fiber are affected by cotton prices and prices of upstream chemicals products. Crude oil prices started gains on the New York Mercantile Exchange since Sep., as prices solidified at a new plateau above $83 per barrel. Traders attributed the rise in PX prices to firmer crude oil prices as well as bullish sentiment in the downstream PTA and polyester markets. Spot PTA prices also posted strong gains at the start of the week, gaining US$35-40/ton from the past week to follow PX in reaching price levels not seen since the beginning of May. Spot PTA prices were also buoyed by the prospect of strong downstream polyester demand, as textile manufacturers move to substitute polyester for cotton after reports of disappointing cotton harvests around the globe led to a sharp increase in cotton futures on the New York Mercantile Exchange.

Of late, the issue on the Renminbi exchange rate appreciation has once again been the focus of international attention. The appreciating yuan in China could spell serious trouble for the Chinese textile industry as it will further slash the marginal profitability of China's textile makers. Moreover, on 19 October, the Chinese central bank announced a series of rate hikes. As we know, chemical fibre industry is capital-intensive. If this trend of rate hikes continues, then the interest rates could hurt Chinese chemical fibre industry.