Operating performance of China's knitting industry during the 11th Five-Year Plan (11th FYP) maintained a growing momentum as a whole. The international markets of China s knitted textiles and apparel kept recovering. Exported value by the end of the 11th Five-Year Plan (2010) period doubled the year end export value of 2005. Cumulative export value of China's knitted garments and accessories in 2010 mounted up to 71.758 billion USD which is 40.858 billion USD of increase from the end of the 10th FYP (2005), rising by 113.6 percent with average annual growth at 22.6 percent.

Impacted by the international financial crisis, China's export of knitted textiles spiraled up soon after a consecutive descendent in 2008 and 2009. Over the last five years, Asia, EU and North America are the primary destinations that Made-in-China knitted textiles are exported to. Bear remembering that export share to Asian countries has been declining while EU, North America, Latin America and Africa all saw varied degrees of growth.

Major offshore markets are Japan, the United States and Hongkong. Export to the United States especially saw noticeable growth in recent years where 9.315 billion USD of knitted garments were exported to in the single year of 2010 which rose by 100% as compared with 2005. The United States has replaced Japan as the No.

1 export market of China's knitted products.

Average export price of knitted garments in 2010 was 2.73 USD which rose by 50 percent from 2005. The overall average export price is moving upward.

Over the past five years, China knitting industry has witnessed substantial achievement without any doubt. But the progress was contributed largely by China s international comparative advantage nevertheless. Beginning year of the 12th FYP (2011), the international situation, economically and politically, is getting more complicated.

The export model is undergoing a transformation period from OEM to ODM. China s knitting industry export in 2011 will be featured as a diversified investment situation, said Mr. YangShibin, President of China Knitting Industry Association. Many indigenous textile magnates of China have fought their way to overseas M&A.

Shandong Ruyi Group has acquired a Japanese company which owns more than 30 independent brands. Bosideng also purchased an indigenous brand in England that owns more than 50 franchised retail stores. Geographically, local Chinese knitting companies are more opt to invest in East Asia and Southeast Asia countries.

Presumably, this trend is getting more noticeable in 2011.

Constrained by multitudes of uncertainties such as raw material price and labor cost upsurge, workforce shortage, exchange rate fluctuation and the rising edge of neighborhood developing countries, the export growth of China knitted textiles in the 12th FYP period will be staved off to a certain extent. 2011 will be a turning point for China s knitting industry.

Related News

Photos

More>>trade

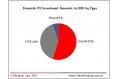

- Quarterly Statistics & Analysis of China s VC/PE Exits- Q1/2010

- Quarterly Statistics & Analysis of China's VC Investments- Q2/2010

- Quarterly Statistics & Analysis of China s VC/PE Fundraisings- Q1/2010

- Quarterly Statistics & Analysis of China s VC lnvestments- Q1/2010

- Quarterly Statistics & Analysis of China s PE Investments-Q1/2010

market

- Statistics & Analysis of China s VC/PE Investments In Telecom & VAS - 2009

- Statistics & Analysis of China s VC/PE Investments in Internet 2009

- Annual Statistics & Analysis of China s PE Investments-2009

- Quarterly Statistics & Analysis of China s VC Investments - Q3/2010

- Overseas IPOs Grew Popular Among VC/PE-backed Chinese High-flying Firms