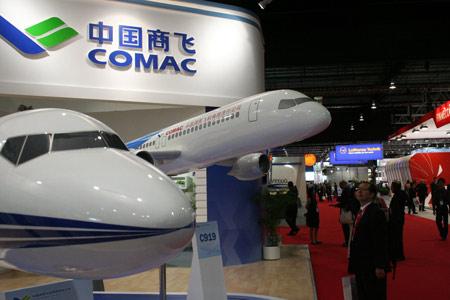

A visitor looks at the C919 aircraft mockup at the Singapore Airshow.[Photo/Xinhua]

China will need 5,000 new commercial airplanes valued at $600 billion over the next 20 years, with demand being driven by the country's sustained economic growth and increasing personal wealth, according to forecasts from the US aircraft manufacturer Boeing Co.

Although high-speed railways and rising fuel costs could adversely affect the air industry, the national aircraft fleet will more than triple in size by 2030, according to Boeing in its outlook for China's commercial airplane market through 2030 released on Wednesday.

About 84 percent of China's new aircraft will be necessary to keep in step with the industry's growth, which will also bring demand for about 70,000 pilots during the period, said Randy Tinseth, vice-president of marketing at Boeing Commercial Airplanes.

He said sustained strong economic growth, growing trade activity, increasing personal income, as well as continued market liberalization will be the driving forces in shaping China's air travel market.

According to the Civil Aviation Administration of China (CAAC), passenger travel in 2010 increased by 16.1 percent compared with 2009 and the average annual growth was 14.1 percent during the 11th Five-Year Plan period (2006-2010).

However, the International Air Transport Association (IATA) said that growth in China, the world's second-biggest domestic market, slowed abruptly to just 5.1 percent in July.

IATA said this was an acceleration in a trend of declining domestic traffic growth, which began in the second half of 2010.

"We are still optimistic about China's long-term market, although it has fluctuations sometimes," Tinseth said.

Boeing forecasts that China's annual GDP increase will stay at 7 percent in the next 20 years, which will drive growth for air travel at an average of 7.6 percent annually.

Tinseth said Boeing's forecast evaluated all the factors affecting aviation, such as high-speed railways.

By 2012, China will have 13,000 kilometers of high-speed rail, linking about 70 cities, according to Boeing. But Tinseth said high-speed rail will affect only about 2 percent of China's domestic revenue passenger kilometers (RPK) and it may also boost the country's economic development, which will benefit aviation.

The domestic market will still take 75 percent of the total RPK in the next 20 years, although Chinese carriers will experience rapid international expansion in the period, Boeing said.

As a result of the development of the domestic market, single-aisle airplanes will make up the bulk of the deliveries, which will reach 3,550 in the next 20 years.

The single-aisle market used to be monopolized by Boeing and Airbus AG.

But the competition will change as more players, including Bombardier Inc and Commercial Aircraft Corporation of China, Ltd (COMAC), enter the market.

COMAC plans to deliver the C919, China's first large passenger aircraft, with 190 seats, from 2016.

"The time of the Boeing and Airbus monopoly is over," Tinseth said, "But we believe every competitor can find their place in the business, since it is such a large market."