Foreign companies see huge opportunities for business

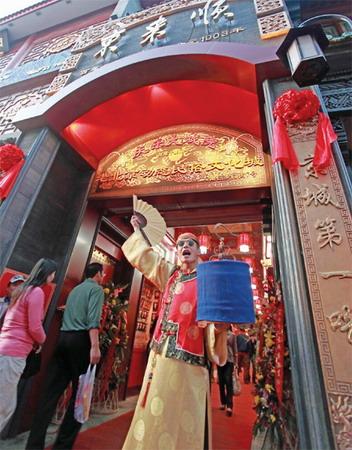

The 107-year-old Donglaishun has 200 stores, 70 percent of which are franchises. [Photo / China Daily]

Yang Yunhui, a 36-year-old Beijing resident, was searching for her future at last month's 13th China Franchise Expo. She is hoping start her own business. "I plan to invest 10 million yuan (1.05 million euros), and my ultimate target is KFC. But it seems that they are not looking for franchisees in first-tier cities," Yang says. Yang is among the thousands of visitors who came to the expo with money and desire to join the team of franchisees in China.More than 22,000 people attended the three-day expo, most of them looking for franchise opportunities. Reflecting the enthusiasm of franchisees, nearly half of the stalls in the 16,000-square-meter exhibition center have already been booked for next year's expo.

As a main gauge of the franchise market in China, the China Franchise Expo reflects the growth of franchises in this country.

When the first expo took place in 1999, 40 companies from eight industries participated. This year, as the curtain opened on the 13th expo in early May, more than 270 companies from 60 industries left the exhibition center with bags full of applications.

"Ever since 1999, when franchising gained popularity in China, people have been favoring this kind of business model, either to build up their own business or to expand their business on a larger scale. Because expansion via franchising is low cost and fast," says Pei Liang, secretary-general of China Chain Store & Franchise Association.

According to statistics from the association, by the end of 2010, there were more than 4,500 franchise systems in China, covering 70 industries. The total number of franchise stores has reached 400,000.

The top 120 franchisers, according to the association, had a total sales revenue of 338.7 billion yuan (36.4 billion euros) in 2010, an 8.9 percent increase from 2009. The 120 franchisers own 131,413 stores, 12.5 percent more from 2009.

Pei calls China "the world's largest market for franchising".

"Franchising makes you feel that people around the world are all helping you to expand your business, while we have to run self-owned stores all by ourselves. That is the charm of franchising," says Zhao Zheng, deputy manager of Chain Store Development Department of Beijing Donglaishun Group, one of China's leading hot pot restaurants.

With 200 outlets, 70 percent of which are franchises, the 107-year-old Donglaishun is just one example of how Chinese companies turned to franchising to expand.

As early as 1993, China Quanjude Co, a restaurant famous for its roasted duck, had already started franchising.

"At that time, franchising seemed to be the fastest way for us to expand our business and popularize our brand name," says Cao Xiaojun, director of Quanjude's market expansion department.

"In first-tier cities like Beijing and Shanghai, we are focusing on self-owned stores so that we can have better control of our brand. But in second-and third-tier cities, local franchisees are more familiar with the markets," Cao says.

Established in 1864, the restaurant chain now has 61 franchise stores and 24 self-owned businesses in 38 cities on the Chinese mainland. The company also has five overseas stores in Japan, Australia, Hong Kong and Myanmar.Just like Chinese companies, foreign brands are also using franchises as a door into the large Chinese market.

"Although foreign brands have not become the mainstream in China's franchising market, I can see that China will be the most preferred market for foreign companies who are looking for international opportunities," says Pei, adding that the economic environment in the United States and Europe has forced companies to develop elsewhere.

First Casual Food Inc, a US fast-food brand, is planning to transfer its main battlefield to China. "We are hoping that in the next 10 years, the Chinese market will account for 30 percent to 50 percent of our total sales revenue," says Marko Puschmann, chief financial officer of the company.

Although foreign fast-food stores such as KFC and McDonald's make up a large part of the foreign market in China, Puschmann says his company is confident about their China venture.

"I think it's the right time to march into the Chinese market, since it is a large piece of cake and our products are different," he says, adding that the market in China is developing so fast that more opportunities will be provided in the future.

"We have no specific criteria for our future Chinese partners. But one thing is for sure, they must have a deep understanding of the Chinese market, since this is the part that we are not so good at," Puschmann says.

As foreign brands make their way into the Chinese market, Liu Wenxian, founder of the first franchise management school in China, agrees that localization is the biggest problem for foreign franchisers.

"It is easy for them to enter the Chinese market, but how to survive remains difficult," he says.

Pei agrees that adjusting marketing strategies to appeal to Chinese consumers is the key point of succeeding in China.

"Pizza Hut is a good example. Chinese people expect high-end style when talking about Western cuisine. So it was very clever for the company to present itself as a fine restaurant, rather than a fast-food chain," Pei says.

He says lots of foreign companies, including Domino's and Burger King, have failed in China because of insufficient localization. But the Chinese franchising market remains promising.

Pei predicts that the expansion will not slow down in the following five to 10 years.

"The Chinese market is still full of potential. There are still industries that we have yet to develop, like personal financing. Once these industries have been explored and developed, new systems and brands will come out," he says.

"But that does not mean franchising in China is fully developed. In the US, the profitability of franchises account for 14 percent of its GDP (gross domestic product). But that figure is 3 to 4 percent in China," Pei says.

Also, using the franchise model as a rapid means of development, some companies are considering taking more control of their stores once the market expansion target has been met.

"We will try to keep the ratio of franchise stores and self-owned stores to 2:1," Cao says.

Cao says although franchise can help the company expand its market quickly with low costs, this business model does not fit a medium- and high-end restaurant brand such as Quanjude in the long term.

"For fast-food brands like KFC and McDonald's, which have standard production and management procedures, a franchise is the best way to expand. However, we are focusing on offering traditional Chinese meals with exquisite food and service, so we need tighter control on stores," he says.

Cao says Quanjude receives 50 to 60 applications for franchises every year, but only five to six of them will be approved. Apart from cutting the numbers of newly opened franchised stores, Quanjude also plans to buy the old ones back.

"We had signed contracts with our franchisees that we can buy the shares of their stores in the future if necessary," Cao says. "Of course, the prices are negotiable."

"Although the notion of chain stores is the most popular among investors, franchises are excluded. The reason is very simple. The profit from franchises comes from a one-time franchising fee and, and an unstable and very small portion of franchisees' profitability. That apparently cannot satisfy the companies," Pei says.