Amid the criticism heaped on ConocoPhillips Co - the United States-based energy conglomerate whose operations spilled more than 700 barrels of oil into the waters of China's Bohai Bay in June - the nation's industrial experts are clamoring for a review of the policies for oil and gas exploration with foreign oil companies in China.

Some oil analysts have said that the spill was not "disastrous" either in terms of the amount of oil leaked or its environmental impact and is not comparable with BP PLC's massive oil spill in the Gulf of Mexico. However, the accident stirred up widespread public anger against ConocoPhillips China because of what some Chinese observers claimed to be the company's "inefficient cleanup" operation and its perceived indifference.

Eventually the country's top maritime watchdog prepared a lawsuit against a foreign oil company for the first time in relation to an oil spill.

Apart from the public outcry, however, some experienced industry experts have raised a question mark over the applicability of policies implemented in the 1980s regulating the participation of foreign companies in domestic oil exploration and production and have called for amendments to them.

Despite the strategic importance of oil resources to the country prior to its economic advance in the 1980s, China endeavored to attract foreign oil giants to participate in domestic oil exploration to help exploit the country's large untapped natural resources and develop its fledgling oil industry with cutting-edge foreign technologies, said Sun Zhengchun, the former chief geologist of China National Petroleum Corp, the country's biggest energy company in terms of production.

As such, in the early 1980s the central government introduced two regulations, one concerned with the exploration of onshore petroleum resources and the other focused on offshore exploration to encourage foreign companies to participate in oil and gas exploration in China.

The regulations, which were amended slightly in 2001 and 2011, stipulate that foreign oil companies involved in offshore oil discoveries must enter into production sharing contracts (PSC) with China National Offshore Oil Corp (CNOOC), which is the only entity authorized by the government to carry out domestic offshore oil exploration activities.

A standard PSC requires the foreign parties to bear all the costs of exploration, but when a field is discovered and goes commercial, CNOOC, on behalf of the central government, will have the option of taking a participating interest of up to 51 percent, with the foreign party taking the remainder.

As the country's earliest and most explored offshore area for oil resources, northeast China's Bohai Bay is the area most open to overseas cooperation and therefore has the greatest number of PSCs. ConocoPhillips, along with other oil giants, including BP and Husky Energy Inc of the US, has actively participated in China's marine oil and gas exploration ventures.

The joint exploration between China and foreign partners has resulted in a leap in the country's offshore oil exploration, with the production of oil and natural gas reaching more than 50 million metric tons of oil equivalent (a unit based on the approximate amount of energy released by burning one barrel of oil) in 2010. That compared with total oil production of about 630,000 metric tons between 1967 and 1979, according to Li Xiangfang, a professor from the China University of Petroleum in Beijing.

The honeymoon's over

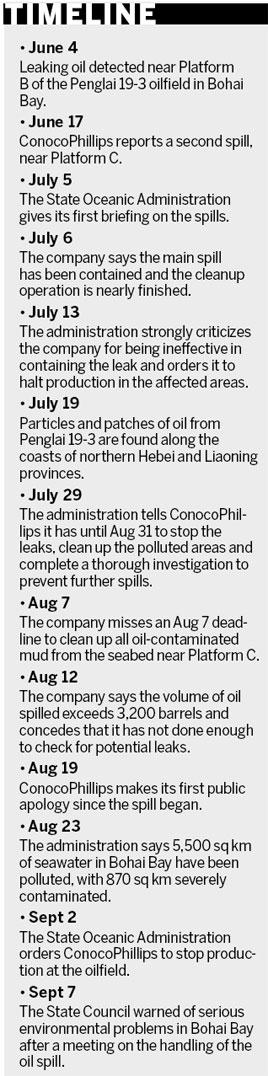

However, the honeymoon period between China and foreign companies was abruptly ended by the oil spill in the Penglai 19-3 oilfield in Bohai Bay, which was observed in June. In addition to the 700 barrels of crude oil, around 2,600 barrels of drilling fluid were also spilled. In total, the accident is reported to have contaminated an area of at least 5,500 sq km.

Three months after the event, the "drilling mud" (seabed ooze contaminated with oil), has yet to be fully cleaned up. In September, Premier Wen Jiabao ordered a thorough investigation into the spill, sparking nationwide criticism of ConocoPhillips and its partner in the venture, CNOOC.

"The leak has rung alarm bells about joint exploration with foreign companies," said Sun, who is also a member of the expert team that investigates oil industry accidents. "The exploration plan has to be adjusted as a first measure. More importantly, we need to review the regulations on joint exploration with overseas companies that were drawn up a long time ago when China was short of exploration capital and advanced drilling technologies as such, the clauses were more beneficial to the foreign operators. But now, things have changed," he said.

The major downside of the policies, which are mainly used in relation to offshore oil activities, is that it's difficult to oversee the activities of the foreign partners during the exploration period. That's especially true when the technology gap between domestic oil producers and its foreign partners is wide and means that it is difficult for Chinese companies to spot any potential errors, said Ren Haoning, an energy researcher with China Investment Consulting Co.

"The ConocoPhillips oil spill is the result of an absence of regulation and supervision during exploration," Ren said.

From the technology perspective alone, attracting foreign capital for joint oil exploration was the right decision at the right time, said Feng Fei, director of the industry department at the State Council's Development Research Center, the Chinese cabinet's think tank.

Feng added that the mode of cooperation needs to change in accordance with the current situation in China. However, he declined to elaborate on what those changes might be.

According to a report issued earlier this year by CNOOC Ltd, the listed division of the company engaged in offshore oil exploration, the company had 30 PSCs with 22 partners at the end of 2010.

"PSCs help us minimize our offshore China finding costs, exploration risks and capital requirements because our foreign partners are responsible for all costs associated with exploration under the usual case. Our foreign partners recover their exploration costs only when a commercially viable discovery is made and production begins," according to the report.

As the biggest offshore oilfield so far discovered in China, containing about 500 million tons of recoverable reserves, the discovery of the Penglai 19-3 oilfield in May 1999 was a bonanza for both ConocoPhillips and CNOOC. CNOOC holds 51 percent of the venture and ConocoPhillips holds the rest.

When exploration began in the early 1990s, the country lacked a system of environmental evaluation, seabed detection equipment and data. The country needs to conduct more research and provide more concrete scientific evidence to provide support for future solutions, said Wu Shiguo, director of the Maritime Oil & Gas Research Center, Institute of Oceanology, Chinese Academy of Sciences. "The oil spill is a warning about the country's rapid offshore exploration activities," he said.

No need to change

However, speaking on condition of anonymity, an official from CNOOC said that there is a general consensus that the PSC scheme under the regulations works well and will be maintained. "There's no need to change to other contract schemes, even though some of the clauses may be questionable," the official said.

In 2010, exploration activities by the company's PSC partners resulted in one new discovery and three oil and gas structures successfully gauged by the five appraisal wells drilled to ascertain the volume of reserves available.

On the other hand, independent exploration conducted by CNOOC made 12 new discoveries in offshore China in the same year, and 12 oil and gas structures were successfully gauged by 18 appraisal wells.

The company said in the same report that in recent years, most of the newly added reserves and production have been through independent exploration and development in Chinese offshore waters, with "about 77.1 percent of its net proven reserves and approximately 68.6 percent of its production (in) offshore China came from the independent projects as of the end of 2010".

"China's offshore oil exploration and development polices should be finely tuned with the country's development over time. At present, it would be better to cease shallow-water production of oil resources for reserves because the country is no longer short of capital to buy oil from overseas," Wu suggested.

Under the PSC scheme, the technologies possessed by the foreign companies are top secret, therefore, in the future, the major focus for China's cooperation with foreign companies in domestic oil exploration will be to raise more local talent to master the most sophisticated technologies, said Sun.

He added that the country should invest more in the research and development of offshore-oil technologies, particularly for deepwater exploration, a field in which China has yet to master the key technologies. "Encouraging foreign companies to jointly explore our country's deepwater oil and gas resources will help spread the exploration risks and accelerate the pace of development in the deepwater areas," said Fan Ying, director of the Energy and Environment Policy Research Center, Institute of Policy and Management of the Chinese Academy of Sciences.

China should not shy away from cooperation with foreign companies because of the Bohai spill, said Fan. He added that what's more important is to set up a sound and efficient emergency-response plan and stress the importance of safety during offshore-oil activities.