China Agri-Industries Holdings Limited ( China Agri or the Company ; Stock Code: 606.HK), a leading producer and supplier of processed agricultural products in China, today announced its interim results for the six months ended 30 June 2009.

RESULTS SUMMARY

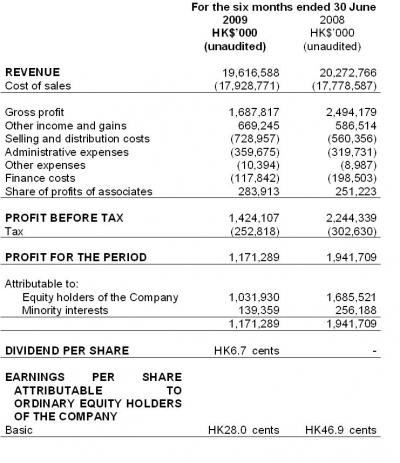

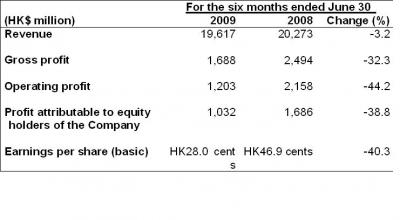

During the period under review, the Company s revenue was approximately HK$19,617 million, down 3.2% from the same period last year. Gross profit and operating profit amounted to HK$1,688 million and HK$1,203 million respectively, representing a decrease of 32.3% and 44.2% year-on-year. Profit attributable to equity holders of the Company amounted to HK$1,032 million, representing a 38.8% decrease year-on-year. Basic earnings per share were HK28.0 cents (2008 interim: HK46.9 cents). The Board declared an interim dividend of HK6.7 cents per share (2008 interim: nil) based on the initial payout ratio of 25.0%.

In 2008, gross profit margin in the agricultural processing business reached an extremely high level. It then returned to a normal level during the review period, resulting in a decrease in profit, which is in line with expectations. Moreover, the economic downturn in the first half of 2009 has depressed the prices of agricultural commodities globally. This in turn has exerted downward pressures on the prices of the Company s major products.

The first half of 2009 presented a challenging operating environment for the agricultural and food processing industry in China. China Agri is still maintaining its dominant position in the industry by capitalizing on its solid foundation, proven business model and experienced management team. During the period, the Company has been able to seize market opportunities and make satisfactory progress in the development of its five businesses.

BUSINESS REVIEW

(1) Oilseed processing business

The Company s oilseed processing business remained the largest revenue contributor and profit driver during the first half of 2009, accounting for 60.3% of total revenue and 54.8% of the segment results. Revenue from oilseed processing business decreased by 9.9% to HK$11,835 million, mainly due to sharp falls in market prices for soybeans, soybean oil and soybean meal over the same period last year. Despite a decrease from 11.5% to 5.9%, gross margin of the oilseed processing business came back to a normal industry level.

The financial statements of COFCO Xinsha Oils & Grains Industrial (Dongguan) Co., Ltd. ( COFCO Dongguan ) and Fei County COFCO Oils & Fats Industrial Co., Ltd. ( COFCO Feixian ) were consolidated into the Company s financial statements following the acquisitions by the Company in April 2009. The completion of the acquisitions added 780,000 metric tons of crushing capacities and 360,000 metric tons of refining capacities to the oilseed business, bringing the annual capacities to 5,580,000 metric tons and 1,530,000 metric tons respectively. Moreover, the Company was able to increase sales by continually strengthening its sales distribution network, promoting its brands and improving its bargaining power.

Looking ahead, the Company intends to build new plants and expand its current facilities to increase its production capacity by approximately 50% up to the year 2011. The Company believes that the market demand for edible oil and protein meal for feeds will continue to grow as living standards improve, disposable incomes rise and dining out increases in keeping with lifestyle changes in China. Leveraging its leading market position in China, the Company is well-positioned to capture the immense opportunities.

(2) Biofuel and biochemical business

The period under review, which incorporated the full-period operation of Guangxi COFCO Bio-Energy Co., Ltd. ( Guangxi Bio-Energy ) and the consolidation of Huanglong Food Industry Company Limited ( Yellow Dragon ), saw revenue from the biofuel and biochemical business rise 15.7% to HK$3,199 million.

Biofuel

During the first half of 2009, operations at the two fuel-ethanol subsidiaries continued to run steadily. The Company increased the efficiency of both plants through the implementation of upgraded technology and raising management standards. To guarantee a stable supply of raw materials, the Company intends to enhance its storage capacity in the vicinity of its production facilities. This will help minimise the Company s exposure to fluctuations in raw material stocks and prices at the time of procurement.

Moving forward, the Company will use non-food feedstock exclusively as raw material for fuel ethanol production at its future facilities. The operations of the Company s existing fuel ethanol plants, however, will not be affected by government plans and policies. The Company will closely monitor the Chinese government s policies and measures on fuel ethanol and seek to capture growth opportunities in a timely manner.

Biochemical

In response to the challenging operating environment of the biochemical industry, the Company implemented a series of measures, including stringent controls on production costs, improvements in quality control, adjustments in raw material sourcing and enhancements in customer service standards. Encouraging initial results have been achieved. The Company also strived to enhance customer service and its competitive edge in biochemical products. The Company is now an official fructose syrup supplier for all seven Coca-Cola and Pepsi Cola bottlers in north-eastern China and the exclusive supplier for six of them.

In the first half of 2009, the Company completed the acquisition of Yellow Dragon, one of the largest corn processing plants in China, adding an extra 650,000 metric tons of biochem corn processing capacity.

Concurrently, the Company will proceed with the acquisition of Shanghai Rong s Technology Company Limited ( Shanghai Rong s Tech ), which is expected to be completed in the second half of 2009. Shanghai Rong s Tech is a well-known sweetener brand in the Yangtze River Delta, with three sweetener production lines and an annual production capacity of 150,000 metric tons. The Company is confident that the acquisition of Shanghai Rong s Tech will increase the variety and volume of high value-added products. The Company s two biochemical enterprises will also be able to supply raw materials directly to Shanghai Rong s Tech, which will help achieve vertical integration and provide the catalyst needed to drive the profitability of the biochemical business.

(3) Rice trading and processing business

With a rapid growth in domestic sales volume, a strengthened sales distribution network and improved brand name recognition, revenue of the rice trading and processing business increased by 12.4% to HK$2,174 million during the first half of 2009. Gross profit margin improved from 14.6% to 21.7%.

During the period under review, the Company recorded increase in sales revenue from rice exports despite the decrease in volume. Sustained by good momentum and rapid development, sales of rice more than tripled domestically over the corresponding period last year, reaching 149,000 metric tons. With the implementation of new business strategy to develop the domestic market, the Company s own-branded packaged rice is now sold at 3,750 supermarkets in over 500 cities in China.

As at 30 June 2009, the total annual rice processing capacity of the Company was 340,000 metric tons. To keep up with demand, the Company began expanding production capacity at its three rice processing plants during the year and intends to continue to invest in rice processing facilities over the next five years. It expects to complete the expansion of capacity in major grain producing regions including the three provinces in northeastern China, as well as in Jiangsu and Jiangxi provinces. Expansion projects will also be carried out in major logistics hubs such as Dalian and in major sales regions such as Beijing and Shanghai, which will lead to the formation of a core supply chain.

(4) Wheat processing business

In line with the steady increase in total demand for flour products, there was a structural change in the demand for high-value products. Sales from the wheat processing business increased by 8.3% to HK$1,666 million on the back of better product mix, production chain extension, high-value added product development and market share expansion. Gross margin maintained at 10.1% compared with 10.0% in the first half of 2008.

To achieve rapid business growth and higher gross profit margin, the Company has acquired high quality industrial, and food and beverage customers. Strategic co-operation agreements with well-known international and domestic food manufacturers and chain restaurants for the supply of customised flour included Ting Hsin Group and Yum Restaurant. The Company also extended sales footprint for its dried noodle products to regions of rapid economic growth, such as the Yangtze River Delta and Pearl River Delta, and gained new local customers at lower cost through major sales networks such as Carrefour and Trust-Mart.

Last year, the Company established a joint venture with Toyota Tsusho to develop a [bread/bakery] business and produce Chinese and Western styles of bread and cake. The Company continued to optimise its business model and acquire customers with high gross profit margins for rapid business growth. During the period under review, it entered into strategic co-operation agreements with high end customers, including Multiple Unit High-Speed Railway and the Great Hall of the People. During the first half of 2009, the Company sold a total of 277 metric tons of bread, an increase of 166 metric tons over the same period last year.

Looking forward to the second half of the year, the Company will focus on developing additional premium customers, improving its strategic sales coverage, and enhancing supply and market share.

(5) Brewing materials business

For the brewing materials business, although the Company was able to lower the cost of raw materials it still saw a decline in gross profit margin as a result of keen market competition and lower product prices. During the period under review, the business recorded an operating loss of HK$4 million.

Nevertheless, the Company reported substantial growth in malt sales during the period under review as a result of its domestic sales and marketing efforts. Domestic sales volumes of malt amounted to 144,000 metric tons, an increase of 73.5% over 83,000 metric tons for the same period last year.

The Company is constructing a new malt production plant in Yakeshi, Inner Mongolia. The expected completion of this plant in the second half of next year will increase the Company s annual malt production capacity from 660,000 metric tons to 740,000 metric tons. When the new Yakeshi plant becomes operational, the Company will have improved access to locally-produced raw materials and the ability to provide better customer service.

China Agri has solid financial fundamentals and a sound reputation. Amid uncertainties in the global economic environment, the Company will continue to sustain its steady business operation and strive to achieve economies of scale. The Company believes that its high quality staple food products will continue to be in strong demand. As a leading player in the market, the Company is confident that it can service with full customer satisfaction by providing quality products at reasonable prices.

For further information, please contact:

China Agri-Industries Holdings Limited

Charlotte Cheung

Tel: (852) 2833 0314

Email: charlottecheung@cofco.com

Hill & Knowlton Asia Ltd

Benny Liu

Tel: (852) 2894 6251 / (852) 9387 6545

Email: benny.liu@hillandknowlton.com.hk

Christy Lee

Tel: (852) 2894 6254 / (852) 6181 8496

Email: christy.lee@hillandknowlton.com.hk

Condensed Consolidated Income Statement

For the six months ended 30 June 2009