China's private equity (PE) firms will face great pressure while seeking to sell their investment portfolios in the next three years, China Business News reported Thursday.

Around 2006, these PE funds invested into a batch of domestic projects. Now many of them may want to exit their investments after three years of operation.

A PE firm usually operates a portfolio for three to five years, and then exits for a high return. PE firms prefer exiting portfolios through an initial public offering (IPO) on the stock market. Other exit routes include selling out stocks to another investor.

However, there aren't many IPO opportunities as a company cannot easily get listed on the mainland stock bourses, said Zhen Xiaolei, research director at consulting company Tower Watson China.

The prices are fluctuating on the mainland stock market, and some even break the IPO prices on the secondary market on the issue day, which means the PE funds would not make as high returns as they expect.

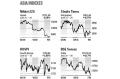

Nevertheless, Zhen said the Asia market remains the most valuable investment market, as the US and Europe show no recovery, and the Asia is driving global growth,

China and India are becoming major destinations for PE investments, as Asia's economic growth is supported by more wealth, urbanization, lower interest rates, higher savings, and lower labor costs, Zhen said.