|

|---|

Rex Features |

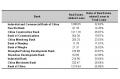

The mix of Middle East chemical exports varies by region. North America imports mostly fertilizers and organic chemicals, such as methanol and ethylene glycol (EG). Europe imports the same, plus large volumes of aromatics and polymers. China imports a variety of chemicals, but is the largest customer market for Middle East polymer exports.

The nature of Middle East exports is evolving, as countries such as Saudi Arabia try to diversify their industry away from just polyethylene (PE) and ethylene glycol (EG), which comprise a large share of Middle East investment based on the low cost (for the most part) of "stranded" natural gas.

In fact, the highest export growth over the past three years has come from polypropylene (PP), fertilizer and inorganic chemicals, growing at CAGRs of 36%, 14% and 6% respectively between Q3 2006 and Q3 2009.

For PE specifically, Middle East capacity has grown at the high rate of 11%/year between 2000 and 2009, with most growth coming from high density polyethylene (HDPE). In tandem with the increased Middle East PE capacity, the Middle East landed price (cost, insurance and freight - CIF) to China for PE has been declining relative to other source regions, with the average 5 cent/lb price disparity in Q4 2000 moving to almost 16 cents/lb by Q1 2010.

This is possibly related to changing competitive dynamics, with new players emerging during that timescale. This pricing disparity has enabled the Middle East to gain in China PE import share, from a level of about 16% in 2000 to 32% by 2009.