Up to the present, Bank of China has been providing services to 10 Qualified Foreign Institutional Investors ( QFIIs ) (with their combined investment quota amount reaching USD 1.57 billion) as well as applicants for such status, making the Bank a well-established leader in the QFII service sector.

Since the later half of 2008, Samsung Investment Trust Management Co., Ltd. (Korea), DAIWA Asset Management Co. (Japan) and Mitsubishi UFJ Securities Co., Ltd. (Japan) have each earned, from CSRC (China Securities Regulatory Commission), the status as a Qualified Foreign Institutional Investor ( QFII ) in People s Republic of China. And the latter two have also been allocated the QFII investment quota by SAFE (State Administration of Foreign Exchange.) All of the three QFIIs have appointed Bank of China as their domestic custodian.

Bank of China is a top-tier consultant and custody service provider for global institutional investors entering China through QFII scheme. Drawing on its internationalized business approaches and capabilities, Bank of China has been a prime choice for QFII candidates.

Related News

Photos

More>>trade

- ICBC Successfully Held the First Online Banking Consulting Event in 2006

- ICBC Entered A Strategic Cooperation Relationship with Datong Coal Mine Group Co

- ICBC New York Branch Welcomed by Empire State Building Lighting

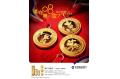

- ICBC Issues Gold and Silver Commemorative Medallion for the 16th Asian Games

- ICBC Celebrates the Opening of Brussels Branch

market

- QPI , PetroChina & Shell sign LOI for refinery and petrochemical manufacturing

- The First "China Energy Forum" Co-Hosted by CAE and NEA Held in Beijing

- New Strain of Bacteria May Help Clean Oil Spill: Study

- Germany, China to Track Greenhouse Gases from Space

- The Middle East has plans to become a major plastics processing centre