Chinese stocks rose, driving the benchmark index to a three-month high, as consumer companies gained on speculation the government will extend measures to boost domestic demand and drive the nation's recovery.

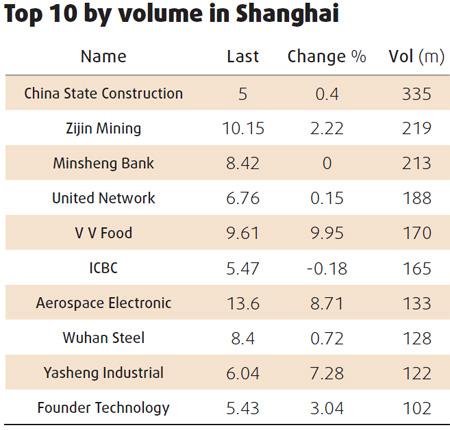

V V Food & Beverage jumped the 10 percent daily limit to 9.61 yuan and Shanghai Bailian Group Co, the listed unit of China's biggest retailer, added 5.5 percent to 17.91 yuan.

"Given the fact that favorable policies will remain in place to bolster growth, consumer stocks are among the market's favorites," said Zhang Ling, who helps oversee about $7.21 billion at ICBC Credit Suisse Asset Management Co.

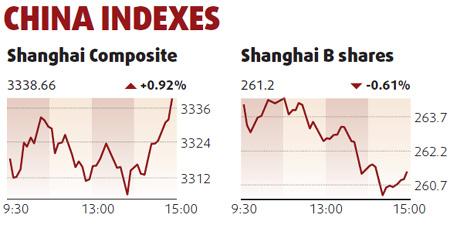

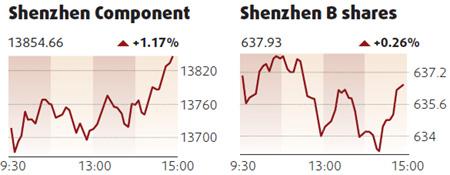

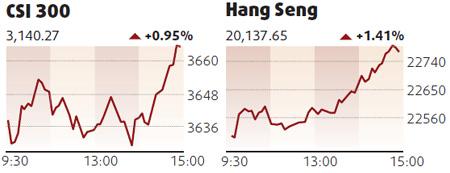

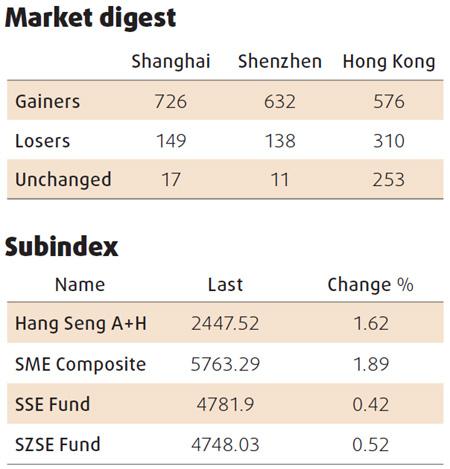

The Shanghai Composite Index rose 30.32, or 0.92 percent, to close at 3338.66, the highest since Aug 3. The CSI 300 Index gained 0.95 percent to 3665.51.

China will focus on expanding domestic demand and keep "consistent, stable" macroeconomic policies including fiscal and monetary expansion, Zhang Ping, minister in charge of the National Development and Reform Commission, said on Nov 20. The government cut taxes and introduced subsidies for purchases from cars to home appliances this year.

Indexes tracking consumer staple and consumer discretionary stocks on the CSI 300 Index gained more than 2 percent yesterday, the most among the 10 industry groups.

Hang Seng advances

Hong Kong stocks advanced for the first time in five days after the head of the mainland's top economic planning agency pledged to maintain "consistent, stable" policies to boost growth.

The Hang Seng Index rose 1.4 percent to 22771.39.

The Hang Seng Index has surged 101 percent from this year's low on March 9.

Shares on the index are priced at an average 17.9 times estimated profit, up from 10.6 times at the start of 2009, according to data compiled by Bloomberg.

The Hang Seng China Enterprises Index gained 2.2 percent to 13625.06. >