Huatai Securities Co hopes to raise as much as 17.26 billion yuan in an initial share sale in Shanghai, where two companies that went public in the past month fell on their first trading day.

The Nanjing-based brokerage will offer as many as 784.6 million shares at between 20 yuan and 22 yuan apiece, according to a filing to the Shanghai stock exchange yesterday. The initial public offering (IPO) would be the biggest in China since Metallurgical Corporation of China Ltd raised 18.97 billion yuan last September.

Huatai, the third brokerage to go public in China since August, is raising money as investor appetite for new equity dries up. China XD Electric Co and China Erzhong Group Deyang Heavy Industries Co this year became the first companies in China since 2004 to fall on their debuts, and China First Heavy Industries Co failed to raise the maximum amount sought in a Shanghai IPO.

"The fact that companies are dropping below their offering price on the day of their debut has a negative impact on the IPOs that follow," said Zhang Jixiu, an analyst at Bohai Securities Co.

Huatai's sale of a 14.01 percent stake drew 52 bids for a total of 740.9 million shares that were within or above the price range from institutional investors, according to the statement. The securities company plans to sell 30 percent of the stock to institutions, with the remainder open to all investors.

Huatai plans to use funds from the IPO to boost its asset management business, investing in its own accounts, and preparing for stock index futures and margin trading.

The company was the 10th-biggest by assets among 107 securities companies in China at the end of 2008. Huatai's profit almost tripled to 4 billion yuan in 2009, according to its IPO prospectus. Haitong Securities Co is charged with arranging the sale.

Huatai's IPO values it at 29.41 to 32.35 times 2009 earnings, according to the statement. That compares with the 25 times profit Everbright Securities Co's offer fetched, and 30.7 times for China Merchants Securities Co when they went public last year, according to Deng Ting, an analyst at Guodu Securities Co.

Merchants Securities closed at 29.75 yuan on Feb 5, below the 31-yuan offering price when it went public in November. Everbright has risen to 26.33 yuan from its 21.08 yuan offer price in August.

Account openings

To allow investors to hedge against a decline in stocks, the country's securities regulator will introduce an index futures product based on the CSI300 Index and a margin trading pilot program. The government hasn't said when the products will be available to investors.

"Huatai is a strong brokerage overall, especially as a securities company backed by a large amount of cash, it will likely be selected for the pilot program for new products," Cheng Binbin, an analyst at Qilu Securities Co, wrote in a report dated Feb 4.

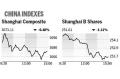

First Heavy, which makes equipment used in the mining and energy industries, raised 11.4 billion yuan selling shares at 5.70 yuan apiece, below the high end of a price range of 5 yuan to 5.80 yuan marketed to investors, according to a Feb 3 filing. The sale added to evidence that demand for IPOs might be drying up in China, where the benchmark Shanghai Composite Index has lost 10 percent this year. In 2009, all 117 companies that went public in the mainland sold stock at the top end of their price ranges, and none fell on their debut.

Bloomberg News