A potential buyer speaks with a real estate agent at a residential property fair in Shanghai. Property prices in 70 major Chinese cities rose 7.7 percent in November year-on-year, up 0.3 percent from October, according to the latest data from the National Bureau of Statistics. [Photo / Bloomberg]

Local govt reliance on property market could prove harmfulSHANGHAI - Local governments' excessive reliance on land-sale revenues will not only catapult already-prohibitive house prices to new highs, but also dissuade industrial entrepreneurs from expanding production, and lead them to speculate on property to make fast money, said experts.

At a recent land auction, a plot in Wenzhou, Zhejiang province, was sold for 3.7 billion yuan ($559 million), or 37,000 yuan a square meter (sq m) by gross floor area, becoming one of the most expensive plots of land in the country.

However, in the eyes of Zhou Dewen, president of the Wenzhou Small- and Medium-sized Enterprises Development Association, it is an anomaly.

"The land-bidding spree is a prelude to sidelined industrial production, but the bubble will burst in the housing market," Zhou said.

According to him, there is growing concern that more manufacturers will move from their businesses to join the housing stockpile, which provides higher and quicker returns. "This is very dangerous, because the sustained development of the national economy cannot be dependent on the housing boom and speculation, or we will have to pay a high cost, just like our neighbor Japan did," he noted.

A report from the Zhejiang provincial government in late November said the price of an average residential property in Zhejiang rose 3.14 times between 1999 and 2009. During the same period, the average income of urban residents increased only 1.92 times.

As a result, entrepreneurs poured money into real estate to pursue high returns. In 2009, up to 70 percent of the top 100 private companies in Zhejiang were involved in real estate, and in 2010, half of the top 100 enterprises in Wenzhou invested in property, said the report.

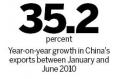

"I can understand their situation," said Rui Mingjie, a professor at Fudan University who specializes in industrial economy. "Since the start of the financial crisis, export-oriented private enterprises in southeastern provinces have felt growing pressure from shrinking overseas orders. It's also hard to make a rapid transition to more value-added industries or move up the industrial chain. Therefore, investment in property, private equity and mutual funds became the best choices," he added.

Gross manufacturing profit has declined to between 1 and 3 percent in recent years, a substantial drop from the previous 8 to 12 percent, according to surveys. "Entrepreneurs are becoming less confident about things they have devoted decades to," said Zhou.

Zhou called for the government to pay more attention to the enormous exodus of capital from manufacturing industries. "The government should establish favorable policies and other kinds of support to retain these enterprises," he said.

However, one analyst, who asked not to be named, said it's almost impossible to reverse the trend of capital flowing from the traditional manufacturing sectors to the property market under the current circumstances.

"Local governments have to make money to pay the public-service bills, and under the tax system, it gets only 25 percent from value-added tax, the largest part of national revenue, as central government takes away the other 75 percent," he said.

"In addition, there is competition among local governments in pursuit of visible achievements, such as infrastructure upgrading and building landmarks, and all this spending relies on land sales," he added.

Property prices in 70 major Chinese cities rose 7.7 percent in November year-on-year, up 0.3 percent from October, according to the latest data from the National Bureau of Statistics.

There are rumors that central government will trial-launch a property tax in Shanghai and Chongqing. "The property tax in Shanghai will be mainly targeted at new homebuyers, whose families own more than 200 sq m of property by gross floor area. And the rate will be between 0.5 and 0.8 percent," said an expert familiar with the situation who spoke on condition of anonymity.

But Chen Jie, a professor of real estate at Fudan University, is concerned that the introduction of a property tax won't reduce house prices. "The ultimate function of property tax is to lessen the widening difference between people's incomes, and to use the collected revenue to subsidize government-led housing infrastructure," he said.