Workers oversee production at a Hualin Steel Co Ltd plant in Hunan province. Exports of Chinese steel products surged to 17.9 million tons in the first five months, up 127 percent from a year earlier. [China Daily]

Govt plan will trigger production cuts, force further consolidation

BEIJING - The Chinese steel industry may suffer losses in the third and fourth quarters due to the government's decision to remove export rebates, putting further pressure on mills.

Those mills have already suffered from falling product prices and soaring raw material costs, leading industry experts said on Wednesday.

"The move is a huge blow to Chinese steel mills, especially those State-owned enterprises producing industrial steel plates, forcing them to cut production," said Yu Liangui, a senior analyst from consulting firm Mysteel.com.

"Small- and medium-sized steel mills will suffer from the financial strain and create more consolidation opportunities for larger steel mills," he said.

Rebates on hot-rolled coil and some cold-rolled coil and galvanized products will be removed starting July 15, the Ministry of Finance said in a statement on Tuesday. Currently, the rebates of hot-rolled coil and cold-rolled coil are 9 percent and 13 percent respectively.

This is the first move to reduce tariffs in three years. China raised steel export rebates to 9 percent in June 2009, and the latest cuts were made on July 1, 2007.

"Overcapacity in the steel industry and growing steel exports in May stimulated the government to scrap the tax rebates," said Qi Xiangdong, deputy secretary-general of China Iron and Steel Association.

China's steel exports almost doubled year-on-year in the first five months due to strong demand from Southeast Asia and South Korea, which is the result of global economic recovery. Exports of Chinese steel products surged to 17.9 million tons in the first five months, up 127 percent from a year earlier, according to customs data.

The decision to remove export rebates comes amid growing export risks imposed by trade measures from the United States and the European Union.

In addition, the Chinese government is striving to cut energy consumption and eliminate outdated production methods.

"The price for hot-rolled coil is around $600 per ton, if the rebate is removed, the price will go up by $50 per ton, reducing Chinese steel products' competitiveness in the global market," said a sales manager from Hebei-based Ye-Steel.

Chinese steel mills began to cut product prices in June, signaling a market adjustment due to weak downstream demand.

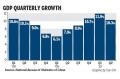

In April, average steel prices in China reached their highest level since last August. But steel prices began to fall after the government released macroeconomic polices to control property prices. Steel prices have declined 11 percent to date.