Department stores and apparel retailers may have bid farewell to the idea of selling merchandise at full price after taking brutal markdowns during the US 2008 holiday season.

Department stores and apparel retailers may have bid farewell to the idea of selling merchandise at full price after taking brutal markdowns during the US 2008 holiday season.

In November and December, American consumers were treated to unprecedented discounts on even the most prestigious brands to spur purchases in the recession.

Retail executives now fear they have trained consumers to shop only when there are discounts, prolonging the squeeze on their profit margins. With no major buying holidays between now and the back-to-school season, analysts say consumers could even put off shopping for six months or more.

"Everyone in our organization realizes that there is a shift in business," Neiman Marcus chief executive Burt Tansky told the National Retail Federation annual convention last week. "The customer mentality has changed. We have to figure out what we can do."

"None of us can continue to sell at promotional prices and deep discounts," he added.

A likely strategy is for retailers to lower initial prices to lure shoppers. That could decrease the need to later mark down unsold goods dramatically, analysts said.

Bonnie Carlson, president of the Promotion Marketing Association, expects clothes will come on the market in 2009 about 20 percent lower in price than they did last year, and in some cases, as much as 40 to 50 percent lower.

"Let's say something last year cost US$100 [HK$780]. This year it's going on the market at US$80," Carlson said.

Perry Ellis International president Oscar Feldenkreis said a smart pricing strategy is key to preserving brand cachet this year.

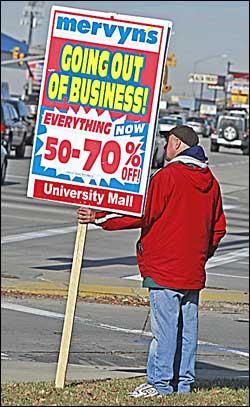

"I don't think retailers can survive with a 50-percent-off sign," Feldenkreis said this week at the ICR XChange conference in California.

JP Morgan's Brian Tunick, who follows apparel and accessories companies such as Gap, Limited Brands and Urban Outfitters, said retailers are engaging in a "race to the bottom" in terms of pricing.

"All the companies I talk to say, `We just don't know what the new 'full price' is,"' Tunick said.

He noted that the economic downturn pits high-end store chains against a growing cadre of lower-cost rivals such as Forever, Charlotte Russe Holding, Wet Seal and Sweden's Hennes & Mauritz, the owner of H&M.

Millard Drexler, chief executive of upscale clothing retailer J Crew Group, said his company may have to lower prices should rivals continue to discount severely.

"The dangerous thing competitively this season is what will the competition do on pricing?" he said during the ICR event.

J Crew was among of a slew of retailers, from Tiffany and Coach on the high end to Wal-Mart Stores on the low end, which cut their forecasts earlier this month for the holiday quarter.

Though J Crew is striving to sell its clothes at full price, Drexler said it is "adjusting prices right now" in its Crewcuts line for children, admitting that opening prices were "too high."

Michael Niemira, chief economist at the International Council of Shopping Centers, agrees there will be deflation.

"This is not an environment where you can get full price by any means, or anything you assume is a good price, even," Niemira said.

But he cautioned that consumers are unlikely to see more of the eye-popping deals like 75-percent-off that marked the 2008 holiday season.

"The bottom line is: Can consumers expect the rate of price decline to continue? No. Because a lot of stores are not continuing."