Cloudary Corp, a subsidiary of Nasdaq-listed Shanda Interactive Entertainment, said Tuesday in a filing with the US Securities and Exchange Commission that it aims to raise up to $200 million with an initial public offering on the New York Stock Exchange.

The filing did not reveal how many shares would be sold in the IPO or their expected price.

Currently Cloudary Corp operates six online literature websites in China. In 2010, the company had 71.5 percent of the online literature market in China in terms of revenue, according to its filing.

The company also has a presence in the field of publishing. At present it owns three publishing companies in China.

Feng Po, an industry watcher with ChinaVenture, a Beijing-based research institute, said that Cloudary might face a bumpy road ahead with its IPO, given that the golden time for Chinese Internet companies listing in the US has passed.

According to Feng, US investors are attracted to companies that can offer blockbuster expansion, but Cloudary is not one of them.

"The company had only 1.1 million active paying users for its online reading business in the first quarter; although that doubled year on year, it is still not large. And its user base has been limited to the young demographic," said Feng.

"It is not very likely that the company's traditional publishing business can generate huge profit in the near future," he added.

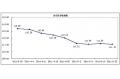

Another problem is that US investors' enthusiasm for Chinese Internet stocks appears to be cooling. Feng said it would be hard for Chinese companies to continue to get a high valuation in the US stock market.

According to a report from ChinaVenture, 38 Chinese companies have been listed in the US stock market since September last year, raising a total of $4.55 billion. Internet companies raised $1.99 billion, accounting for 43.7 percent of the total.

In the first quarter, Cloudary posted a loss of $0.6 million, down from $2.36 million in the same period of 2010. Revenue in the first quarter has more than doubled to $21.2 million.

"There is still no strong competitor for Cloudary in the Chinese online literature market, but the company needs to enlarge its user base in order to maintain sustainable growth," said You Tianyu, an information technology analyst at iResearch Consulting Group.

Goldman Sachs (Asia) and Merrill Lynch, Pierce, Fenner & Smith are the underwriters of the IPO, said the filing.