Lou Jiwei, chairman of China Investment Corp, attending the Asian Financial Forum in Hong Kong last month. The sovereign wealth fund, based in Beijing, has reportedly begun stockpiling cash in US money-market funds. [Agencies]

Sovereign wealth fund owned stocks valued at more than $9 billion according to latest disclosureChina Investment Corp (CIC), a $300 billion sovereign wealth fund based in Beijing, filed its first quarterly disclosure on US equity holdings, reporting that it owned stocks valued at $9.63 billion as of Dec 31.

The fund last Friday filed what's known as a Form 13F, which the US Securities and Exchange Commission requires from all institutional investment managers with more than $100 million of US equities. Other sovereign wealth funds have begun filing such reports amid calls for more disclosure.

CIC, created in September 2007 through a $200 billion allocation of China's reserves, began stockpiling cash in US money-market funds after initial investments in companies such as Morgan Stanley and BlackRock Inc declined in value. The filing last Friday shows that CIC has resumed investing in US equities, primarily through index funds rather than individual stocks.

"China is diversifying among different US dollar-denominated assets," said Rachel Ziemba, a senior analyst at Roubini Global Economics LLC in New York, which researches sovereign wealth funds. "What we are seeing is a way to quickly gain exposure to these markets rather than doing a lot of due diligence" on individual companies.

China, the biggest foreign holder of US government debt, trimmed its holdings of Treasuries by $9.3 billion to about $789.6 billion during November, the largest cut in five months. CIC invested about $10 billion in commodity producers worldwide during the second half of last year, according to data compiled by Bloomberg.

The SEC requires managers to report all holdings in stocks that trade on US exchanges, as well as options and convertible debt. The reports must be filed within 45 days of the end of each quarter.

Morgan Stanley, BlackRock

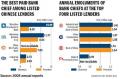

According to CIC's report, three previously disclosed investments now comprise about 63 percent of its US holdings. These include a $1.77 billion stake in Morgan Stanley, the New York-based securities firm; a $3.54 billion interest in Teck Resources Ltd, Canada's largest diversified mining company; and $714 million of stock in BlackRock, a New York firm that is the world's largest money manager.

The filing shows that CIC has been buying exchange-traded funds that track stock indexes, economic sectors and commodity prices, such as the SPDR Gold Trust. Its ETF holdings, including about 4.1 million shares in each of the iShares S&P Global Materials Index Fund and the Energy Select Sector SPDR Fund, had a market value of $2.4 billion on Dec 31, according to the filing. That equaled about 25 percent of assets reported in the Form 13F.

The Chinese fund disclosed that it made investments valued at $31 million or less in banks including San Francisco-based Wells Fargo & Co, Citigroup Inc in New York and Bank of America Corp, based in Charlotte, North Carolina. The wealth fund also owned $11 million of equity units issued by New York-based insurer American International Group Inc in July 2007.

CIC in December 2007 agreed to buy $5.6 billion of Morgan Stanley equity units that are currently convertible into 116 million common shares, according to the bank's most recent quarterly report.

The wealth fund, which has yet to convert the equity units, bought 45.3 million Morgan Stanley common shares last June, the quarterly report said.

According to December regulatory filings, CIC had put cash in money-market funds run by Legg Mason Inc, Goldman Sachs Group Inc and Invesco Aim Advisors Inc.