Investors at a brokerage in Wuhan, Hubei province. The benchmark Shanghai index fell 0.7 percent on Wednesday on concern faster exports and inflation will spur the central bank to raise interest rates from a five-year low. Han Shang / China Foto Press

SHANGHAI - Mainland stocks fell for the first time in four days, led by automakers and developers on concern faster exports and inflation will spur the central bank to raise interest rates from a five-year low."Cyclical stocks like developers aren't likely to outperform this year because their fundamentals haven't improved and the government is still tightening," said Wang Zheng, a fund manager at Jingxi Investment Management Co in Shanghai. "For the year, the broader market may be flat on limited earnings growth."

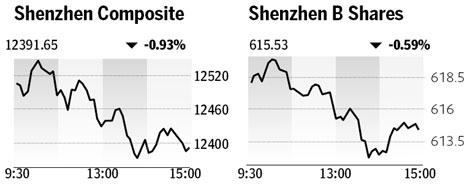

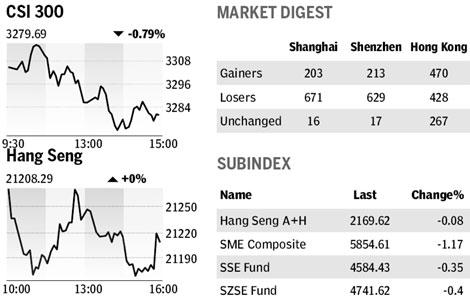

The Shanghai Composite Index fell 20.21, or 0.7 percent, to 3,048.93 at the close. The CSI 300 Index slid 0.8 percent to 3,279.69.

SAIC, China's largest carmaker, retreated 3.7 percent to 21.13 yuan ($3.10). FAW, which makes passenger cars with Volkswagen AG, dropped 3 percent to 23.30 yuan.

China's passenger car sales rose 55 percent last month from a year earlier, the China Association of Automobile Manufacturers said on Wednesday, the slowest growth since June 2009.

Poly Real Estate, China's second-largest developer by market value, lost 1.8 percent to 19.91 yuan. China Vanke Co, the biggest residential real estate developer, dropped 1.5 percent to 9.48 yuan. China Merchants Property Development Co retreated 1.3 percent to 23.62 yuan.

Shanghai's average housing sale price dropped 10 percent to 18,549 yuan per square meter in the first week of March from the previous week, Shanghai Securities News reported, citing Shenzhen World Union Properties Consultancy Co.

Inflation outlook

Consumer prices in China probably increased 2.5 percent from a year before, the most in 16 months, according to the survey median. While the gain was likely exaggerated by seasonal factors, economists project the momentum to continue, sending the rate to as high as 4.4 percent during the year. That exceeds the 3 percent target set by Premier Wen Jiabao in last week's session of the ongoing legislative meeting. The figure is due for release on Thursday.

"We believe the central bank sees inflation as a big danger to the economy," said Wang Qian, an economist with JPMorgan Chase & Co in Hong Kong. "As such, the central bank is likely to hike interest rates soon to manage inflation expectations."

Wang sees a 0.27 percentage point increase in the one-year lending and deposit rates as early as this month.

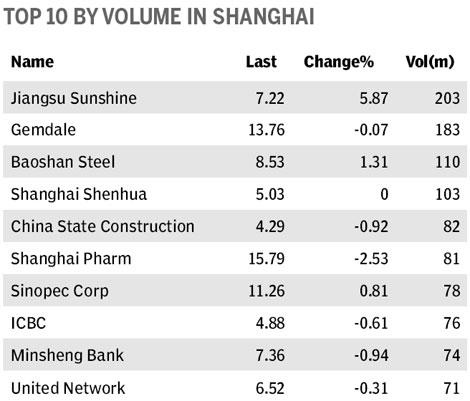

Baoshan Steel gained 1.3 percent to 8.53 yuan, the highest since Jan 19. Earnings per share may exceed 0.20 yuan for the three months ending March 31, CICC analyst Luo Wei said in a note, after an investors meeting with executives from the Shanghai-based steelmaker. The company posted earnings of 0.01 yuan a share for the first quarter last year.

Hang Seng gains

Most Hong Kong stocks rose as Cathay Pacific Airways Ltd and CITIC Pacific Ltd reported higher profits, overshadowing concerns China's faster exports and inflation will prompt it to raise interest rates.

Cathay Pacific, Hong Kong's largest carrier, advanced 4.7 percent. CITIC Pacific, an arm of China's biggest State-owned investment company, surged 7.5 percent. Hang Lung Properties Ltd, which fell 1.9 percent, led a 0.7 percent decline in the Hang Seng Property Index.

China COSCO Holdings Co dropped 1.7 percent after a measure of commodity shipping rates retreated.

The Hang Seng Index gained 0.74 point, or less than 1 percent to close at 21,208.29, after gaining as much as 0.4 percent and falling as far as 0.2 percent. The Hang Seng China Enterprises Index gained 0.1 percent to 12,217.33.

BLOOMBERG NEWS

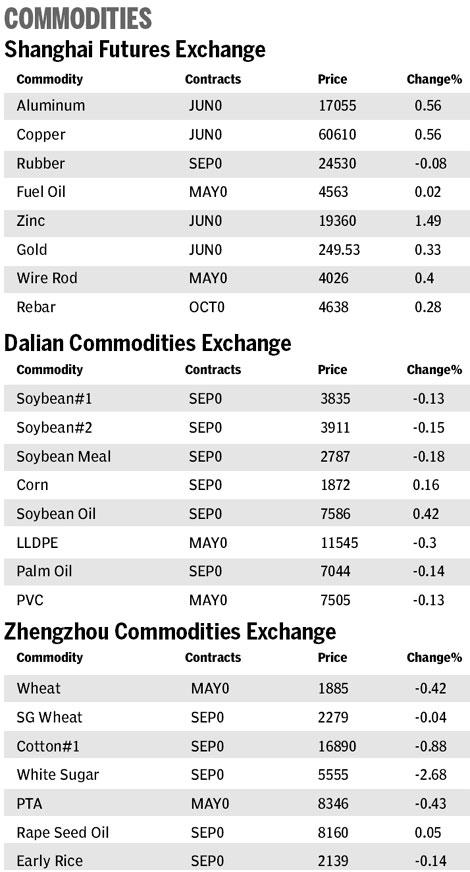

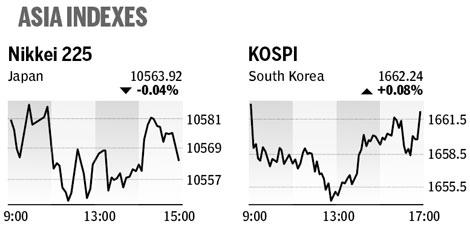

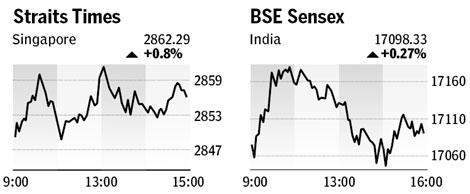

Market roundup