COSL Announces 2010 Interim Results

Net Profit reached to RMB2.17 billion

figures mentioned in this release are adapted from the unaudited financial statements for the first half of 2010 prepared in accordance with Hong Kong Accounting Standards.

Financial Overview unaudited

Unit: million Currency: RMB

26 August 2010, Hong Kong China Oilfield Services Limited COSL or the Group ; HKSE stock code: 2883, Shanghai Stock Exchange stock code: 601808, the leading integrated oilfield services provider in the offshore China market, today announced its interim results for the six months ended 30 June 2010.

During the first half of 2010, despite the slow recovery of the world economy due to uncertainties surrounding the debt crisis in Europe, production activities in offshore China were still on the rise, thanks to China s ongoing economic development and consistent increases in offshore capital expenditures by major oil companies.

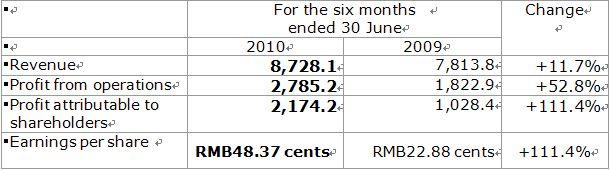

During the interim period under review, the Group s revenue rose 11.7% year on year to RMB8,728.1 million. Profit from operations grew 52.8% year on year to RMB2,785.2 million. Efforts in exploring new domestic and overseas markets leveraging the Group s competitive edges helped lift profit attributable to shareholders for the same period last year substantially by 111.

4% to RMB2,174.2 million from RMB1,028.4 million there was a RMB819.9 million impairment provision for the company s assets for the same period last year. Basic earnings per share were RMB48.37 cents 1H2009: RMB22.88 cents.

Commenting on the results for the interim period, the Group s Vice Chairman and Chief Executive Officer Mr. Liu Jian said: During the first half of 2010, oilfield service industry was still hovering around the bottom of the cycle and supply increasingly outstripped demand in the global drilling platform market.

The overall utilization rate for deep water drilling platforms was maintained at about 92%, still lower than the 96% for the same period last year. The overall utilization rate for jack-up drilling platforms rose slightly from the 70% at the beginning of the year to about 72%. There were significant reductions in day-rates for drilling platforms around the world in light of the intensifying competition.

Nonetheless, as the Chinese Government continued to stimulate the country s economy while major oil companies consistently increased their offshore capital expenditures, survey and production activities in offshore China during the first half continued their modest growth momentums compared with the same period last year.

Competition in oilfield services market in China, meanwhile, continued to intensify.

In the Drilling Segment, as at 30 June 2010 COSL operated and managed a total of 27 drilling rigs of which 23 are jack-up drilling rigs and 4 are semi-submersible drilling rigs of which 1 on management terms and 2 accommodation rigs, 4 module rigs and 6 land drilling rigs. Of these, 13 operated in Bohai China, 2 in East China Sea, 1 in the Yellow Sea, 4 in South China Sea, 7 in overseas waters including Persian Gulf and Australia, etc.

During the period, jack-up drilling rigs achieved 3,935 operation days while semi-submersible drilling rigs achieved 477 days, aggregating a total of 4,412 days, up 401 days from 4,011 for the same period last year. Jack-up drilling rigs added 464 days to 3,935 days as the two new jack-up drilling rigs that commenced operation in late 2009 achieved 322 days for the period.

COSL Drilling Europe AS CDE added 314 days as they added 1 more drilling rig to their fleet and enhanced their efficiency. Due to more days spent on maintenance, the jack-up rigs operated 172 fewer days while semi-submersible drilling rigs operated 63 fewer days during the period. This increase in number of days spent on maintenance lowered the average calendar-day utilization rate of the drilling rigs by 1.

7 percentage points to 94.6%, of which that of jack-up drilling rigs was 95.4% while that of semi-submersible drilling rigs was 87.8%.

The four module rigs operating in Gulf of Mexico achieved 717 operating days or a calendar-day utilization rate of 99.0%. The 5 land drilling rigs operating in Libya and the other one operating in China achieved 1,062 operating days or a calendar-day utilization rate of 97.8%.

In terms of service fees, during the first half of 2010 the average day rate of drilling rigs was about USD120,000/day USD/RMB conversion rate was 1: 6.7909 on 30 June 2010, down 11.1% from USD135,000 for the same time last year USD/RMB conversion rate was 1:6.8319 on 30 June 2009. The average day rate of jack-up drilling rigs was about USD 110,000/day, down 12.7% from about USD126,000/day for the same period last year. The average day rate of semi-submersible drilling rigs was about USD193,000/day, up 2.7% from about USD 188,000/day for the same period last year.

In the Well Services Segment, the Group continued to put more efforts into research and development to enhance the technical level gradually and raise its the technical competency in the segment. The Group s self-developed logging-while-drilling system succeeded in the downhole testing for the first time and achieving real-time measurements of logging-while-drilling parameters such as directional parameters, natural gamma rays, electromagnetic wave resistivity. The Group launched its logging service for the first time in Africa and provide customers with electrical imaging and rotary sidewall coring systems. The nitrogen foam water control project that the Group has been developing for a year successfully commenced construction in South China Sea and had already gained positive recognitions from clients.

Despite the keen competition in this segment, the Group continued its efforts in exploring new markets. Services including drilling fluid, cementing, while drilling, open-hole wireline logging, cased hole service, directional project and well work-over all saw increases in volume. The newly launched Environmental Protection Services also experienced gradual increases in efficiency.

In the Marine Support and Transportation Services Segment, as at 30 June 2010 the Group has 78 utility vessels of various types, and at the same time owned 3 oil tankers and 5 chemical carriers. The 78 vessels achieved 13,395 operating days, up 201 days year on year. The calendar-day utilization rate for this fleet of utility vessels was 95.2%, up 3.2 percentage points year on year. The Group actively deployed external resources and achieved an aggregate freight volume of 949,000 tons for its oil tankers, up 69.2% from 561,000 tons for the same period last year. The aggregate freight volume for its chemical carriers was 888,000 tons, up 118.7% from 406,000 tons for the same period last year.

In the Geophysical Segment, due to shrinking demand from major oil companies and the icing in Bohai Sea earlier in the year, the Group s geophysical services experienced a decline on service volume. During the period 2D collection volume declined 3,723 km or 17.2% year on year. 3D collection volume rose 508 km2 year on year as the Group actively explored new overseas markets for the winter time slot during which domestic operations were not preferable. Due to shrinking demand from oil companies, the operation volume of 2D data processing services declined 82.0% while 3D data processing volume was down 11.5% year on year.

The Group continued its efforts in exploring new markets, and launched a submarine cable collection business that achieved an operation volume of 185 km2during the period. Engineering survey service was also actively promoted and reported a healthy development.

Integrated Project Management, as one of the Group s four core strategies, continued to leverage its long service chain, high integration capability edges to offer clients convenient and affordable oilfield services. The integrated project management of the Group achieved RMB663.2 million in revenue, up RMB182.3 million or 37.9% from RMB480.9 million for the same period last year.

Mr. Liu concluded: Looking forward into the second half of 2010, there are still uncertainties surrounding the world economy and recovery is slow and more complex than ever. Uncertainties evolved from the sovereign debt crisis in Europe will slow down the recovery there, which might backfire the recovery momentum of the world economy. The oilfield industry is still facing a difficult operating environment and consistently stiff competition.

Faced with this difficult environment, we shall continue to leverage our competitive advantages. On the top of consolidating our foothold in existing markets, we shall continue our efforts in exploring overseas new markets and strengthen our strategic alliance relationships with clients. We shall continue to improve our operation and management efficiency while keeping cost under tight control in order to enhance our competitiveness.

Meanwhile, we shall continue to shoulder our social responsibilities by promoting reduction of emissions and energy consumption. We shall deepen our efforts on QHSE, promote protection of the environment and enhance our competitiveness in order to create better value for our shareholders.