22 March 2011, Hong Kong China Oilfield Services Limited COSL or the Group ; HKSE stock code: 2883, Shanghai Stock Exchange stock code: 601808 , the leading integrated oilfield services provider in the offshore China market, today announced its annual results for the year ended 31 December 2010.

In 2010 the oilfield services industry was still subject to impacts from the global financial crisis and the leakage incident in Gulf of Mexico. Competition was still fierce while challenges were acute. COSL reinforced its presence in the domestic market in China while expanding into overseas markets.

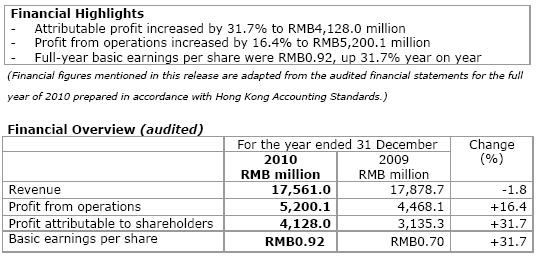

The Group proactively initiated communications with clients and continued to provide to them high-quality services, thus maintained services fee rates at relatively stable levels. For the full year of 2010, the Group s revenue was RMB17,561.0 million, down 1.8% from the previous year s RMB17,878.7 million.

Stripping out the impact of deferred income write-back in 2009, revenue for 2010 should have increased by RMB755.4 million or 4.5% Profit attributable to shareholders reached RMB4,128.0 million, up 31.7% from the previous year, mainly driven by substantially lower finance costs and projected asset and liability impairment losses.

Basic earnings per share for the whole year were RMB0.92, up 31.7% from the previous year. The Board of Directors has resolved to recommend a final dividend payment of RMB0.18 per share.

The decline in revenue for the year was due to the fact that an operation contract for a semi-submersible rig which was still under construction had been cancelled in 2009. The accrued RMB1,073.1 million revenue for this rig had been booked in 2009.

Stripping out this, the Group s revenue for the year would have increased by RMB755.4 million or 4.5% from the previous year, driven by commencement of operations of key large-scale equipment.

In the Drilling Segment, as at the end of 2010 COSL operated and managed a total of 29 drilling rigs of which 25 are jack-up drilling rigs 1 on charter terms and 4 are semi-submersible drilling rigs and 2 accommodation rigs, 4 module rigs and 6 land drilling rigs. The drilling fleet achieved 8,936 operating days for the year, up 781 days for 9.6% year on year.

During the year, jack-up drilling rigs achieved 7,933 operating days, up 844 days or 11.9% year on year driven by two major constituents. The first was an addition of 316 days by COSL Drilling Europe AS CDE 265 days from 2 newly added rigs and another 51 days from better efficiencies of other vessels .

The second constituent was the additional 528 days contributed by other vessels, being the net of the 657 extra days from 2 new vessels and 129 fewer days due to maintenance. Semi-submersible drilling rigs achieved 1,003 operating days for the year, down 63 days due to the days spent in maintenance.

Due to the larger number of days spent in maintenance the calendar day utilization rate for the whole jack-up and semi-submersible fleet declined 0.4 percentage point to 94.6%.

The 2 accommodation rigs operating in the North Sea achieved 730 operating days, equivalent to 100.0% utilization rates both in available- and calendar-day terms. The 4 module rigs continued to serve clients in Gulf of Mexico, achieving 1,418 operating days or 97.1% calendar-day utilization. The 6 land rigs achieved 2,127 operating days or 97.1% calendar-day utilization.

In terms of service fees, during the year the average day rate of drilling rigs was about USD129,000/day USD/RMB conversion rate was 1:6.6227 on 31 December 2010 , down 3.7% from USD134,000 for the same time the previous year USD/RMB conversion rate was 1:6.8282 on 31 December 2009 . The average day rate of jack-up drilling rigs was about USD 110,300/day, down 5.8% from about USD120,000/day for the same period the previous year. The average day rate of semi-submersible drilling rigs was about USD194,000/day, up 3.2% from about USD 188,000/day for the same period the previous year.

In the Well Services Segment, the Group continued to enhance its research and development capability during the year and promote its R&D results. The Group s self-developed logging-while-drilling system succeeded in the down-hole testing for the first time and achieving real-time measurements of logging-while-drilling parameters such as directional parameters, natural gamma rays, electro-magnetic wave resistivity.

The nitrogen foam water control project that the Group has been developing for a year successfully commenced construction in South China Sea and had already gained positive recognitions from clients. Enhanced Reservoir Characteristic Testers ERCT started full commercial operation and delivered 6 sets of equipment to serve in Bohai and Nanhai waters, achieving 100% operation success rate.

Cross-line Dipole Array Acoustic Logging Tool EXDT operated 25 well-times in more than 20 wells in Bohai and Nanhai waters and maintained the premium data quality. Exquisite Analytical Induction Logging EAIL served in 5 wells in Nanhai and started an operation in Myanmar.

In this segment the Group reinforced its presence in the domestic market in China while proactively expanding into overseas markets. For the first time it provided logging services for onshore wells and completed a logging operation for Sino Gas & Energy Company with high-quality logging statistics collected.

This marked the Group s official entry into the onshore new energy logging market. The newly launched Environmental Protection Services also experienced gradual increases in efficiency.

In the Marine Support and Transportation Services Segment, the Group achieved 26,769 operating says, down 933 days year on year due to net effect of: 1 a reduction of 2,987 days prompted by writing off of 8 utility vessels during the year and return of 6 utility vessels; 2 and increase of 332 days from 3 well maintenance support vessels which started operations during the year and another support vessel; 3 1,745 days added by 10 new utility vessels during the year; and 4 a reduction of 23 days from other utility vessels. During the year the Group s oil tankers and chemical carriers achieve increases in volume of freights shipped. Oil tankers shipped 2.028 million tonnes of freight, up 43.5% from 1.431 million in the previous year. Chemical carriers shipped 1.779 million tonnes, up 62.0% from 1.098 million tonnes in the previous year.

In the Geophysical Segment, due to the global financial crisis and the exceptional snowing in earlier in the year, that affected this segment, the Group achieved stable development of the segment through detailed management to enhance operating efficiency and expand into survey operations in deep waters.

During the year 2D date collection volume declined 9,431 km year on year to 24,469 km due to the bad weather at the beginning of the year and conversion of a 2D geophysical vessel into a submarine cable collection vessel to be engaged in 3D data collection operation. 3D data collection volume rose 2,614 km2 year on year to 13,008 km2 due to the robust demand for this service and as the Group actively explored new overseas markets for the winter time slot during which domestic operations were not preferable.

The newly launched submarine cable collection business achieved an operation volume of 405 km2 during the year. The operation volume of 2D data processing services declined 34.3% year on year to 14,846 km while 3D data processing volume was 7,983 km2, about level to that of the previous year.

Engineering survey service was also actively promoted and kicked start its first deep-water operation in Li Wan, establishing a firm footing for the Group s presence in this area.

For Integrated Project Management, the Group bucked the overall down trend and expanded operations into Bohai, Huanghai, Donghai and Nanhai waters and provided high-quality, high-technical-standard integrated project management services for 10 wells managed by overseas clients.

For Overseas Businesses, the Group ploughed more efforts into key markets and key projects, securing existing projects and signed new projects. The newly-launched semi-submersible rig COSLPioneer won from Statoil of Norway an expression of intent to operate for up to five years. 2 jack-ups were also awarded contracts in Indonesia. New well workover and acidification contracts were won in Indonesia. Geophysical vessels started to serve clients in Myanmar, Indonesia and Papua New Guinea.

COSL Chairman Mr. Liu Jian said Driven by our outstanding operation performance and cost control, COSL achieved encouraging results for the year and consistently improved its profitability. COSL will continue its existing strategies in the future and enhance returns to shareholders.

COSL Group CEO and President Mr. Li Yong said In 2011 we shall strengthen our focuses on specialist areas in order to consistently enhance our competitive edges, proactively tap into domestic and overseas markets, improve our internal control and implement comprehensive risk management to maintain our steady development.

Related News

Photos

More>>trade

market

- XCMG Construction Machinery Holds a Customer Summit at Bauma China 2010

- XCMG 1000-tonnage Products Sweep across the Bauma China 2010

- XCMG s XGC28000 crawler crane became landmark product in Bauma Shanghai

- Skyscraper safe guardia: XCMG s 88-meter fire truck launched in Bauma

- XCMG leads technical development of China earthmoving machinery products to