Mainland stocks rose for the first time in five days as the nation's improving economic prospects bolstered retailers and consumer companies, overshadowing concern new share sales will divert money from existing equities.

Mainland stocks rose for the first time in five days as the nation's improving economic prospects bolstered retailers and consumer companies, overshadowing concern new share sales will divert money from existing equities.

Kweichow Moutai Co, China's biggest producers of baijiu liquor, advanced 1.5 percent to 167.77 yuan ($24.56) after the government said it's targeting 8 percent growth in 2010 and an 11 percent gain in industrial production. Wuliangye, the second largest, gained 5.4 percent to 29.25 yuan. Tsingtao Brewery Co, China's second-biggest brewery by volume, advanced 2.9 percent to 34.47 yuan.

Bank of Nanjing Co, partly owned by BNP Paribas SA, slid 1.9 percent to 18.6 yuan on plans to sell shares in a rights offer on concern new shares will divert funds from existing equities.

"Corporate earnings will continue to increase next year amid the economic rebound," said Chen Shide, a Guangzhou-based fund manager at GF Fund Management Co, which oversees about $11.4 billion. "The consumer sector is the one with the most solid and certain growth prospects as the government strives to boost domestic spending."

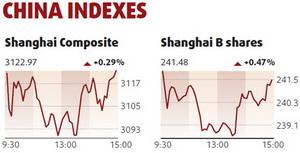

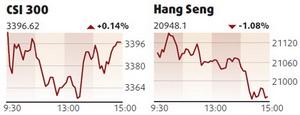

The Shanghai Composite Index added 9.09, or 0.29 percent, to 3122.97 at the close after changing directions at least 10 times. The gain snapped a four-day, 5.7 percent loss. The CSI 300 Index rose 0.1 percent to 3396.62.

Hang Seng falls

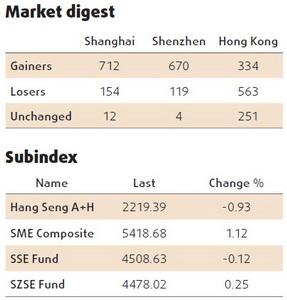

Hong Kong's benchmark index closed at its lowest level since October as HSBC Holdings Plc dropped after the Observer of London said the bank plans to list shares in Shanghai, and developers slid on concern the authorities will do more to curb real estate speculation.

The Hang Seng Index fell 1.08 percent to 20948.1, extending its drop in the past five sessions to 5.2 percent. Shares on the gauge trade at an average 16.4 times estimated profit, up from 10.6 times at the start of 2009, data compiled by Bloomberg show.