Gray-slate-clad villas surrounded by an imposing stone wall and an ostentatious main gate flanked by thick Roman columns are making history by setting record sale prices despite repeated government warnings of overheating in the property market.

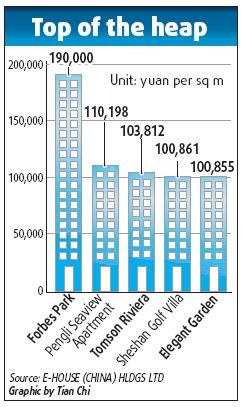

In the latest sale at Forbes Park estate in the Gubei area, a villa of about 700 sq m was sold to an anonymous buyer at about 190,000 yuan per sq m.

It is an all-time high for residential properties in Shanghai, nearly double the earlier record of 100,000 yuan per sq m for Tomson Riviera apartments in Lujiazui financial center of Pudong district.

The annual average disposable income of Shanghai residents in 2008 was 26,675 yuan, which means it will take seven years' income for someone to buy a single square meter in the complex.

Most of the tenants in the complex are overseas Chinese from Hong Kong and Taiwan, plus a few expatriate executives in multinational firms, said a saleswoman at the estate's sales office.

The upmarket area is particularly favored by Taiwan industrialists and Hong Kong investors, and the estate is developed by Wan Te Yuan, a relatively little-known company which has been involved in this project of 21 villas and two tower blocks since 2004.

The salesperson at Forbes Estate said that a total of 18 villas have been sold and the apartments in the two tower blocks have either been sold or are for rent.

Forbes Park, according to property agents in the vicinity, was not a hot property because it is not located in Gubei's prime area. "Far from shops and supermarkets, Forbes Park definitely is not the star property in our district," said Liao Tao, the manager of the Gubei branch of Great Town Real Estate.

But "timing is everything in this market", he said. "There are too many big spenders chasing too few quality properties in the inner city," he said.

"In December 2004, only one property - by Rich Gate in downtown Luwan district - was sold for over 50,000 yuan per sq m, but in 2009, 1,460 units were sold above this price, showing robust growth in the high-end market," said a report by local property agent E-House.

"The units are too expensive for most Chinese, but not for those who are used to luxury accommodation and high living overseas," said Xue Jianxiong, an analyst with E-House (China) Holdings Ltd.

"Compared with upscale housing in cosmopolitan cities around the world, there is upward potential. Hong Kong's most expensive property was traded at 700,000 yuan per sq m in October, while top luxury properties are priced about 690,000 yuan per sq m in London," he added.

Property prices in Shanghai and in most other major mainland cities have risen to levels fewer and fewer people can afford. More than 80 percent of urban residents cannot afford to buy homes, said the latest report from the Chinese Academy of Social Science.

In December, the central government introduced various measures to moderate the property prices, including tighter mortgage conditions policies for second-home buyers.

Li Qin, an employee at Tomson Riviera told China Daily that the developer is to release a batch of independent villas near the city's Tomson Golf Club in Pudong New Area next year, but refused to be pinned down on prices.

"It should not be lower than 100,000 yuan per sq m," Xue Jianxiong said.