The arbitrage window between Shanghai and London has opened, at around 400 yuan in favor of imports, lifting hopes that China's imports may rise from levels seen in the past month or two, adding to already bullish sentiment in the market.

"Chinese are buying with expectations of better prices next year, as traders elsewhere are closing their positions ahead of the holidays," said a Shanghai-based trader.

The dollar slipped against the euro yesterday but still hovered near its highest point in more than three months as currency players anticipated more short covering in the greenback in a week shortened by a holiday.

"If you look at the factors behind the strength in the dollar - an improved outlook on the US economy, anticipation of interest rates hike and inflation - these factors actually brighten copper's prospects," said Zhu Bin, an analyst at Nanhua Futures.

"The strong dollar therefore isn't necessarily a blow to metals. The overall sentiment in financial markets is quite good."

Three-month copper on the London Metal Exchange (LME) rose $80, or 1.2 percent, to $6,925 a ton in early trade, extending a 1-percent rise last week.

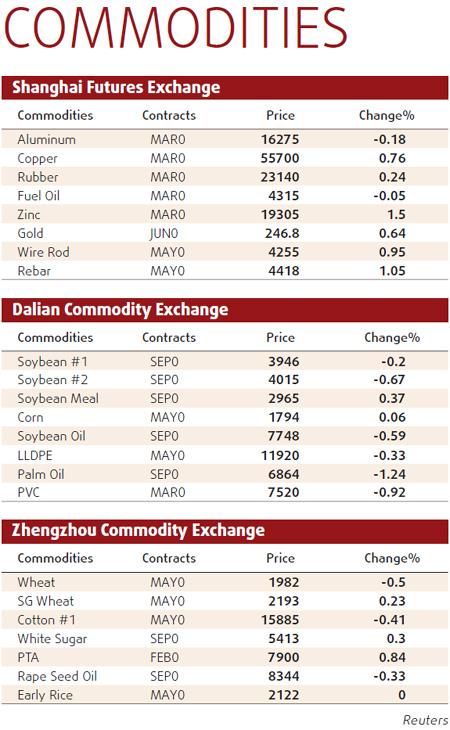

Shanghai's benchmark third-month copper futures contract shook off early losses to end at 55,700 yuan a ton, up 0.4 percent.

After a spectacular rally this year, copper prices may become very volatile in 2010, Zhu warned.

"The current supply-demand conditions don't support a strong rally. Prices will be subject to fluctuations in market sentiment, which might manifest as huge volatility," he said.

Shanghai aluminum edged down 0.2 percent to 16,275 yuan a ton, and LME aluminum gained $3 to $2,245 a ton.

Aluminum prices have been on a steady ascent, up more than 10 percent since late November, despite record high stockpiles.

LME aluminum stocks hit a record high above 4.6 million tons on Friday.

Nickel also rose, up 1 percent at $17,290 a ton, underpinned by an announcement that Russia will reinstate a 5 percent export tariff on the metal, waived early this year to help Russian producers.