SHANGHAI: China's stocks rose for the first time in four days as a rally in raw material prices and speculation January lending surged spurred gains by commodity producers and financial companies.

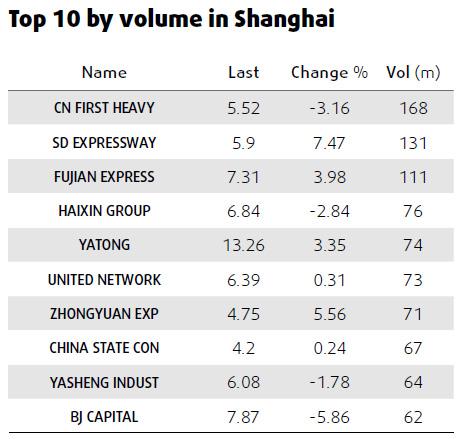

Jiangxi Copper Co, the nation's biggest producer of the metal, gained 2 percent and Industrial Bank Co gained 1.1 percent. Chongqing Gangjiu Co jumped 6.4 percent after the municipality was chosen by the government as one of the nation's five "key" cities. China First Heavy Industries Co dropped on the first day of trading in Shanghai, capping gains on the index.

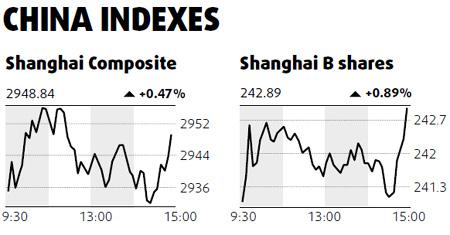

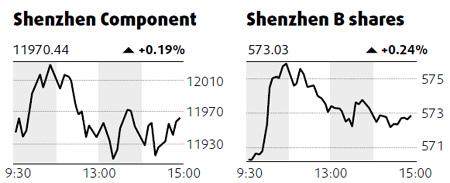

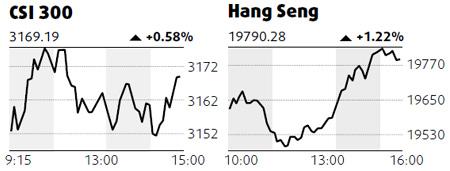

The Shanghai Composite Index rose 0.5 percent to close at 2,948.84, paring its 2010 slump to 10 percent. Stocks have fallen this year on concern the government will raise interest rates and curb lending to cool the economy and avert asset bubbles.

The markets will be shut next week for the Lunar New Year festival. "Any big movement before the holiday isn't likely because of a lack of market participants," said Wei Wei, an analyst at West China Securities Co.

"The market will probably trade in a fluctuating pattern until the end of the week."

Hong Kong shares up

Hong Kong stocks rose for the first time in four days as property shares gained after developers including China Overseas Land & Investment Ltd reported higher sales.

China Overseas Land, controlled by the country's construction ministry, climbed 2.4 percent. Hang Lung Properties Ltd, a Hong Kong developer which also invests in the mainland, rose 4.2 percent. Esprit Holdings jumped 5.1 percent after Goldman Sachs reiterated its "buy" rating on the retailer.

"The fundamentals, valuations, everything looks reasonably well," said Anthony Lok, Hong Kong-based head of research at BOC International Holdings Ltd, told Bloomberg Television. "Certainly you can make a case that things are much worse in a lot of other places in the world. I'd rather still be in China than, say, hold Greek sovereign bonds at this point and time."

The Hang Seng Index added 1.2 percent to close at 19790.28.