BEIJING China raised banks' reserve requirements for the third time in a month Friday, acting to cool its economy as inflation topped 5%, exports gained sharply and the real-estate market continued to pick up.

Data issued Saturday morning in Beijing showed the consumer price index for November rising 5.1% from a year earlier, a faster-than-expected acceleration from the 4.4% gain in October. The highest inflation since mid-2008 reinforced the case for the government to keep withdrawing the easy-credit policies it has pursued since the financial crisis, as did figures showing strong growth in key drivers of the economy.

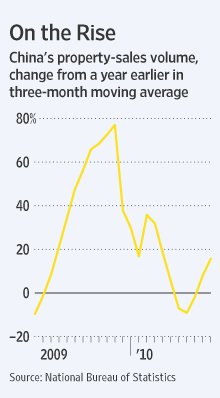

Exports and imports both soared to monthly records in November, while the country's trade surplus narrowed to $22.9 billion from October's $27.15 billion, data showed Friday. And property prices rose for the third straight month in November, rebounding after a minor correction earlier this year despite a series of measures by Beijing to rein in the real-estate boom.

"Exceedingly strong exports growth amid an already overheated domestic economy is not good news, as it adds to the overheating pressures which will require the government to take even more stringent measures to bring down inflation," Goldman Sachs economist Yu Song said in a note.

While the central bank's decision to raise reserve requirements by a half percentage point will reduce the amount of money China's banks have available to lend, it will have less impact on the economy than an interest-rate increase would have.

That could ease market fears that Beijing will clamp down too sharply on growth but perhaps at the price of raising worries that authorities are not doing enough. "Many market participants seem to think that the People's Bank of China is falling behind the curve," said Mark Williams of Capital Economics in London.

The further pickup in inflation in November continued to be led mostly by food prices, which rose 11.7% from a year earlier after the 10.1% gain in October. More worrying analysts may the pickup in nonfood inflation, the main Chinese measure of core inflationary pressures, to 1.9% in November from 1.6% in October.

More-stringent measures by Beijing could lower hopes for a pickup in the global economy, as China is one of the few major economies that is growing rapidly. In the U.S., economic indicators such as retail sales and consumer confidence have lately pointed to a pickup in activity, and markets are pricing in greater growth prospects as the Obama administration's tax-cutting deal promises more stimulus for the U.S. next year.

Last week, the Politburo of the Communist Party, China's highest decision-making body, ratified the transition to a tighter monetary policy, which it now officially describes as "prudent" rather than "moderately loose."

But so far authorities have moved cautiously in tackling inflation: After raising interest rates once in October, the People's Bank of China raised the reserve requirement on Nov. 10 and Nov. 19.

Even as Beijing signals a shift in policy, signs are emerging that it may be having difficulty constraining the lending activity of the country's banks. Growth in the broad M2 measure of money supply accelerated in November and banks made far more loans than expected.

Total new lending for this year now stands at 7.44 trillion yuan ($1.12 trillion). Many analysts expect authorities to let banks exceed the full-year loan target of 7.5 trillion yuan.

China is getting more of a boost from overseas demand than many had anticipated: The strong growth in exports, up 34.9% in November from a year earlier, far above October's 22.9% rise, could be a positive sign for the global economy.

Royal Bank of Scotland economist Ben Simpfendorfer said the export rise is a sign retailers in the U.S. and Europe have stocked up inventories aggressively for the holiday shopping season.