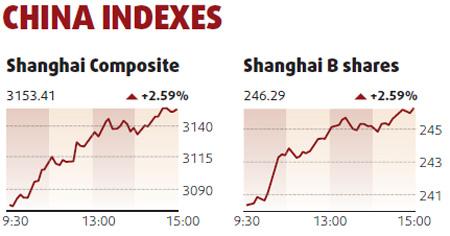

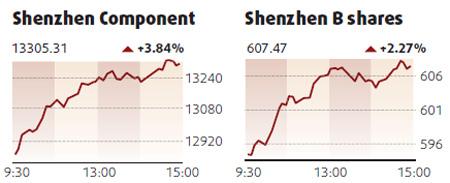

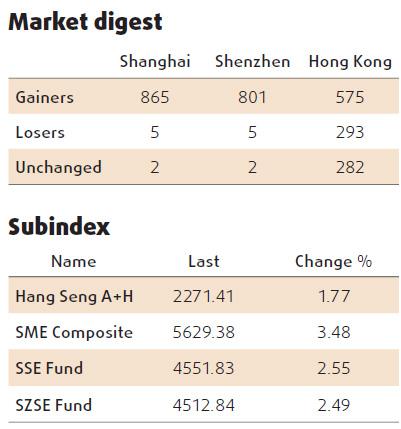

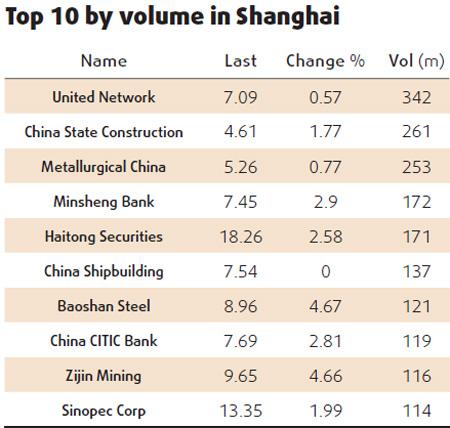

The mainland's key index ended up 2.59 percent, partly led by China State Construction Engineering Corp on news that its parent was buying more shares in the listed unit, as institutional investors returned to the market after winding up year-end settlements.

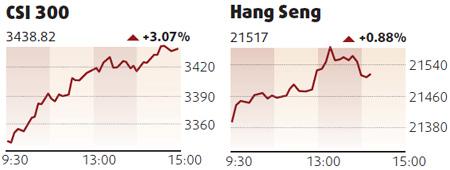

The Shanghai Composite Index finished up 79.63 points at 3,153.41, scoring its biggest daily percentage gain this month and regaining the key 125-day moving average, now at 3,098.

The index was also boosted as prospects for China's economic recovery offset the negative impact of heavy new share supplies.

Cash calls for year-end settlement by institutions, including mutual funds and brokerages, had contributed to a one-month market fall of nearly 10 percent until Tuesday, although the fall was also driven by an official campaign to clamp down on excessive asset prices, including adding share supplies.

"Institutional investors typically push share prices up in the final few trading days of the year for better year-end book value, although they also typically only trade lightly at this time of year," said a senior trader at a major Chinese brokerage.

Traders said they expected the market to stage a slow but steady rally for the rest of this year, adding, however, that the key index should encounter stiff resistance at the psychologically important 3,300-point level.

Hang Seng steady

Hong Kong shares rose for a third straight day yesterday aided by property plays on upbeat expectations for a government land auction next week.

Geely Auto rose to a weekly high of HK$4.3, before closing at HK$4.26, up 7.04 percent. Ford Motor said it was nearing an agreement to sell its Volvo unit to Geely, parent of Geely Auto.

The benchmark Hang Seng Index ended up 0.88 percent or 188.26 points at 21,517 in holiday-shortened trading session, its highest close in more than a week. The index ended the four-day week up 1.61 percent.

The China Enterprises Index of top locally listed mainland stocks rose 1.16 percent to 12,673.74. Market turnover increased to HK$27.55 billion ($3.55 billion), from Wednesday's HK$21.86 billion.

The Hong Kong market closed at midday for the Christmas holiday and will reopen on Dec 28.

"The market was quiet and steady this morning," said Alfred Chan, chief dealer at Cheer Pearl Investment. "Players took a breather after recent volatility while property stocks stayed firm ahead of a land auction."

Local property issues extended their advance on hopes for a strong response to an upcoming auction of two plots of land for residential purposes in Hong Kong on Monday. Market watchers expected the auction to draw keen competition among developers.

New World Development rose 1.15 percent, Wharf Holdings climbed 1.41 percent, Sun Hung Kai Properties gained 0.7 percent, and Sino Land was up 0.83 percent.

"Despite the firmer market, participants were still cautious on concern over further Chinese government measures to tackle asset bubbles," Chan said. He forecast the market to be capped at around 21800 before the end of this year.

Insurers and banks advanced further, with China Construction Bank rising 1.69 percent and HSBC up 0.91 percent.